Project On Modes Of Entering Into International Business For Class 12 CBSE

Acknowledgement:

First and foremost, I would like to extend my heartfelt gratitude to [Teacher’s Name], our esteemed Business Studies teacher for class 12 CBSE. Their continuous guidance, expert knowledge, and constructive feedback have been invaluable in shaping the direction of this project. Their dedication to fostering a deep understanding of the subject has been instrumental in broadening my perspective and enhancing the quality of this work. I am thankful for their unwavering support and belief in my abilities, which encouraged me to delve deeper into the topic and explore various dimensions of entering into international business.

In addition to my teacher, I would like to thank my parents for their unwavering support and encouragement throughout this academic journey. Their constant motivation and belief in my capabilities have been the driving force behind my passion for Business Studies and international business. Their understanding and encouragement during challenging times have been a source of strength, enabling me to stay focused on the project and overcome obstacles that came my way.

I also want to express my gratitude to my friends who provided me with moral support and were always there to lend a helping hand whenever I needed it. Their enthusiasm and interest in my project were motivating, and their insightful discussions contributed to shaping my ideas and strengthening the content of the project.

Furthermore, I would like to extend my thanks to all the authors, researchers, and experts whose works I have referenced and consulted throughout the research process. Their contributions to the field of international business have been invaluable in shaping the depth and credibility of the project.

Lastly, I am thankful to the entire academic institution for providing me with the resources, infrastructure, and conducive learning environment that enabled me to undertake this project successfully. The opportunities provided by the school have been instrumental in nurturing my curiosity and passion for the subject.

In conclusion, this project on “Modes Of Entering Into International Business” would not have been possible without the support and encouragement of all the individuals mentioned above. Each one has played a significant role in shaping this work, and I am deeply grateful for their contributions. Their belief in my abilities and their willingness to guide and support me have been an invaluable asset in this academic endeavor.

Introduction:

In today’s interconnected world, the global business landscape presents an array of exciting possibilities for companies seeking growth and expansion. The allure of tapping into new markets, reaching a diverse customer base, and maximizing profitability has driven businesses to venture beyond their national borders. However, the path to international success is far from straightforward and demands meticulous planning, adaptability, and strategic foresight.

The primary objective of this project is to delve into the intricate world of international business and explore the diverse modes through which companies can enter foreign markets. Understanding these modes is crucial as they determine the nature of the company’s presence in the international arena and influence the overall success of its global ventures.

As businesses contemplate international expansion, they encounter multifaceted challenges such as understanding cultural differences, navigating complex regulatory environments, and effectively competing with established local players. These challenges necessitate a comprehensive analysis of the various entry modes available to companies, as each mode presents distinct advantages, risks, and implications.

The project will shed light on the significance of adopting the appropriate entry mode and the critical role it plays in shaping the company’s trajectory in the global market. An ill-suited entry mode can lead to costly mistakes, while a well-chosen approach can serve as a launchpad for sustained growth and success on an international scale.

Moreover, this project aims to identify and analyze successful examples of companies that have effectively implemented different entry modes. By examining their strategies, decisions, and outcomes, we can gain valuable insights into the best practices and pitfalls to avoid when venturing into international markets.

Throughout this exploration, the project will emphasize the importance of meticulous planning, market research, and a comprehensive understanding of target markets. Additionally, it will delve into the significance of the three fundamental pillars that support successful international business entry: adaptability and flexibility, cultural awareness and sensitivity, and strategic planning and execution.

As globalization continues to reshape the business landscape, it is essential for companies, especially aspiring entrepreneurs and future business leaders, to grasp the intricacies of international expansion. This project seeks to equip readers with valuable knowledge and a holistic perspective on the modes of entering into international business, empowering them to make informed decisions and navigate the challenges of the global marketplace.

In conclusion, the world of international business offers vast opportunities for companies seeking to grow and thrive beyond their domestic borders. However, this journey requires a deep understanding of various entry modes and a strategic approach that aligns with the company’s goals and resources. By delving into the nuances of entering into international business, this project aims to prepare readers for the dynamic challenges and promising prospects that await in the global arena.

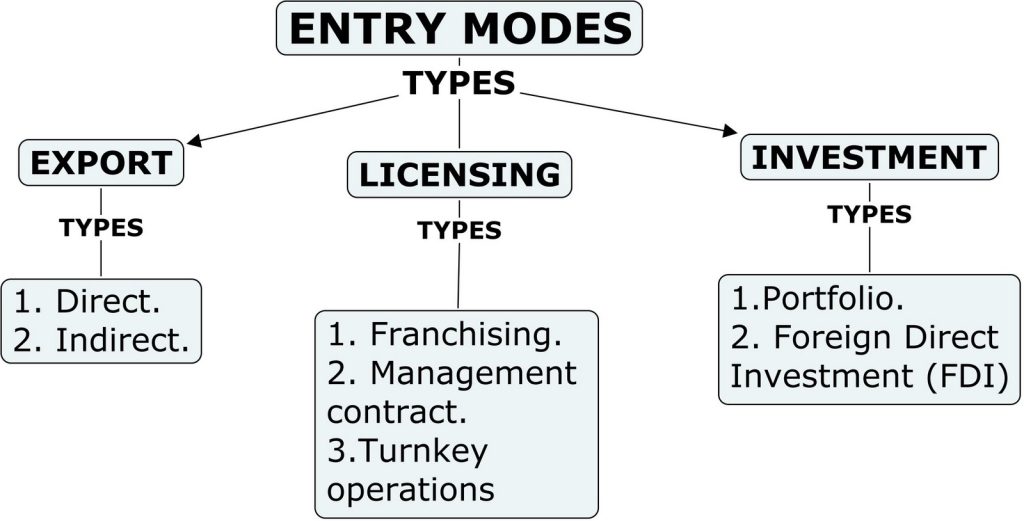

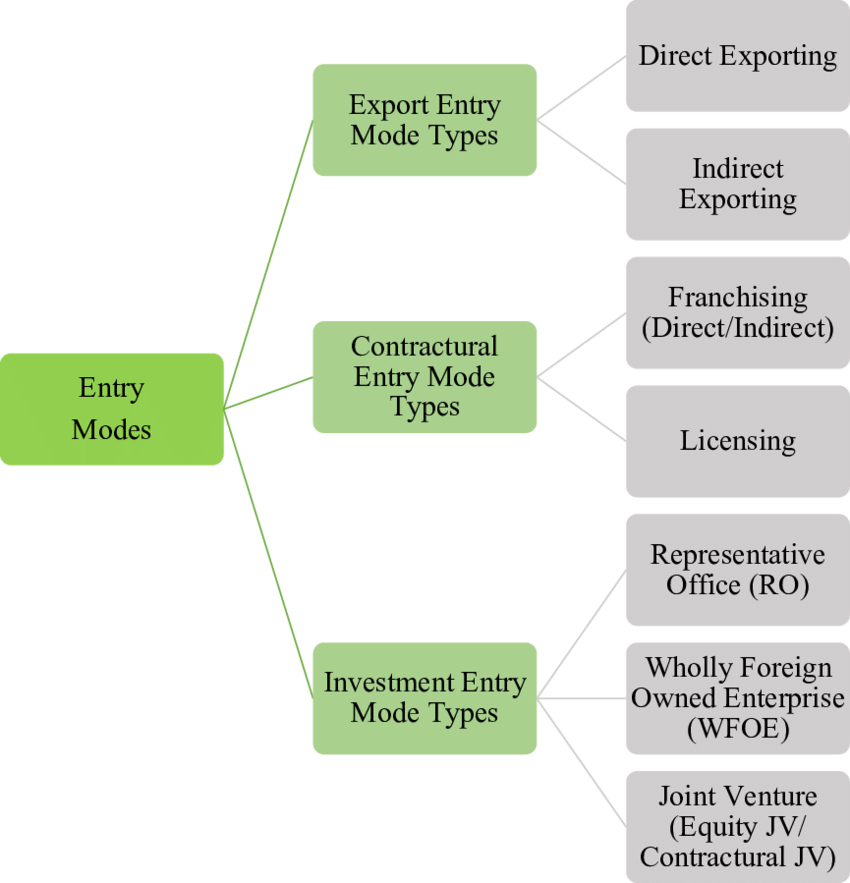

Modes of Entering into International Business:

In this section, we will delve into different modes through which companies can enter the international market. These modes include:

– Exporting

– Licensing and Franchising

– Joint Ventures

– Foreign Direct Investment (FDI)

– Strategic Alliances

– Contract Manufacturing

– Subsidiaries and Acquisitions

Examples of International Business Entry Modes:

The real-world experiences of companies that have ventured into international markets provide valuable insights into the diverse entry modes and their outcomes. By studying these examples, we can better understand the challenges and opportunities associated with each approach. Let’s explore some prominent cases of companies that have successfully adopted various modes to enter the international market:

Company: Apple Inc.

Entry Mode: Exporting and Licensing

Example: Apple Inc. , the tech giant renowned for its innovative products, initially entered international markets through exporting its iconic products like the iPhone, iPad, and MacBooks. As demand surged globally, Apple strategically opted for licensing agreements with international partners to manufacture its products locally. This approach enabled Apple to overcome trade barriers, reduce costs, and gain a competitive edge in diverse markets.

Company: McDonald’s Corporation

Entry Mode: Franchising

Example: McDonald’s, the fast-food giant, embraced franchising as its primary mode of international expansion. By offering franchises to local entrepreneurs, McDonald’s rapidly expanded its global presence. Franchising allowed the company to leverage the local knowledge and expertise of franchisees, adapt menus to local tastes, and build a strong brand presence worldwide.

Company: Toyota Motor Corporation

Entry Mode: Foreign Direct Investment (FDI)

Example: Toyota, one of the world’s largest automotive manufacturers, employed Foreign Direct Investment to establish production facilities in various countries. By setting up manufacturing plants overseas, Toyota reduced production costs, ensured a steady supply chain, and solidified its position as a global leader in the automotive industry.

Company: IKEA

Entry Mode: Strategic Alliances and Subsidiaries

Example: IKEA, the Swedish furniture retailer, pursued strategic alliances with local partners to enter new markets. These alliances allowed IKEA to tap into local knowledge, access distribution channels, and gain insights into consumer preferences. Additionally, IKEA established subsidiaries in some markets to have more direct control over operations and branding.

Company: The Coca-Cola Company

Entry Mode: Joint Ventures

Example: The Coca-Cola Company, the beverage giant, has formed joint ventures with local bottling companies in several countries. These joint ventures helped Coca-Cola penetrate diverse markets while adhering to local regulations and cultural norms. The partnerships also facilitated efficient distribution and ensured the availability of products tailored to local preferences.

Company: Samsung Electronics

Entry Mode: Contract Manufacturing and Acquisitions

Example: Samsung Electronics, a global leader in electronics, engaged in contract manufacturing to produce its products in countries with cost-effective production capabilities. Furthermore, Samsung pursued strategic acquisitions of companies in specific regions to gain access to new technologies and markets.

In each of these examples, companies meticulously assessed the opportunities and challenges presented by different entry modes. Their success in international markets can be attributed to strategic decision-making, adaptability to local conditions, and a customer-centric approach. By studying these examples, aspiring international businesses can learn valuable lessons and better prepare themselves for the complexities of expanding their operations beyond national borders.

Importance of International Business Entry Modes:

Entering into international markets is a transformative decision for any company, and the choice of entry mode plays a pivotal role in determining the success and sustainability of such expansion. The importance of carefully selecting the appropriate entry mode cannot be overstated, as it directly impacts various aspects of the company’s global ventures. Let’s delve into the significance of this crucial decision:

Market Penetration and Expansion:

The right entry mode enables companies to penetrate new markets effectively and expand their global footprint. Whether it’s exporting, licensing, franchising, joint ventures, or foreign direct investment (FDI), each mode offers distinct advantages and challenges in terms of market access. Companies must carefully consider the market conditions, consumer preferences, and competitive landscape to choose the mode that aligns with their growth objectives and resources.

Revenue Growth and Profitability:

Selecting the most suitable entry mode can have a significant impact on revenue growth and profitability. Companies that make informed choices can optimize their market reach, cater to diverse customer segments, and capitalize on emerging opportunities. For instance, franchising and licensing can provide a steady stream of revenue through fees and royalties, while FDI can grant greater control over operations and higher profit potential in the long term.

Risk Mitigation and Resource Allocation:

Different entry modes come with varying levels of risk and resource requirements. A well-thought-out entry mode can help mitigate risks associated with international expansion, such as political instability, currency fluctuations, and regulatory uncertainties. Companies can allocate resources efficiently by choosing a mode that aligns with their financial capabilities and risk tolerance.

Global Brand Recognition:

A successful international entry mode can bolster a company’s global brand recognition and reputation. Companies that enter international markets strategically and cater to local preferences can build a positive brand image, enhancing customer trust and loyalty worldwide. Global brand recognition, in turn, fosters increased market share and strengthens the company’s competitive position.

Learning and Adaptation:

The process of selecting an entry mode itself can be a valuable learning experience for companies. Conducting thorough market research and analyzing various options necessitates a deeper understanding of the target markets and the nuances of international business. This knowledge equips companies with the ability to adapt to diverse cultural, economic, and regulatory environments.

Long-Term Growth and Sustainability:

A well-executed international business entry mode can pave the way for sustainable long-term growth. The right mode allows companies to establish a strong presence in foreign markets, nurture relationships with local stakeholders, and build a loyal customer base. Long-term growth and sustainability depend on the company’s ability to navigate challenges, seize opportunities, and continuously innovate to meet evolving market demands.

In conclusion, the importance of international business entry modes cannot be overstated. A carefully selected mode aligns the company’s resources, capabilities, and growth objectives with the complexities of international markets. The right choice can open doors to new opportunities, drive revenue growth, enhance brand recognition, and establish a solid foundation for long-term success in the global arena. Companies must approach this decision-making process with diligence, market intelligence, and a strategic vision to reap the full benefits of international expansion.

Strategies for Establishing International Business:

To ensure a successful foray into international markets, companies must adopt certain strategies. This section will focus on crucial steps such as:

– Conducting Comprehensive Market Research and Analysis

– Selecting the Right International Partners

– Navigating Legal and Regulatory Hurdles

– Developing Sound Financial Plans and Risk Management Techniques

Three Pillars of Successful International Business Entry:

To sustain and thrive in international markets, businesses must build their operations on three fundamental pillars. These pillars are:

– Adaptability and Flexibility: Adapting to diverse cultural, economic, and market conditions.

– Cultural Awareness and Sensitivity: Understanding and respecting the customs and traditions of foreign markets.

– Strategic Planning and Execution: Developing a well-defined international business strategy and effectively executing it.

Conclusion:

Expanding into international markets is a transformative journey that presents businesses with a plethora of opportunities to tap into new customer bases, increase revenue streams, and establish a global brand presence. However, this endeavor is not without its challenges, and companies must approach it with meticulous planning, thorough research, and strategic execution. Throughout this project, we have explored the significance of international business entry modes and the three fundamental pillars that underpin successful expansion. As we conclude, it becomes evident that the right approach to internationalization can lead to remarkable achievements and sustainable growth on a global scale.

First and foremost, the importance of selecting the appropriate entry mode cannot be overstated. Whether it is exporting, licensing, franchising, FDI, or strategic alliances, each mode presents unique advantages and challenges. Companies must carefully assess their market objectives, available resources, risk tolerance, and target market characteristics to make an informed decision. By choosing the most suitable entry mode, companies can unlock new markets, expand their market share, and capitalize on growth opportunities while minimizing potential risks.

Furthermore, the three pillars of successful international business entry—adaptability and flexibility, cultural awareness and sensitivity, and strategic planning and execution—form the foundation of a company’s global expansion strategy. Embracing adaptability and flexibility allows companies to respond effectively to dynamic market conditions, regulatory changes, and customer preferences in different regions. Cultural awareness and sensitivity are paramount in navigating diverse cultural landscapes, establishing meaningful connections with local consumers, and earning their trust. Strategic planning and execution involve developing a comprehensive international business strategy that aligns with the company’s long-term vision, resources, and capabilities. Properly executed strategies ensure that businesses can navigate challenges, seize opportunities, and sustainably grow in international markets.

In conclusion, international business expansion offers immense potential for companies to achieve remarkable growth and global recognition. However, it requires a deliberate and thoughtful approach. By carefully selecting the right entry mode, businesses can access new markets and unlock their growth potential. Additionally, adhering to the three pillars of successful international business entry empowers companies to adapt, connect, and strategize effectively, thereby enhancing their chances of sustained success in the global arena.

As companies venture into international business, they must continuously learn, innovate, and refine their strategies to stay ahead in the ever-evolving global landscape. By embracing the lessons learned from successful examples, adopting a customer-centric approach, and prioritizing cultural understanding, businesses can create lasting impacts, foster international relationships, and thrive in the dynamic world of global commerce.

In conclusion, international business expansion presents boundless opportunities, but its realization demands a combination of diligence, adaptability, and a keen understanding of diverse markets. By embracing the right entry mode and strengthening operations on the three pillars, companies can embark on a journey of sustainable growth, broadened horizons, and an enduring presence in the global marketplace.

Certificate of Completion

[Student’s Name][Class/Grade Level]This is to certify that I, [Student’s Name], a [Class/Grade Level] student, have successfully completed the project on “Project On Modes Of Entering Into International Business For Class 12 CBSE.” The project explores the fundamental principles and key aspects of the chosen topic, providing a comprehensive understanding of its significance and implications.

In this project, I delved into in-depth research and analysis, investigating various facets and relevant theories related to the chosen topic. I demonstrated dedication, diligence, and a high level of sincerity throughout the project’s completion.

Key Achievements:

Thoroughly researched and analyzed Project On Modes Of Entering Into International Business For Class 12 CBSE.

Examined the historical background and evolution of the subject matter.

Explored the contributions of notable figures in the field.

Investigated the key theories and principles associated with the topic.

Discussed practical applications and real-world implications.

Considered critical viewpoints and alternative theories, fostering a well-rounded understanding.

This project has significantly enhanced my knowledge and critical thinking skills in the chosen field of study. It reflects my commitment to academic excellence and the pursuit of knowledge.

Date: [Date of Completion]Signature: [Your Signature] [School/Institution Name][Teacher’s/Examiner’s Name and Signature]

In order to download the PDF, You must follow on Youtube. Once done, Click on Submit

Follow On YoutubeSubscribed? Click on Confirm

Download Project On Modes Of Entering Into International Business For Class 12 CBSE PDF