Partnership Firm Process and Procedure- Class 12th Project

INTRODUCTION:

A partnership is an arrangement where parties, known as partners, agree to cooperate to advance their mutual interests. The partners in a company may be individuals, businesses, interest-based organizations, schools, governments, or combinations. Organizations may partner to increase the likelihood of each achieving their mission and to amplify their reach. A partnership may result in issuing and holding equity or maybe only governed by a contract. Hence we will talk about all the Partnership Firm Process and Procedure in this article.

The proprietorship form of ownership suffers from certain limitations such as limited resources, limited skill, and unlimited liability. Expansion in business requires more capital and managerial skills and also involves more risk. A proprietor finds him unable to fulfill these requirements. This call for more persons come together, with different edges and start a business — for example, a person who lacks managerial skills but may have capital.

Another person who is a good manager but may not have capital. When these persons come together, pool their money and skills, and organize a business, it is called partnership. Partnership grows mainly because of the limitations or disadvantages of proprietorship.

The Indian Partnership Act, 1932, Section 4, defined partnership as “the relation between persons who have agreed to share the profits of a business carried on by all or any of them acting for all.” The Uniform Partnership Act of the USA defined a partnership “as an association of two or more persons to carry on as co-owners a business for profit.”

AIMS AND OBJECTIVES:

The project aims to learn about the process of registering a partnership firm and its benefits

Objectives of the study are

- To learn about what is a partnership firm

- To learn about the process of registering a partnership firm

- To learn about the different benefits of partnership firm

- To study how a partnership firm is different from a company

- To determine the pros and cons of partnership firm

METHOD AND METHODOLOGY:

Primary data is data gathered for the first time by the researcher. It is the raw form of data and thoroughly studied and hence, a helpful tool for secondary data. Here the method used for the collection of primary data is by using the reference to the website.

The referred websites in this project are used as a source of data for this project. Most of the content is collected from these websites. The authenticity of this information cannot be taken seriously, and thus, keeping that in mind, most of that data might be real or fake.

NEED AND IMPORTANCE:

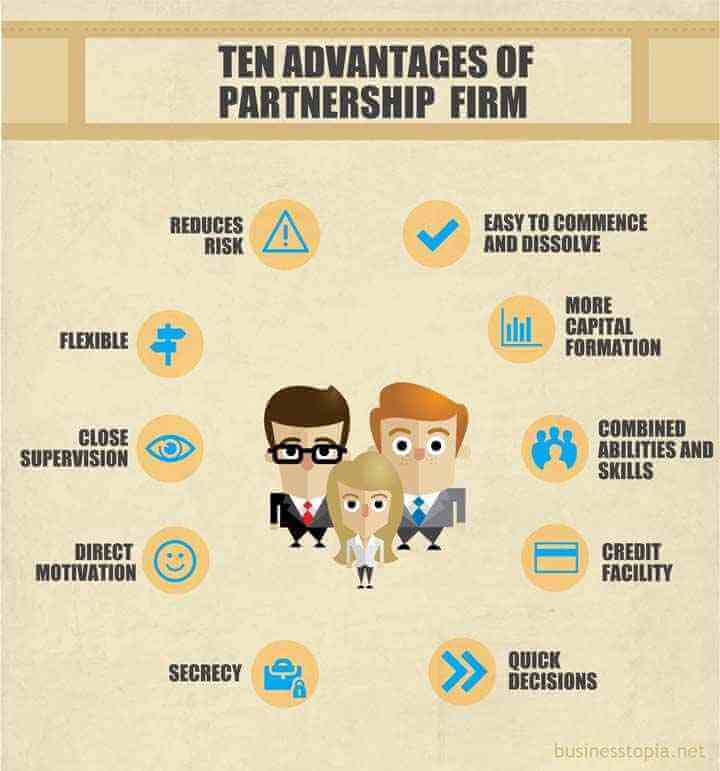

Advantages of a partnership firm

- Availability of large resources

- Better decisions

- Flexibility in operations

- Sharing risks

- Protection of interest of each partner

- Benefits of specialization

Disadvantages of a partnership firm

- Instability

- Unlimited Liability

- Lack of Harmony

- Limited Capital

- No legal status

- Not easy to transfer ownership

Also, Check –Visit A Slum And Find Out Their Basic Problems

DETAIL REPORT OF PROJECT:

Registration of partnership firm

A partnership firm can be registered, whether at the time of its formation or even subsequently. You need to apply with the Registrar of Firms in the area in which your business is located.

- Application for partnership registration should include the following information: – Name of your firm – Name of the place where the business is carried on – Names of any other site where the company is given on – Date of partners joining the firm – Full name and permanent address of partners. – Duration of the firm

- Every partner needs to verify and sign the application

- Ensure that the following documents and prescribed fees are enclosed with the registration application:

- Application for Registration in the prescribed Form

- Duly filled Specimen of Affidavit – Certified copy of the Partnership deed

- Proof of ownership of the place of business or the rental/lease agreement thereof It may be noted here that the name of your partnership firm should not “contain any words which may express or imply the approval or patronage of the government except where the government has given its written consent for the use of such words as part of the firm’s name”. Once the Registrar of Firms is satisfied that the application procedure has been duly complied with, he shall record an entry of the statement in the Register of Firms and issue a Certificate of Registration.

Essential Elements of a Partnership Firm

- Contract for Partnership

The partnership is the result of a deal. It does not arise from status, the operation of law, or inheritance. Thus, at the time of the death of the father, who was a partner in the partnership firm, the son can claim a share in the partnership property but cannot become a partner unless he enters into a contract for the same with other persons concerned. Similarly, the members of a HUF carrying on a family business cannot be called partners for their relation arises not from any contract but status. Thus, a “contract” is the very foundation of partnership.

- Maximum No. of Partners in a Partnership is 20

Since the partnership is the result of a contract, at least two people are necessary to constitute a partnership. The Indian Partnership Act, 1932, does not mention anything about the maximum no. of partners in a partnership firm. Still, as per the Companies Act, a partnership consisting of more than ten persons for banking business and more than 20 persons for any other company would be considered as illegal. Hence, these should be regarded as the maximum limits to the number of partners in a partnership firm. Only the persons competent to contract can enter into a contract of partnership. Persons may be natural or artificial. A Company may be a fake legal person, enter into a settlement of the business if authorized by its Memorandum of Association to do so.

- Carrying on of Business in a Partnership

The third essential element of a partnership is that the parties must have agreed to carry on a business. The term “business” is used in its broadest sense and includes every trade, occupation, or profession. Therefore, if the purpose of us to carry on some charitable work, it will not be a partnership. Similarly, if several persons agree to share the income of a particular property or to divide the goods purchased in bulk amongst them, there is no partnership, and such persons cannot be called partners because, in neither case, they are carrying on a business.

Thus, where A and B jointly purchased a tea shop and incurred additional expenses for buying pottery and utensils for the job, contributing the money in equal proportions and then leased out the shop on rent which was shared equally by them , it was held that they are only co-owners and not partners as they never carried on any business

- Sharing of Profits

This essential element provides that the agreement to carry on business must be the object of sharing profits amongst all the partners. Thus, there would be no partnership where the company is carried on with an altruistic motive and not for making a profit or where only one of the persons is entitled to the whole of the advantages of the business. The partners may, however, agree to share the benefits in any ratio they like. Sharing of losses not necessary

To constitute a partnership, the partners don’t have to agree to share the failures (Raghunandan vs. Harmasjee). It is open to one or more partners to agree to bear all the shortcomings of the business.

Moreover, how the profits/losses are to be shared should be expressly stated in the partnership deed. In the absence of this being mentioned in the partnership deed, the provisions of the Partnership Act, 1932, would apply, which state that the profits/losses should be distributed equally among all partners.

- Mutual Agency in a Partnership

The fifth element in the definition of partnership provides that the business must be carried on by all the partners or any (one or more) of them acting for them all, i.e., there must be an interactive agency. Thus, every partner is both an agent and principal for himself and other partners, i.e., he can bind by his acts the other persons and can be bound by the laws of other partners. The importance of the element of mutual agency lies in the fact that it enables every partner to carry on the business on behalf of others.

Types of Partnerships

- General Partnership

In a traditional partnership model, all the partners share in the profits and risks of the business. Each partner has unlimited liability for the debts of the company – your assets can be seized if your business owes money. If your partners do anything wrong with the business, you are also held responsible.

- Limited Partnership

Limited partnerships have two different types of partners: general partners and limited partners.

General partners are responsible for managing the business. They have unlimited liability (the same as a general partnership).

Limited partners are only liable for what they’ve contributed to the business – they can only lose the money they’ve invested. Limited partners do not manage the business.

- Limited Liability Partnership

A limited liability partnership protects the partners from the debts of the business or the actions of other partners.

Limited liability partnerships are only available to some professions:

- Chartered Accountants

- Certified management accountants

- Certified general accountants

- Medical doctors

- Chiropractors

- Dentists

- Optometrists

- Lawyers

ANALYSIS OF DATA:

Features of the partnership firm

The essential functions and characteristics of a partnership are:

- Agreement: The organization arises out of a contract between two or more persons.

- Profit-sharing: There should be an agreement among the partners to share the profits of the business.

- Legitimate business: The business to be carried on by a partnership must always be legal.

- Membership: There must be at least two persons to form a partnership. The maximum number is 20. But in the case of the banking business, the maximum is ten members.

- Unlimited liability: The liability of every partner is unlimited, joint, and several.

- Principal-agent relationship: Every partner is an agent of the firm. He can act on behalf of the firm. He is responsible for his acts and also for the deeds done on behalf of the other partners.

- Corporate management: The firm and the partners are one. When a contract is made in the name of the firm, all the partners are responsible for it individually and collectively.

- Non-transferability of shares: A partner cannot transfer his stock of interest to others without the consent of the other partners.

Conclusion of Partnership firm Process and Procedure:

According to the above definition of a partnership firm, we can describe the following characteristics of a partnership firm:-

- There should be a proper contract between the partners, which shall state all the terms and conditions of the partnership firm. The agreement clearly will show the rights and liabilities of the partners, capital to be employed by the partners, the interest on money of the partners, the salary and other remuneration to the partners, the admission of new partners, the dissolution of the partnership firm, etc.

- Nothing is definite in the Indian Partnership Act in respect of several partnership firms. Still, as per the Company Act, there should not be more than ten persons in the case of banking business and 20 persons in other businesses. Otherwise, the partnership shall be deemed illegal.

- The partnership firm should be formed for doing business, and the aim of the business firm should be to earn a profit. For example, Mr. X and Mr. Y agreed to go on a pleasure trip and agreed to divide the expenditure 50:50; it is not a business. Hence, it will not be treated as a partnership firm.

- The profit should be divided between the partners after the end of the financial year as per the agreement. The benefit cannot be carry forwarded in the case of the partnership firm.

- The business can be carried out by one partner or a few partners or by all.

DISCUSSION:

Do you want to minimize your record-keeping, audit, and administrative requirements?

There is no provision for the regular meeting of the Board and members for LLPs. Partners can decide when and how to meet decide on delegation of powers etc. However, the rule exists that LLP should maintain a minute book. However, the Quarterly Board of Directors meeting and the annual shareholding meeting is mandatory for a limited company. If you want to lower your liability with regards to paperwork and administrative activities, opt for an LLP business structure.

Also, Companies are mandatorily required to get their win audited annually, whereas, for LLPs, only those having turnover more than Rs.40Lacs or Rs.25Lacs contribution in any financial year are required to get their accounts checked annually as per the LLP Act.

SUGGESTION:

There are different sorts of business to business partnerships that every business proprietor, perhaps follow to develop their businesses. The great motto is behind any business associations is to find out new customer leads and transform entirely into enhanced revenue and sales for all organizations.

Partnership in business facilitates companies to progress in processes speedily and reduces all financial crisis-related to obtaining new clients. A successful collaboration provides capability in particular sectors and also increases the production of products accessible more services to the customers. Though, lots of companies do not succeed abruptly after contracts are approved, just because of failure to fix divergence that takes place during the execution of the business deal.

However, all small matters can twist into big dilemmas that exterminate every successful business partnership. But there are significant benefits to the partnerships that ensure that the organization provides essential value to both parties’ relationships. Building business associations with retailers generally create a tremendous economic sense, along with help to pursue sole business opportunities.

Building an effective and lasting business partnership is not an easy task ever. Still, when you come to the right place and the right people, it’s great to associate or enhance the right relationship as a partner in the business. Maintain open and transparent communication between you and your team members and partner of your organization that will help further stay remain with mutual agreement.

ACKNOWLEDGMENT:

My profound gratitude to all the faculty members of the Department, for their timely assistance and encouragement throughout my research work.

I duly acknowledge the encouragement and support of the research scholars in the department, and all my colleagues and friends.

It gives me immense pleasure to take the opportunity to all the people who are directly or indirectly involved in the completion of my project based on Partnership Firm Process and Procedure.

With deep reverence, I offer my deepest gratitude _____, without whom this project could not have been fulfilled.

Lastly, I thank Almighty, my parents, family members, friends, and teachers for their constant encouragement and support, without which this project would not be possible.

Name of School/College

BIBLIOGRAPHY / REFERENCE :

- http://www.yourarticlelibrary.com/partnership-firms/partnership-firms-definition-features-advantages-and-disadvantages/40804

- http://www.commercevilla.com/partnership-firm.html

- https://quickbooks.intuit.com/in/resources/legal/registration-procedure-for-partnership-firms-in-india/

- https://en.wikipedia.org/wiki/Partnership

- https://accountlearning.com/partnership-features-advantages-disadvantages/

- http://www.sterlingccpl.com/bizstart-partner.php

- https://inc42.com/resources/choose-best-business-structure-company/

DOWNLOAD PDF OF THE PROJECT PARTNERSHIP FIRM PROCESS AND PROCEDURE

Password: hscprojects.com

In order to download the PDF, You must follow on Youtube. Once done, Click on Submit

Follow On YoutubeSubscribed? Click on Confirm

Download Partnership Firm Process and Procedure- Class 12th Project PDF

It was very helpful for me thanks a lot

It’s help me a lot.. thanks for the giving info..

So awsome i really get what i want of topic partnwrship firm

It was very helpful for me thanks🙏🙇

It was very help full link

Well Thnks a lot

it is very helpful to me .thanks a lot.

It is very helpful for me . Thank you very much

Its really help full thnx for giving….

Thanks it is very helpfull

Amazing info thanks a lot

Thanks a lot for giving me important information

The appropriate information needed was available thank you for this

Thanks very much,i really need of this information for my ocm project

It was very helpful… Thanks.🙏. I got most of the information and also correct information from here…

Very nice thanks for this information

Perfect artical for project

It’s amazing!

It was very helpful for me in accountancy project

there is one destination for all proect

This is so helpful to me thanks a lot

Thanks . It’s very helpful for me