Economic Project On Government Budget

INTRODUCTION:

A government budget is an annual statement presenting the government’s proposed revenues and spending for a financial year that is often passed by the legislature, approved by the chief executive or president, and presented by the finance minister to the Nation. The budget is also known as the Annual financial statement of the country. This document estimates the anticipated government expenditures for the ensuing financial year.

For EXAMPLE – Property tax

Meaning:

In the modern world, every government aims at maximizing the welfare of its country. It requires several infrastructural economic and welfare activities. This requires appropriate planning and policy of the government which is called a budget. All these activities related to infrastructure, welfare, and economic growth depend upon the thing. The solution to all these problems is known as a “budget”.

A budget is a document containing detailed programs and policies of action for the given fiscal year.

Definition:

- A budget is a financial plan of the government for a definite period.

- A budget is a document containing a preliminary approved plan of public resources and expenditure.

- A government budget is an annual statement showing item-wise estimates of receipts and expenditures during a fiscal year.

IMPACT OF COVID-19 ON GOVERNMENT BUDGET:

The government is likely to meet the budget targets for 2020-21 due to the covid-19 crisis but contraction in economic growth may not be as severe as being pointed out by the outside world, economic affairs secretary Tarun Bajaj said. He said the government regularly is monitoring 14-15 parameters which can give early signs of where the economy is heading. This includes E-way bills, power consumption, GST collection, etc. and every parameter is showing promising results, he said.

GRAPHICAL REPRESENTATION:

KEY POINTS:

- The budget is prepared by the government at all levels, i.e., the central government prepares its respective annual budget.

- Estimates expenditures and receipts are planned as per the objectives of the government.

- The budget is presented in the parliament on such a day as the President may direct. By continuous it is presented before it can be implemented.

- It is required to be approved by the parliament.

OBJECTIVES:

- Reallocation of resources

- Economic stability

- Reducing inequalities in income and wealth

- Economic growth

- Management of public enterprises

OBJECTIVES OF GOVERNMENT BUDGET:

Reallocation of Resources:

- Through the budgetary policy, the government aims to reallocate resources following the economic and social priorities of the country.

- Tax concessions or subsidies.

- Directly producing goods and services.

Reducing Inequalities In Income & Wealth:

Economic inequality is an internet part of every economic system. The government aims to reduce such inequalities of income and wealth, through its budgetary policy. The government aims to influence the distribution of income by imposing taxes on the rich and spending more on the welfare of the poor.

Economic Stability

The government budget is used to prevent business fluctuation of inflation and deflation to achieve the objective of economic stability. Policies of the surplus budget during inflation and deficit budget during deflation help to maintain the stability of prices in the economy. There is a large number of public sector industries that are established and managed for the social welfare of the public. The budget is prepared with the objective of making various provisions for managing such enterprises.

Economic Growth

The growth rate of a country depends on the rate of savings and investments. For this purpose, the budgetary policy aims to mobilize sufficient resources for investment in the public sector.

Therefore, the government makes various provisions in the budget.

COMPONENTS OF BUDGET:

Revenue budget:

- Revenue receipts

- Revenue expenditure

Capital budget:

- Capital receipts

- Capital expenditure

REVENUE BUDGET:

Components of the budget refer to the structure of the budget. Two main components of the budget are :

Revenue Receipts:

It refers to those receipts that neither create any liability nor cause any reduction in the assets by the government. They are regular and recurring and the government receives them in its normal course of activities Revenue receipts satisfy these conditions :

- The receipts must not create a liability for the government.

- The receipt must not cause a decrease in the assets of the government.

Source Of Revenue:

There are two types of revenue receipts of the government.

- Tax Revenue- refers to the total receipts from taxes and duties imposed by the government.

For example, Direct tax & Indirect tax

Tax is a compulsory payment, no one can refuse to pay it. Tax receipts are spent by the government for the common benefit of people in the country.

- Direct taxes are those which are imposed on the property and the income of individuals and companies is paid directly by them to the government. They are imposed on individuals and companies.

- Indirect taxes refer to those taxes which affect the income and property of individuals and companies through their consumption expenditure.

How To Classify A Tax As Direct Or Indirect?

- A tax is a direct tax if its burden cannot be shifted. For example- income tax is a direct tax as its impact and incidence are on the same person.

- A tax is an indirect tax, if its actual burden of the tax lies on different persons, i.e. its burden can be shifted to the other.

Items Categorized As Direct Or Indirect Tax?

- It is a direct tax as its impact and incidence lie on the same person. It is a direct line on the same person.

- Value-added tax is an indirect tax as it is imposed on the seller but beard by the customer.

- Services tax is an indirect tax as its impact and incidence lie on different people.

Non-Tax Revenue:

it refers to receipts of the government from all sources there than those of tax receipts.

- Internet – Government receives interest on loans given by it to state government union territories.

- Fees – Fees refer to charges imposed by the government to cover the cost of recurring services provided by its conduct fees registration fees impact fees etc.

- Licenses Fees – It is a payment charged by the government to grant permission of keeping a gun or commercial vehicle.

- Fines & Penalties – They refer to those payments which are imposed on lawbreakers, fines for jumping light, etc.

- Escheats – It refers to claims of government on the property of a person who dies without leaving a will.

- Gifts and Grants – Government receives gifts and grants from the foreign government.

- Forfeitures – These are in the form of penalties that are imposed by the court for non-compliance with other contracts, etc.

Revenue Expenditure:

Revenue expenditure refers to the expenditure that neither creates any liability nor causes a reduction, in any liability of the government.

- It is recurring in nature

- It is incurred on the normal functioning of the government.

The expenditure must not create an asset of the government payment of salaries or pension is revenue expenditure as it does not create any asset.

Metro is not a revenue expenditure as it leads to the creation of an asset for the government.

CAPITAL BUDGET:

The main two components of the capital budget are :

Capital Receipts:

Those receipts which are either create liability or cause a reduction in the assets of the government. They are non-recurring and non-routine.

The receipts must create a liability for the government. Borrowings are capital receipts as they lead to an increase in the liability of the govt. however, the tax received is not a capital receipt as it does not result in the creation of any liability.

The receipts must cause a decrease in the assets, receipts from the scale of share of public enterprises is a capital receipt as it leads to a reduction in assets of the government.

Capital receipts are of three types :

- Borrowings: They are the funds raised by the government to meet expenses.

- Government open market

- Reserve Bank Of India

- Foreign Government

- Recovery Of Loans: Government grants various loans to the state government or union government.

- Other Receipts: These include disinvestment and small savings. Disinvestment refers to the act of selling a part of the whole of shares of a selected public sector undertaking held by the government small savings refer to funds raised from the public in the form of post office deposits.

Capital Expenditure:

It refers to the expenditure that either creates an asset or reduces any liability of the government.

- It is non-recurring

- It adds to the capital stock of the economy and increases its productivity through expenditure.

For example, a loan to states and union territories is an expenditure on building roads, flyovers, etc. the expenditure must create an asset for the government.

As construction of the metro is a capital expenditure as it leads to the creation of the asset. However, any amount paid as salaries is not capital in the assets.

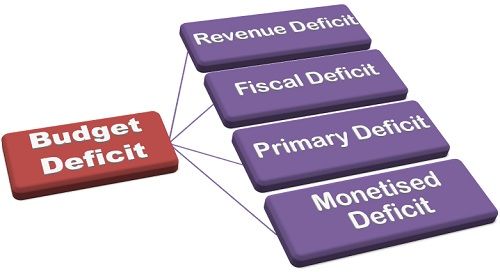

BUDGETARY DEFICIT:

A budgetary deficit is defined as the excess of total estimated expenditure or our total estimated revenue when the government spends more time it collects than it incurs a budgetary deficit regarding the budget of the Indian government.

- Revenue Deficit

- Fiscal Deficit

- Primary Deficit

Revenue Deficit:

The revenue deficit is concerned with the revenue expenditure and revenue receipts of the government. It refers to an excess of revenue expenditure of revenue receipts.

Implications:

- It indicates the inability of the government to meet its regular and recurring expenditures in the proposed budget.

- It implies that the government is dissolving, i.e., the government is using up saving from other sectors of the economy to finance its expenditure.

Fiscal Deficit:

The fiscal deficit presents a more comprehensive view of budgetary imbalances. It is widely used as a budgetary development in India. The extent of the fiscal deficit is an indication hour for gout is spent.

Implications:

The fiscal deficit indicates the total borrowings requirements of the government.

Sources:

- Borrowings: It can be met by borrowings from internal or external sources.

PLAN AND NON-PLAN EXPENDITURE:

Planned expenditure refers to the expenditure that is incurred for the programs detailed in the current five-year plan.

Non-planned expenditure refers to the expenditure other than the expenditure related to the current five-year plan.

Plan expenditure is spent on current development and investment outlays non-plan expenditure is spent on the liability of the government. Non-planned expenditure arises only when the plans provide such expenditure.

DEVELOPMENT AND NON-DEVELOPMENTAL:

Developmental expenditure refers to the expenditure which is directly related to the economic and social development of the country.

Expenditure on such services is not a part of the essential functioning of the government.

The non-developmental expenditure refers to the expenditure which is incurred on the essential goods and services of the government. It does not directly contribute to the economic development, but it directly helps in the development of the economy such expenditure is essential from the administration’s view.

MY OPINION ON THE TOPIC:

After listening to a long 2 hours speech by the finance minister, I had some equally frustrating and fascinating thoughts moving beyond the usual debate of will this is good economics or bad politics?

The two can co-exist. As a whole, the budget needs to move away from populist and prudent definitions. It needs to be examined on the merit of what it does to different classes of people.

It had a huger impact and I had to take a bit of time to properly digest what I heard.

BIBLIOGRAPHY

- Teachers

- Books

- Friends/family

- Internet

-http://www.hhcpa.com/blogs/non-profit-accounting-services-a-look-into-the-importance-of-budges

-http://www.theunreal.times.com/2015/02/27/budget-criticism101/-the-10-most-common-ways.

CERTIFICATE:

This is to certify that ______________ of grade ____roll no. _____ of_______has successfully complete the project on The Government Budget under my supervision and has submitted the project in practical requirement. Under economics examination 202_-2_.

The concepts and ideas are original and the project is a bonafide piece of work carried out by her under my supervision.

ACKNOWLEDGEMENT:

Many people helped me through their successful competition of the project.

First of all, I thank the Almighty God for his goodness and mercy in giving me the strength to complete this project.

I hereby express my abundant and sincere gratitude to Dr. Kxx, department of economics, Royal Global school, for her valuable guidance, constant encouragement, and creative suggestions rendered during this project.

I thank our principal Mrs xx for providing me with all facilities and also for the constant inspiration and encouragement for the successful competition of this project.

I offer my deepest gratitude to my family members whose prayers and blessings guided me in the successful completion of this project. I also owe my gratitude to my classmates whose support was inevitable for the completion of the project.

DOWNLOAD PDF OF THE PROJECT

Password: hscprojects.com

In order to download the PDF, You must follow on Youtube. Once done, Click on Submit

Follow On YoutubeSubscribed? Click on Confirm

Download Economic Project On Government Budget PDF

very nice project