A Report On Procedure Of Purchasing And Selling Of Shares Through Account

INTRODUCTION :

Dematerialization, in short, called ‘Demat,’ is the process by which an investor can get physical certificates converted into electronic form maintained in an account with the Depository Participant. The investors can dematerialize share certificates that are already registered in their name and belong to the list of securities admitted for dematerialization at the depositories.

Any purchase of shares through a stock exchange needs to be routed through brokers registered with the transfer. Hence, for buying and selling shares regularly, you need to register with a broker. This can be done by approaching a broker and signing up a client agreement form. It is also essential for a person to open a Demat account through which securities are delivered and received. This Demat account can be opened with a depository participant, which again is a Sebi-registered intermediary. A broker asks his client to deposit money with them and then buys shares for you. The stocks you buy from the broker will be transferred to your Demat account, after which you own the shares. Similarly, when a person sells shares, he has to move stocks to the broker’s mind through his Demat account.

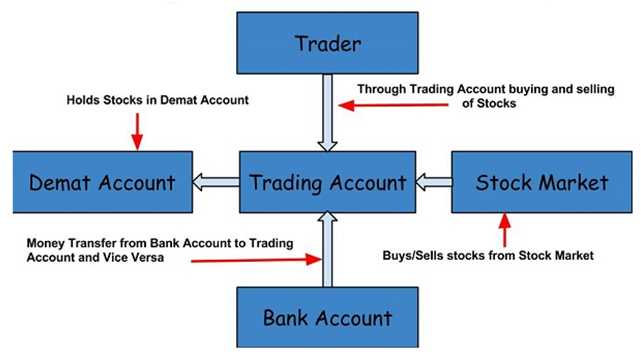

The Demat account is used as a bank where shares bought are deposited in. While A trading account is used to place buy or sell orders in the stock market.

So Trading account is an interface between your Bank account and your Demat account when you buy something, Trading account takes money from your Bank Account (Its already taken from your Bank account and saved in Trading account) and buys shares and stores it in your Demat account. When you Sell something, Your trading account takes back the shares from your Demat account and Sells them in Stock Market and gets back the money, and that goes back to your Bank account (actually, you manually transfer it to Bank account from Trading account most of the times.

Let’s use an example

You have Rs.100 in your wallet. You go to a shop and tell the seller that you want a packet of chips, you check the price, and finalize the transaction. Then, you take the money out of your wallet and give it to the seller. In this case, the wallet acts as the Demat account, while you act as the trading account.

AIMS AND OBJECTIVES :

To Learn the process of Buying and Selling of shares through DEMAT Account.

An objective is the brainchild of any project report. The project report will always Contain specific goals that need to be accomplished. The following are the objectives that are behind the preparation of this project on “Buying and selling through Demat Account.”

- To learn what is a Demat account and what are the benefits of Demat account

- To learn why there is a need for a Trading account along with Demat account for someone to buy and sell his shares

- To discuss what happens inside when someone buys or sells his shares through a Demat account. We will discuss how the money is taken from the share buyer and the transferred to share seller and vice versa.

- To understand the company, its achievements and tasks, products and services and also to collect information about its competitors, its products, and services offered

- After following and collecting information about the organization and its competitors, it will be easy to trade

- It also attempts to find ways and means of enhancing the effectiveness of derivative trading.

- To find proper solutions using which the present system could be overhauled.

- To understand the problem faced by customers and finding a way to solve the queries

METHOD AND METHODOLOGY :

Research methodology refers to the search of knowledge.once can also define research methodology as a scientific and systematic search for required information on a specific topic.

The word research methodology comes from the word “advanced learner’s dictionary meaning of research as a careful investigation or inquiry especially through research for new facts in the branch of knowledge, for example, some authors have a defined research methodology as systematized effort to gain new knowledge

- Most of the data is already available on Wikipedia, but it cannot be used fully in the Indian share market, so we had to dig into other resources

- Through the study of a detailed report on opening a Demat account and buying and selling it from Kotak securities blog

- Through different trading books like “Trading for dummies.”

- Most of all the data were collected from Youtube explanatory videos about Demat account

Primary Data:-

Primary data is data gathered for the first time by the researcher. It is the raw form of data and thoroughly studied and hence, a helpful tool for secondary data. Here the method used for the collection of primary data is the Web analytics Technique.

DETAIL REPORT OF PROJECT :

One cannot buy and sell shares directly through his Demat account. One needs to open a Trading account that will allow you to buy/sell stocks. Many banks offer three in one Demat account.

So to start trading of shares, one must have two accounts.

1. Trading account – a Trading account is the one that is opened with your trading member. It is this account that you use to place your buy and sell orders.

2.Demat account – A Demat account is simply a savings account in your bank. IT only holds your stocks and other dematerialized securities. The Demat account is opened with one of the depositories viz. NSDL or CDSL

How to purchase and sell using a Demat account?

- Step 1:

Link your trading and Demat accounts. This way, you won’t have to keep supplying your Demat account details for every transaction.

- Step 2:

Place an order through your online trading account. This could be a market order, a limit or buy a prescription, or an after-market order. If your brokerage allows you to place orders through the phone, then you will need to supply your trading account details.

- Step 3:

The exchange will process your order. It will verify the details of the transaction, the market price, the availability of the shares in the market, and so on. It will also check the details of your Demat account that is linked to your trading account. This is especially so in case of a sell order.

- Step 4:

Once the order is processed, the shares will be either deposited in or debited from your Demat account.

When you want to buy a share of a company, as a retail investor, you will need to place it through your stockbroker. An investor is not allowed to place orders directly with the stock exchanges.

The broker then transmits this order to the exchanges, typically on a real-time basis. Inside the transaction, the law goes into the trading system. Depending on the order category, the order is sent for execution (market orders) or to the order book (limit order). [There are some more order categories, but I will not go into those details for the sake of simplicity].

A market order is executed against the first opposite order that comes along, i.e., your buy order is executed against the first sell order available.

All orders in the order book are prioritized by price-time priority. So a limit order goes and sits in the order book accordingly and will be executed only when the price of your order is reached. Till then, it remains in the order book as an open order. If the trading session ends before your order is executed, your order is automatically canceled by the exchange.

Once an order is executed, the process of clearing and settlement begins. Here the money is taken from the buyer, i.e., you and given to the seller of the security. Simultaneously, the share is taken from the Demat account of the seller and transferred to the Demat account of the buyer. All these processes are done transparently to both the buyer and the seller and are done jointly by the exchanges, the trading members, the clearing members, the custodians, and the banks.

ANALYSIS OF DATA :

To start with the process of buying and selling shares through the Demat account, you need to have a Demat account first. Here I have explained a detailed report on the procedure of opening a Demat account. Create an account now to start with the next process of buying and selling of shares.

The commencement of E-Trading and Demat has transformed the capital market in India. With the help of the Demat and Trading account, buying and selling of shares have become a much faster and even process than trading with the assistance of a physical broker. It provides for the assimilation of the bank, broker, stock exchange, and depository participants. This helps to get rid of the painstaking procedure of investing in the stock exchange.

Today, if one wants to invest in the stock market, he has to contact a broker on the phone or meet him personally to place an order. A broker generally gives such importance and additional service only to high net worth customers. But the introduction of Internet trading, even a common or a small investor, gets an opportunity to avail the service at an affordable price, which is much lesser than what is charged by a physical broker over the phone.

Online trading has given the customer real-time access to account information, and stock quotes elaborated on market research and interactive trading. The prerequisites of Internet trading are a computer, a modem and a telephone connection, registration with a broker, a bank a/c, and depository account. The introduction of depository service is considered as the beginning of the trading of Stocks. This means that you can arrange delivery of scripts sold anytime, anywhere, to anyone with a click of a mouse. Dematerialization facilitates to keep the securities in electronic form instead of paper form.

It offers more advantages than the physical certificate form. Despite the benefits of Dematerialization, the awareness levels among the investors relating to Demat account is not adequate because of numerous reasons. The investors are not sufficiently responsive to the concept of the Demat account and the various financial institutions providing such services. This study involves understanding the different theories of Demat and analyzing the investment pattern of individuals in India and a review on Analysis of awareness among investors regarding On-Line Trading and Dematerialization has been submitted to PuneInstitute of Business Management, Pune in partial fulfillment of postgraduate program

CONCLUSION :

Advantages of Demat

The bonus/right shares allotted to the investor will be immediately credited to his account. There is no risk due to loss on account of fire, theft, or mutilation. Transaction costs are usually lower than those in the physical segment. A Demat account also helps avoid problems typically associated with physical share certificates. For example, delivery failures caused by signature mismatch, postal delays, and loss of document during transit.

Further, it eliminates the risks associated with forgery and due to damaged stock certificates. Demat account holders also avoid stamp duty (as against 0.5 percent payable on physical shares) and filling up of transfer deeds. The most significant advantage of having a Demat account is that you don’t have to pay for stamp since these are electronically stored, which reduces the transaction cost.

Disadvantages of Demat

- Trading in securities may become uncontrolled in the case of dematerialized securities.

- It is incumbent upon the capital market regulator to keep a close watch on the trading in dematerialized securities and see to it that trading does not act as a detriment to investors.

- For dematerialized securities, the role of key market players such as stock-brokers needs to be supervised as they have the capability of manipulating the market.

- Multiple regulatory frameworks have to be conformed to, including the Depositories Act, Regulations, and the various Bye-Laws of various depositories.

- Agreements are entered at various levels in the process of dematerialization. These may cause worries to the investor desirous of simplicity.

- There is no provision to close a Demat account, which is having illiquid shares. The investor cannot close the mind, and he and his successors have to go on paying the charges to the participant, like annual folio charges, etc..

- After liquidating the holdings, many Indian investors don’t close their Demat account. They are unaware that DPs charge even on dormant accounts

DISCUSSION :

After our casual conversation on Demat accounts, one beautiful Sunday, My friend called me and surprisingly asked me to complete the study. The debate went on something like this

Which account should I open?

The best option was a 3-in-1 account that banks are offering these days. This clarifies that a 3-in-1 account is a convenient way for investors and a more profitable way for most bankers.

What are intraday brokerage and delivery brokerage charges?

Very put, the intraday brokerage is the amount you pay on the trading amount of your purchase or sale of shares. It applies only to those trades that settle in a day. Where you wish to hold the shares for any period longer than a day, the delivery brokerage charges will be applicable, which are 5 to 10 times the intraday brokerage charges.

It was quite clear that trading online with Demat account is much easier and faster

YOUR OPINION/ SUGGESTION :

Nowadays, practically every trade is made with a Demat account. Although it’s allowed to have 500 shares in a physical form, nobody wants to have a physical form of dividends. Therefore, the Demat account is crucial for trading.

You can choose to buy your entire requirement in one go or ten installments. This will ensure that your investment decisions are focused on achieving your objectives or goals and are not influenced by factors that are administrative or process bound.

So what I believe is, “The more extensive the coverage of instruments under the DEMAT account umbrella, the greater the convenience that everyone will experience.”

ACKNOWLEDGMENT:

My profound gratitude to all the faculty members of the Department, for their timely assistance and encouragement throughout my research work.

I duly acknowledge the encouragement and support of the research scholars in the department, and all my colleagues and friends.

I thank my friends in the stock market and the management of broking firms who helped me with valuable data in time.

It gives me immense pleasure to take the opportunity to all the people who are directly or indirectly involved in the completion of my project based on A report on the procedure of purchasing and selling of shares through DEMAT account

With deep reverence, I offer my deepest gratitude _____, without whom this project could not have been fulfilled.

Lastly, I thank Almighty, my parents, family members, friends, and teachers for their constant encouragement and support, without which this project would not be possible.

Name of School/College

BIBLIOGRAPHY / REFERENCE :

- Wikipedia.com for Definition of Demat accounts.

- The economic time’s news article about “How Demat Account Works.”

- Quora.com Question and answers.

- Kotak Mahindra’s article on “buying and selling through Demat account.”

In order to download the PDF, You must follow on Youtube. Once done, Click on Submit

Follow On YoutubeSubscribed? Click on Confirm

Download A Report On Procedure Of Purchasing And Selling Of Shares Through Account PDF

Thank you so much for giving us lot of information about demant account

Very Helpful Information

Thank you very much this information very helpful for mi you give to lot information about demat account

Thanks for the information