Collection Of News Clippings About Share Markets

INTRODUCTION:

Share: Share is nothing. However, the possession of the corporate is divided into minor elements, and every part is termed a Share of Stock. In this project, we shall discuss the collection of news clippings about share markets. Share is also referred to by completely different names like equity, money security, etc. An individual carrying a share of a corporation holds that a part of possession therein company. An individual holding most shares takes most control and is selected like the director, chairman, etc.

Share Market: A Share market is a place where shopping for and marketing shares takes place. Currently days, because of the net and advanced technology, there’s no would like to gift physically in exchanges like NSE and BSE; however, actually, the shopping for and marketing of shares will be done from anyplace, wherever there’s a pc with the net association. One ought to have a Demat and commerce account, pc, and net association, and they will begin the shared trade or investment from any place.

AIMS AND OBJECTIVES:

This project aims to do a collection of news clippings about share markets.

There are many objectives of this project. The primary goals are given below.

Objectives:

- To understand what is share market

- To know the working of the share market

- To understand the current share market

- To know the risks involved in the share market

- To ascertain any doubts regarding the share market

- To understand the advantages of the share market

METHOD AND METHODOLOGY:

The method used to gather the required information on the project is an internet survey method. The Internet has extensive knowledge on this subject. It has a vast collection of data on the share market, and it’s working. The survey has unveiled information about this topic, which has covered major few points listed below and explained in a detailed report of the project.

- What is the share market

- Current share market conditions

- Risks involved in the share market

- Advantages of share market

DETAILED REPORT OF THE PROJECT:

What is Share Market

A stock exchange, equity market, or share market is the aggregation of consumers and sellers (a loose network of economic transactions, not a physical facility or distinct entity) of stocks (also referred to as shares) that represent possession claims on businesses; these could embrace securities listed on a public stock market, similarly, as stock that’s solely listed in camera. Samples of the latter embrace shares of personal firms that are sold to investors through equity crowdfunding platforms. Stock exchanges list common equity shares similarly as different security sorts, e.g. company bonds and convertible bonds.

There are two styles of share markets:

Primary share market

A company enters the first market to boost funds. Within the primary market, a corporation gets registered to issue shares to the general public and lift cash. Firms typically get listed on the stock market through the first market route. Just in case a corporation is commercialism shares for the primary time, it’s referred to as an Initial Public providing or commerce, once the corporation becomes public. At the same time, going for trade, the corporate needs to give details concerning itself, its financials, promoters, businesses, stocks being issued, and value band soon.

Secondary share market

Investors trade already listed securities in the secondary market by shopping for and commercialising them. Secondary market transactions area unit transactions wherever one capitalist buys shares from another at the overall value. Usually, these transactions are conducted through a broker. The secondary market offers investors an opportunity to sell all their claims and exit the monetary market.

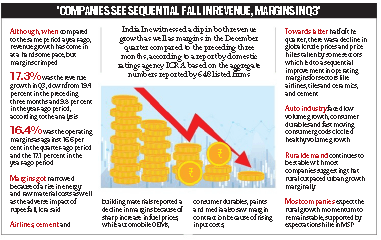

Current Share Market Conditions

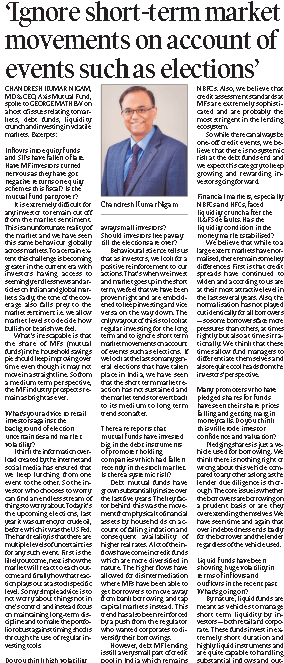

In India, the forthcoming general elections will be the main target, and the economy and market performance can pivot around that event. Uncertainty can loom before the polls, with the present government specialising in social programs to solidify its support.

However, commentators predict that post-election, the new government can introduce commercial enterprise stimulation as the attention can come to the economy. With several ar oral communication, the economy is expected to stay sturdy. However, growth could be barely below 2018.

With predictions of low artefact costs, oversupply within the native farm market, and import-export controls being unbroken in situ alongside food subsidies; inflation is predicted to be unbroken under control.

Another central inflation thought is oil value which, if it remains comparatively low, the rupee is predicted to regain a number of the bottom it lost in 2018. Broadly, low inflation and low-interest rates can result in India doing higher than others.

India has an economy largely dependent on domestic factors and is therefore cushiony from any impact from United States-China trade issues and US interest rates.

Analysts expect upward movement in the Indian stock exchange will be restricted before the elections. However, that commerce momentum will be repaired within half of the year. The final accord is that the Indian stock exchange should be up around ten per cent by the top of the year.

Generally, there’s pessimism within the market globally, which can continue into the prior quarter. Expectations are that markets are going to be volatile. However, uncertainty within the half of the year can dissipate and provide rise to the need for playacting higher within the second.

It is unlikely that the planet can move into a recession despite a weaker international growth outlook. However, markets can struggle for a stable footing until higher financial information emerges from major economies like the United States, China, Japan, and the EU.

Risks Involved in Share Market

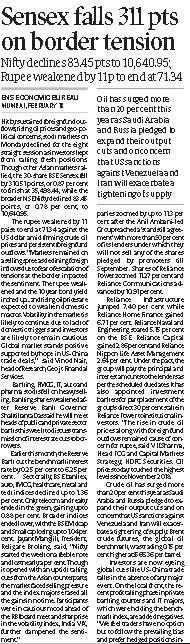

- Market risk

This is additionally known as systematic risk and relies on the regular worth fluctuation within the market. The market index Sensex and slap-up go up and down throughout the day. And plenty of time, it should affect the returns from a stock.

- Business Risk

The second kind of stock risk comes from the business. This risk is escalated if the company isn’t doing well. Reasons like the failure of management, poor quarter-by-quarter results, or your misjudgment in selecting a corporation return underneath business risk.

- Liquidity Risk

Before finance during a stock, you must undoubtedly check how solvent the corporate is? Firms with high debts could notice it exhausting to pay their bills. They could often even cut the dividends or, in the worst case, could go bankrupt. Liquidity risks are concerned for altogether businesses.

- Taxability Risk

The government changes taxes all the time, and therefore taxes could increase or decrease within the explicit business wherever you are endowed. The amendment in taxation will affect the stock’s worth.

Further, few industries are taxed relatively higher than the alternative, and therefore, their net income, once taxed, could also be less. Additionally, as the govt. Controls taxation, there’s no abundant that the management or the investors will do.

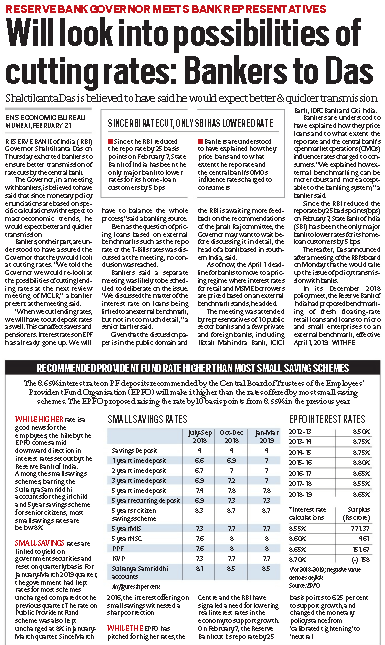

- The rate of Interest Risk:

The open market or international market interest rates changes from time to time. And this could absolutely or adversely affect the stock reckoning on the direction within which the interest rate is moving. For example, once the interest rates are high, a corporation may notice it troublesome to borrow cash (at high speeds). Further, the bond market declines because the interest rate will increase, which can also affect the company bonds.

- Regulative Risks:

There are various laws obligatory within the entirely different businesses that should even be termed because of the risk concerned in stocks. For example, Cigarettes, telecommunication, beverages, pharmaceutical, and a few alternative industries are highly regulated.

- Inflationary Risk:

With a rise in inflation, the worth of material can increase, which might affect the assembly value. Several firms concerned with commodities like oil, leguminous plant bean, etc., are affected tons by inflationary risk.

Further, for a few industries, the rate is too high.

Advantages of Share Market

- Possibilities of exceedingly sensible returns in a brief time

Even in the past, folks have gained extremely sensible returns on their stock exchange investments. You mostly stand an honest likelihood to earn immense profits once you decide upon a stock exchange investment. So, once you invest available market in India, though you place yourself at heaps of risks, you’re also in a position to earn reasonable returns quickly.

- Minority possession

It will sound like an exaggeration; however, once you place your cash in a much-supposed company’s stocks, you become an owner of the corporate, no matter how smaller your share could also be. You’ll be able to improve your standing within the market by astutely putting your cash into several corporations. Moreover, you’ll be able to exit whenever you would like.

- Right to Vote

Minority possession provides you with the proper to vote and voice your opinions at the company level.

ANALYSIS OF DATA:

Share market plays a significant role in aiding businesses to boost capital for growth and growth. Through IPOs, corporations issue shares to the general public and successively receive funds that area unit used for numerous functions. The corporate gets listed on the stock market during an initial public offering, which provides a chance to even a typical man to take a position within the company. The visibility of the corporate will increase furthermore.

You can be a dealer or capitalist within the share market. Traders hold stocks for a brief amount of your time, whereas investors hold stocks for an extended length. As per your money desires, you’ll opt for the investment product. The investors within the company will use this investment to satisfy their life goals. It’s one of the critical investment platforms because it provides liquidity. As an example, you’ll get or sell shares anytime supported by the requirement. That is, money assets may be born-again to money anytime. It offers ample opportunities for wealth creation.

CONCLUSION:

To conclude my findings,

To study how you’ll earn on the stock market, one needs to perceive how it works. Once an individual needs to buy/sell shares within the share market, he needs to 1st place the order with a broker or will do themselves mistreatment online commerce systems (this is mentioned later). Once you place the get order, the message is transferred to the exchange [either NSE or BSE ], and therefore the order stays within the queue of exchange’s different orders and gets executed if the worth} of that share involves that value. Once you get the confirmation of these dealings, the shares purchased will be sent to your Demat account. The stakes are going to keep in a Demat account in electronic format. Index in share market Index consists of a cluster of claims. Index denotes the direction of the entire market. Once folks say the market goes up or down, it means Index is mounting or down. The index consists of high capitalisation and high liquidity shares: high capitalisation shares – firms with the highest range of shares and the highest worth of every share. Market capitalisation is calculated by multiplying the current share worth and the scope of claims within the market. High Liquidity shares – Shares within the market with high volumes. You need to understand the record, share capital, net profit, debts, belongings pattern, etc.

DISCUSSION:

The discussion has revealed:

Welcome to a replacement world of Shares. Investment in equities is considered risky due to it being subjected to plug fluctuations; however, if endowed providentially and with wisdom, equities are comparatively the best choices to take a position due to the capitalist’s high returns. Investing in equities is done the same. SEBI, a regulator of the financial services business, has already simplified the method. However, most people are unaware of this method of investment inequities.

SUGGESTION:

I discussed my project find a few opinions and suggestions from family and friends. They are given below:

- While investing, one should read all the terms and conditions as they are subject to market risk.

- Anyone getting into the share market should understand and have a good knowledge of it.

- A risk-taker should consider taking a job in the share market.

- There should be seminars in college about the share market and its working, so the youth understands.

ACKNOWLEDGMENT:

My profound gratitude to all the Department faculty members for their timely assistance and encouragement throughout my research work.

I duly acknowledge the encouragement and support from the research scholars in the department and all my colleagues and friends.

It gives me immense pleasure to take the opportunity to all the people who are directly or indirectly involved in completing my project based on the Collection of news clippings about share markets.

With deep reverence, I offer my deepest gratitude to _____, without whom this project could not have been fulfilled.

Lastly, I thank the Almighty, my parents, family members, friends and teachers for their constant encouragement and support, without which this project would not be possible.

Name of School/College

BIBLIOGRAPHY / REFERENCE:

- https://www.quora.com/What-is-a-share-and-what-is-a-share-market

- https://economictimes.indiatimes.com/markets/stocks/news/what-is-share-market/articleshow/59531308.cms

- https://en.wikipedia.org/wiki/Stock_market

- https://economictimes.indiatimes.com/markets/stocks/news/where-global-and-indian-stocks-are-headed-in-2019/articleshow/67418856.cms

In order to download the PDF, You must follow on Youtube. Once done, Click on Submit

Follow On YoutubeSubscribed? Click on Confirm

Download Collection Of News Clippings About Share Markets PDF