Comprehensive Accountancy Project – 2019-2020

COMPREHENSIVE PROJECT

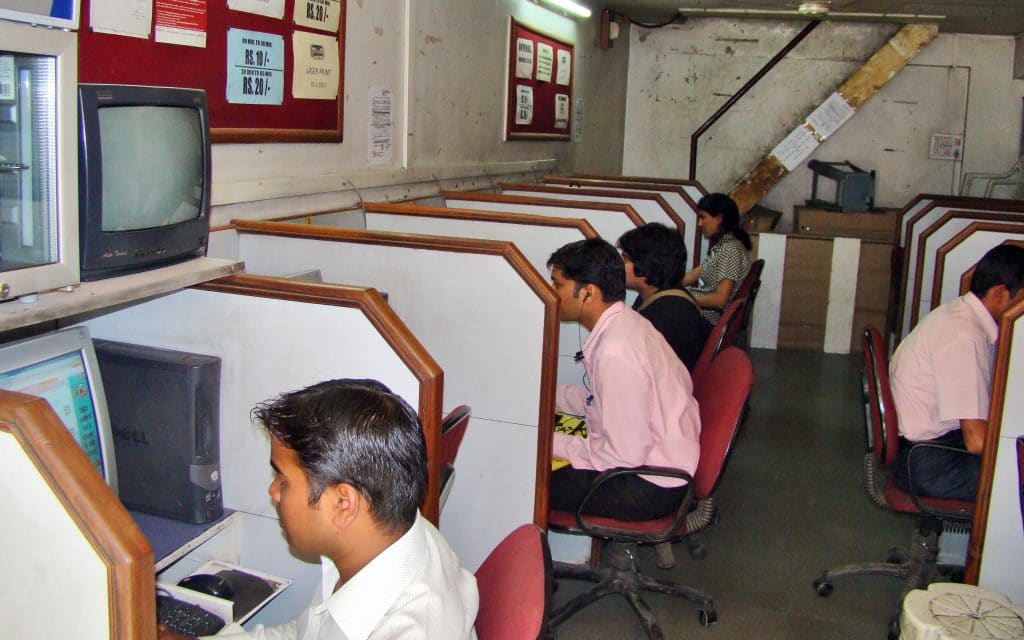

RAMA’S CYBER CAFÉ

Mr. Rama decided to commerce a computer business in a building which was constrained for Rs 1,00,000 and contributed a further sum of Rs 2,50,000. He wanted to start with 10 computers. He went on to HDFC bank and put up his proposal and managed to get a loan to the extent of 75 percent of the cost of the computer Rs 4,00,000 with pointers it was agreed that the loan was rapid in three annual installments as follows :

- At the end of first year = Rs 1,00,000 + 30000 interest

- At the end of 2nd year = Rs 1,00,000 + 20000 interest

- At the end of the 3rd year = Rs 1,10,000 (Rs 1,00,000+10000 interest)

He started business on 1st Apr 2019 on the same date he deposited Rs 2,40,000 in the bank. He gave Rs 1,00,000 to the computer company as 25% of the value of the computer purchase & Rs 3,00,000 out of bank loan availed. He deposited Rs 10000 0 with VENL for the telephone internet connection he got the computer code finished by paying Rs 25,000 and also spent Rs 4520 on getting pamphlets printed and distributed. All payments were to be made by cheques and all the receipts were each to be deposited in the bank on the same day. At the end of the year, their results showed the following.

╔═════════════════════════════════════════════════════════════╦══════════╗

║ Revenue from fees from students of computer class ║ 2,80,000 ║

╠═════════════════════════════════════════════════════════════╬══════════╣

║ Revenue on account of internet facility ║ 1,20,000 ║

╠═════════════════════════════════════════════════════════════╬══════════╣

║ Revenue from the sale of computer stationary ║ 98,000 ║

╠═════════════════════════════════════════════════════════════╬══════════╣

║ Purchase of computer stationary like floppy disk, CDs, etc. ║ 55,000 ║

╠═════════════════════════════════════════════════════════════╬══════════╣

║ Telephone chargers ║ 34,000 ║

╠═════════════════════════════════════════════════════════════╬══════════╣

║ Petty expenses ║ 12,000 ║

╠═════════════════════════════════════════════════════════════╬══════════╣

║ Entertainment expenses ║ 10,000 ║

╠═════════════════════════════════════════════════════════════╬══════════╣

║ Miscellaneous expenses ║ 10,000 ║

╠═════════════════════════════════════════════════════════════╬══════════╣

║ Wages paid to servant ║ 6,000 ║

╚═════════════════════════════════════════════════════════════╩══════════╝He withdraws 61,000 by cheque each month for their expenses. He paid the bank loan regularly.

Required :

- journalise the above transactions. But then into the edge and prepare a trial balance

- Prepare profit loss and balance sheet after taking into account that electricity charges of Rs 124,000 are yet to be paid.

- Charge depreciation at the rate of 25% on computers 10% on furniture and 5% on building

- Calculate the profitability ratio and comment on the efficiency of the business if the net profit ratio and gross profit in a similar type of business concerns are 20% and 50% respectively.

- Mr. Rama wants to expand his business. He approached that bank for a further loan. Compose the ratio that the banker will require before granting the loan. Current ratio. The quick ratio and debt-equity ratio.

JOURNAL ENTRY

| Date | Particular | LF | Dr (Rs) | Cr (Rs) |

| 2019 | ||||

| April | Cash Ac | 2,50,000 | ||

| Building Ac | 1,00,000 | |||

| To capital Ac | 3,50,000 | |||

| (being capital invested in the business) | ||||

| April | Bank Ac | 2,40,000 | ||

| To cash Ac | 2,40,000 | |||

| (being cash deposited in Bank) | ||||

| April | Bank Ac | 3,00,000 | ||

| To bank Ac | 3,00,000 | |||

| (being loan taken HDFC bank) | ||||

| April | Computer Ac | 4,00,000 | ||

| To bank Ac | 4,00,000 | |||

| (being computer purchasing paying Rs 4,00000) | ||||

| April | Electricity board Ac | 1,000 | ||

| VSNL Ac | 1,01,000 | 1,01,000 | ||

| (being security deposits with electricity board and VSNL) | ||||

| April | Furniture and fixtures Ac | 25,000 | ||

| To bank Ac | 25,000 | |||

| (being café furniture) | ||||

| April | Advisement Ac | 4,500 | ||

| To bank Ac | 4,500 | |||

| (being cheque issued for advisement) | ||||

| 31Mar | Depreciation Ac | 1,07,500 | ||

| To computer Ac | 1,00,000 | |||

| To furniture Ac | 2,500 | |||

| To building Ac | 5,000 | |||

| (being depreciation charged) |

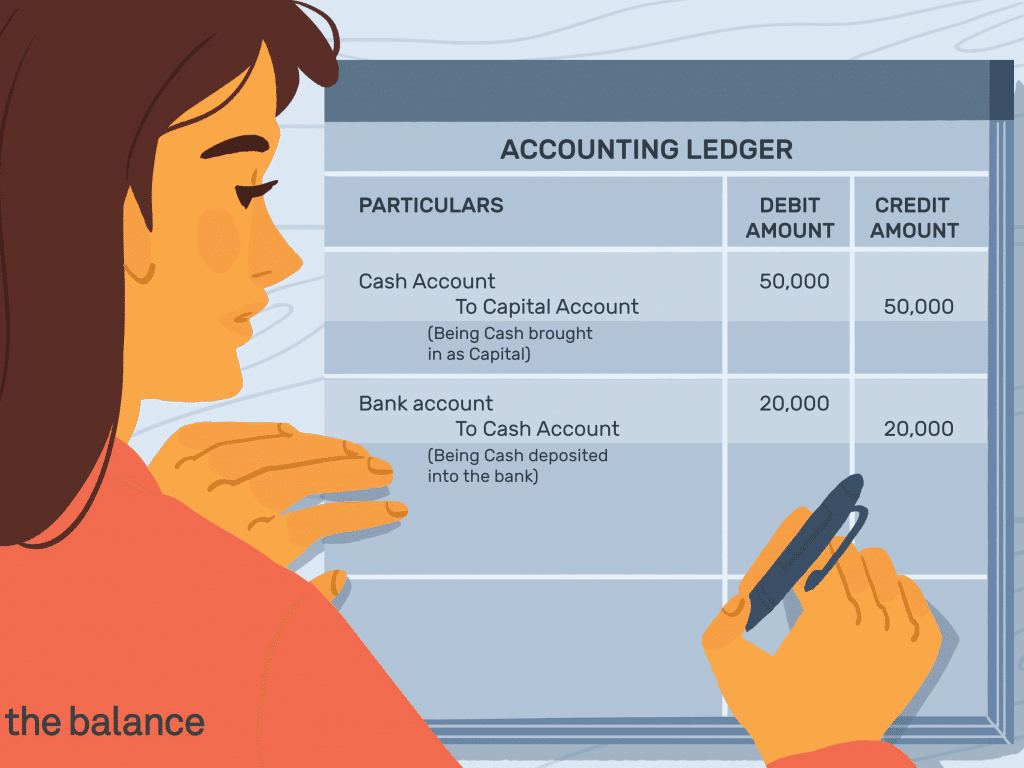

LEDGER POSTING

Cash A/c

| DATE | PARTICULAR | LF | AMOUNT | DATE | PARTICULAR | LF | AMOUNT |

| 2019 1 APRIL | To capital Ac | 2,50,000 | 2019 1Apr | By bank Ac By balance | 2,40,000 10,000 | ||

| 2,50,000 | 2,50,000 |

Building

| DATE | PARTICULAR | LF | AMOUNT | DATE | PARTICULAR | LF | AMOUNT |

| 2019 | To capital Ac | 1,00,000 | 2020 | By Dep Ac | 5,000 | ||

| 1 April | 31 Mar | By B/c Cid | 9,50,000 | ||||

| 1,00,000 | 1,00,000 |

Capital A/c

| DATE | PARTICULAR | LF | AMOUNT | DATE | PARTICULAR | LF | AMOUNT |

| 2020 | To B/c c/d | 3.50,000 | 2019 | By buildings | 1,00,000 | ||

| 31 Mar | 1 Apr | By cash Ac | 2,50,000 | ||||

| 1 April | |||||||

| 3,50,000 | 3,50,000 |

Computer A/c

| DATE | PARTICULAR | LF | AMOUNT | DATE | PARTICULAR | LF | AMOUNT |

| 2019 | To bank Ac | 4,00,000 | 2020 | By Dep Ac | 1,00,000 | ||

| 1 Apr | 31 Mar | By B/c c/d | 3,00,000 | ||||

| 4,00,000 |

Bank A/c

| Date | Particular | LF | Amount | Date | particular | LF | amount |

| 2019 | 2019 | By computer A/c | 4,00,000 | ||||

| 1 April | To cash A/c | 2,40,000 | 1 Apr | ||||

| 1 April | To bank loan A/c | 3,00,000 | 2020 | ||||

| 2020 | 31 Mar | By electricity-based | 1000 | ||||

| 31Mar | To sales | 4,98000 | 31 Mar | By VSNL A/c | 1,00,000 | ||

| 31 Mar | By furniture | 25,000 | |||||

| 31 Mar | By advertisement | 4500 | |||||

| 31 Mar | By purchase A/c | 55,000 | |||||

| 31 Mar | By telephone EP | 341000 | |||||

| 31 Mar | By daily expenses | 121000 | |||||

| 31 Mar | By entertainment | 10,000 | |||||

| 31 Mar | By miscellaneous A/c | 10,000 | |||||

| 31 Mar | By wages A/c | 6000 | |||||

| 31 Mar | By bank wan | 72,000 | |||||

| 31 Mar | By b/c c/d | 1,30,000 | |||||

| 2020 | 10,38,000 | 10,38,000 | |||||

| 1 Apr | To balance b/d | 1,78,500 |

Bank Loan A/c

| DATE | PARTICULAR | LF | AMOUNT | DATE | PARTICULAR | LF | AMOUNT |

| 2020

31 Mar | To bank Ac | 1,30,000 | 2019

1 Apr | By bank Ac

| 3,00,000

| ||

| 31 Mar | To b/c c/d | 2,00,000 | 31 Mar | By int on bank loan | 30,000 | ||

| 3,30,000 | |||||||

| 3,30,000 | |||||||

| 2020

1 Apr | BY b/c b/d | 2,50,000 |

Electricity Board A/c

| DATE | PARTICULAR | LF | AMOUNT | DATE | PARTICULAR | LF | AMOUNT |

| 2019 1 Apr | To bank Ac | 1000 | 2020 31 Mar | By B/c c/d | 1000 | ||

| 2020 1 April | To b/c b/d | 1000 | 1000 | ||||

| 1000 |

Vsnl A/c

| DATE | PARTICULAR | LF | AMOUNT | DATE | PARTICULAR | LF | AMOUNT |

| 2019 1 Apr | To bank Ac | 1,00,000 | 2020 31 Mar | By b/c c/d | 1,00,000 | ||

| 1,00,000 | 1,00,000 | ||||||

| 1,00,000 |

Sales A/c

| DATE | PARTICULAR | LF | AMOUNT | DATE | PARTICULAR | LF | AMOUNT |

| 2020 31Mar | To trading Ac | 4,80,000 | 2020 31 Mar | By bank Ac | 4,38,000 |

Purchase A/c

| DATE | PARTICULAR | LF | AMOUNT | DATE | PARTICULAR | LF | AMOUNT |

| 2020 31 Mar | To bank Ac | 55,000 | 2020 31 Mar | By trading Ac | 55,000 | ||

| 55,000 |

Furniture A/c

| DATE | PARTICULAR | LF | AMOUNT | DATE | PARTICULAR | LF | AMOUNT |

| 2019 | To bank Ac | 25,000 | 2020 | By Dep Ac | 2500 | ||

| 1 Apr | 31 Mar | By B/c c/d | 22,500 | ||||

| 25,000 |

Advertisement A/c

| DATE | PARTICULAR | LF | AMOUNT | DATE | PARTICULAR | LF | AMOUNT |

| 2019 1 Apr | To bank Ac | 4500 | 2020 31 Mar | By P&L AC | 4500 |

Telephone Charges A/c

| DATE | PARTICULAR | LF | AMOUNT | DATE | PARTICULAR | LF | AMOUNT |

| 2019 1 Apr | To bank Ac | 34,000 | 2020 31 Mar | By P&L Ac | 34,000 |

Interest Of Bank Loan A/c

| DATE | PARTICULAR | LF | AMOUNT | DATE | PARTICULAR | LF | AMOUNT |

| 2020 31Mar | To bank loan Ac | 30,000 | 2020 31 Mar | By P&L Ac | 80,000 |

Entertainment Expenses A/c

| DATE | PARTICULAR | LF | AMOUNT | DATE | PARTICULAR | LF | AMOUNT |

| 2020 31 Mar | To bank Ac | 10,000 | 2020 31 Mar | By P&L Ac | 10,000 |

Drawing A/c

| DATE | PARTICULAR | LF | AMOUNT | DATE | PARTICULAR | LF | AMOUNT |

| 2020 | To bank Ac | 72,000 | 2020 | By b/c c/d | 72,000 | ||

| 31 Mar | 31 Mar | ||||||

| 72,000 | 72,000 |

Petty Expense

| DATE | PARTICULAR | LF | AMOUNT | DATE | PARTICULAR | LF | AMOUNT |

| 2020 31 Mar | To bank Ac | 12,000 | 2020 31 Mar | By P&L AC | 12,000 |

Wages A/c

| DATE | PARTICULAR | LF | AMOUNT | DATE | PARTICULAR | LF | AMOUNT |

| 2020 31 Mar | To bank Ac | 6,000 | 2020 31 Mar | By trading Ac | 6,000 |

Depreciation

| DATE | PARTICULAR | LF | AMOUNT | DATE | PARTICULAR | LF | AMOUNT |

| 2020 31 Mar | To computer Ac | 1,00,000 | 2020 31 Mar | By P&L Ac | 1,07,500 | ||

| 31Mar | To furniture Ac | 2900 | |||||

| 31Mar | To building Ac | 5000 | |||||

| 1,07,500 | 1,07,500 |

Miscellaneous Expenses A/c

| DATE | PARTICULAR | LF | AMOUNT | DATE | PARTICULAR | LF | AMOUNT |

| 2020 31 Mar | To bank Ac | 10,000 | 2020 31 Mar | By P&L Ac | 10,000 |

Electricity Charges A/c

| DATE | PARTICULAR | LF | AMOUNT | DATE | PARTICULAR | LF | AMOUNT |

| 2020 31 Mar | Tools electricity | 1,24,000 | 2020 31 Mar | By P&L Ac | 1,24,000 |

Electricity Payable A/c

| DATE | PARTICULAR | LF | AMOUNT | DATE | PARTICULAR | LF | AMOUNT |

| 2020 | To B/c c/d | 1,24,000 | 2020 | By electricity | 1,24,000 | ||

| 31 Mar | 31 Mar | charge | |||||

| 1,24,000 | 1,24,000 |

TRIAL BALANCE

TRIAL BALANCE AS OF SLOT MAR, 2020

| PARTICULAR | AMOUNT |

| Cash Ac | 10,000 |

| Building Ac | 95,000 |

| Bank Ac | 1,79,500 |

| Computer Ac | 3,00,000 |

| Electricity board Ac | 1,000 |

| VSNL Ac | 1,00,000 |

| Furniture Ac | 22,500 |

| Advertisement Ac | 4,500 |

| Purchase Ac | 55,000 |

| Telephone charge Ac | 34,000 |

| Petty expense Ac | 12,000 |

| Entertainment expense Ac | 10,000 |

| Miscellaneous expense Ac | 10,000 |

| Wages Ac | 6,000 |

| Drawing Ac | 72,000 |

| Int. on Bank loan Ac | 30,000 |

| Dep Ac | 1,07,500 |

| Electricity charges Ac | 1,24,000 |

| Capital Ac | 3,50,000 |

| Bank loan Ac | 2,00,000 |

| Electricity payable Ac | 1,24,000 |

| Revenue from fees & sales Ac | 4,98,000 |

| Total | 11,72,000 |

TRADING AND PROFIT AND LOSS

TRADING AND PROFIT & LOSS ACCOUNT FOR THE YEAR ENDED 31 MAR 2020

| PARTICULAR | AMOUNT |

| To purchase Ac | 55,000 |

| To wages | 6,000 |

| To gross profit | 4,37,000 |

| 4,98,000 | |

| To advertisement Ac | 4,500 |

| To electricity Ac | 1,84,000 |

| To telephone charge Ac | 34,000 |

| To petty expenses Ac | 12,000 |

| To entertainment expenses Ac | 10,000 |

| To Int. on bank loan Ac | 10,000 |

| To depreciation Ac | |

| Computer | 1,00,000 |

| Building | 5,000 |

| Furniture | 2,500 |

| To set profit | 1,05,000 |

| By sales | 4,98,000 |

| By gross profit | 4,37,000 |

| 4,37,000 |

BALANCE SHEET

BALANCE SHEET AS OF 31 MAR 2020

| LIABILITIES | AMOUNT | ASSET | Amount |

| Bank loan | 2,00,000 | Cash in hand | 10,000 |

| Electricity payable Ac | 1,24,000 | Bank | 1,78,500 |

| VSNL(security deposit) | 1,00,000 | ||

| Capital | 3,50,000 | Electricity based (S.D) | 1,000 |

| Less : drawing (72,000) | Computer | 3,00,000 | |

| 2,78,000 | Building | 95,000 | |

| Add net profit 1,05,000 | 3,83,000 | Furniture | 22,500 |

| 7,07,000 | 7,07,000 |

- Calculation of profitability Ratio

- gross profit Ratio : Gross profit x100 = 4,37,000 x 100 = 87.75%

Net sake 4,98,000

- Net profit Ratio : Net profit x 100 = 1,05,000 x 100 = 21.08%

Net sake 4,98,000

Note: efficiency of business is quite satisfactory because net profit ratio and gross profit ratio are higher than the normal rate for a similar type of business organization

- Granting bank loan

Bank will see the following ratios before granting loan.

- Current Ratio: current Asset

Current liabilities

= cash + Bank _______________________________________

Electricity payable + bank loan to repaid next year

= 10,000+8,600 = 1,88,500 = 84%

1,00,000 + 1,24,000 2,24,000

2. Quick current ratio will be same on current ratio because there is neither closing stock nor prepaid expenses

3. Debt equity Ratio = Debt = 1,00,000 = 0.26:1

Equity 3,83,000

The bank therefore should grant the loan as the ratio are favorable.

SPECIFIC PROJECT

BAJAJ AUTO LTD

Bajaj Auto is a global two-wheeler and three-wheeler Indian manufacturing company. It manufactures and sells motorcycles, scooters, and auto-rickshaw Bajaj Auto is a part of the Bajaj Group. It was founded by Jamnalal Bajaj in Rajasthan in the 1940s. it is based in Pune, Mumbai with plants in Chakan (Pune), Waliej (near Aurangabad ) and its partner is Uttaranchal. Bajaj Auto is the 6th largest manufacturer of motorcycles in the world and 2nd largest in India. It is the world’s largest three-wheeler is manufactured.

NET PROFIT RATIO

Net profit = profit x 100

sales

| Segment | Profit | Sales | Ratio |

| Automotive | 1616.29 | 7425.15 | 21.76% |

| Investment | 362.79 | 363.46 | 99.91% |

| Total | 1979.05 | 7788.61 | 121.57% |

RETURN ON INVESTMENT

Return on Investment = profit x 100

Capital employed

| Segment | Profit | Capital employed | ROI(%) |

| Automotive | 1616.29 | 5032.46 | 32.11% |

| Investment | 362.79 | 18346.47 | 1.97% |

| Total | 1979.05 | 23378.93 | 34.08% |

SEGMENT PROFIT

Percentage = segment profit x 100

Total profit

Degree = percentage x 36

100

| Segment | Profit | Percentage of total | degree |

| Automotive | 16116.29 | 81.66% | 294’ |

| Investment | 362.79 | 18.33% | 66.99’ |

| Total | 1979.05 | 99.99% | 359.99’ |

SEGMENT REVENUE

Percentage = segment profit x 100

Total profit

Degree= percentage x 360

100

| Segment | Revenue | Percentage of total | Degree |

| Automotive | 7425.15 | 96.33% | 343.2’ |

| Investment | 363.46 | 4.66% | 16.79’ |

| Total | 7788.6 | 99.99% | 359.99’ |

CAPITAL EMPLOYED

Percentage = segment profit x 100

Total profit

Degree = percentage x 360

100

| Segment | Capital employed | Percentage | Degree |

| Automotive | 5032.46 | 21.01% | 75.65’ |

| Investment | 18346.47 | 76.61% | 276.8’ |

| Unallocated | 568.47 | 2.37% | 8.54’ |

| Total | 23947.4 | 99.99% | 359.99’ |

COMBINED ANALYSIS

| Segments | Revenue | Profit | Capital employed | Return on investment | Net profit ratio |

| Automotive | 7425.15 | 1616.25 | 5032.46 | 32.11% | 21.31% |

| Investment | 363.46 | 362.79 | 18346.47 | 1.97% | 99.81% |

| Unallocated | – | – | 568.47 | – | – |

| total | 7788.61 | 1979.05 | 23947.4 | 34.08 | 121.37% |

OPERATING ACTIVITIES

Meaning: Operating activities are principal revenue-generating activities of an enterprise other than increasing financing activities. The amount of cash flow arising from operating is a key indicator of the eaten to which the operations of the enterprise have generated cash i.e. whether the cash. Generated is adequate to maintain operating activity of the enterprise pay dividend pay loan etc. Inflows: cash sales, cash received from debtors.

FINANCING ACTIVITIES

Financing activities are activities that result in a change in the size and composition of finance of the enterprise. The amount of cash flow arising from the financial activities to use and associating crime so future cash by procurement of funds to the enterprise.

Inflows: the issue of future, issue of share.

Comparative statement of operating activities for the year ended 31st march 2018-19

| PARTICULAR | 31 Mar 2019 | 31 Mar 2018 | Absolute change | % change |

| Cash inflow (outflow) | 27,186.86 | 4327.84 | 1,840 | 42.59% |

Comparative statement of financing activities for the year ended31 March 2018-19

| PARTICULAR | 31 Mar 2019 | 31 Mar 2018 | Absolute change | % change |

| Cash inflows (outflow) | (2,073.06) | (1885326) | 188.78 | 10.01% |

Comparative statement of Investment activities for the year ended 2018-19

| Particular | 31Mar 2019 | 31Mar 2018 | Absolute change | % Change |

| Cash outflow | (338.44) | (2053.09) | (1714.65) | 83.51% |

ACKNOWLEDGEMENT

I would like to give my heartfelt thanks to Mr. Oevender Kumar Mourya, my accountancy teacher who always gave valuable suggestions and guidance for the completion of this project. He helps to understand and remember the important details of this project. My project has been succeeded only because of his guidance. I would like to thank Mr. (principal of our school) for his capital support in the project. And I would also like to thanks all those people who directly or indirectly support the completion of the project.

Date :

Place: Delhi

Name: Rakesh Rathore

Signature :

Roll number :

CERTIFICATE

This is herby to certify that, the original and genuine investigation work has been carried out to investigate the subject matter and the related data collection and investigation has been completed and solely sincerely and satisfactorily done by Rakesh Rathore a student of class 12 under the Roll No. for the academic session 2019-20 regarding the investigatory project entitled accountancy for the physics department under the direct supervision of the undersigned as per the requirement for the board examination.

Internal Examiner

Principle

External

DOWNLOAD PDF OF THE PROJECT

Password: hscprojects.com

In order to download the PDF, You must follow on Youtube. Once done, Click on Submit

Follow On YoutubeSubscribed? Click on Confirm

Download Comprehensive Accountancy Project – 2019-2020 PDF