Economics Project CBSE Class 12 – Inflation

INTRODUCTION:

To put it simply, Inflation is a long term rise in the prices of goods and services by the devaluation of the currency.

Inflation problems arise when we experience unexpected inflation which is not adequately matched by a rise in people’s income. If incomes do not increase along with prices of goods, everyone purchasing power has been effectively reduced. Which can, in turn, lead to a slowing or stagnant economy.

OBJECTIVE OF STUDY:

- To know more about Inflation.

- To understand the history of inflation.

- To analyze the various measures in Inflation.

- To know about the positive and negative impact.

- To analyze how Inflation can be controlled.

NEED AND SIGNIFICANCE OF THE STUDY:

The impact of Inflation still has an ever rolling effect on the economy. Not only in our country.

Inflationary actions objects in the whole world. This it is very important to study the various changes that are happened in our country are to Inflation.

This study also helps us to know about the various impacts of Inflation.

The study of Inflation helps us to understand various measures taken by the Indian government to control the actions of Inflation.

INFLATION:

In economics. Inflation is a sustained increase in the general price level of goods and services in an economy over a period of time.

When the price level rises, each unit of currency buys fewer goods and services. Consequently, Inflation reflects a reaction in one purchasing power per unit of money. A loss of real value in the medium of exchange and unit of account within the economy.

HISTORY:

The rapid increase in the quantity of money supply has occurred in many different societies throughout history changing with different forms of money used. For instance when gold was used or lead and reissue them at some nominal value by altering the gold with other metal, the Government profits. This practice would increase the money supply but at the same time the relative value of each coin would be lowered as the relative value of the coins becomes lower. Consumers would need to give more coins in exchange for the same goods and services before. These goods and services would experience a price increase as the value of each coin are increased.

MEASURES:

The Inflation rate is widely calculated by calculating the movement or change in a price index. Usually the consumer price index. The Inflation rate is the percentage rate of change of a price index over time. The retail prices index is also a measure of inflation that is commonly used in the United Kingdom. It is broader than the CPI and contains a larger basket of goods and services.

CPI Consumer Priced Index:

Other widely used price indices for calculation of inflation include the following:

- Producer price indices CPPI which measures the average changes in prices received in domestic producers for their output. This differ from the CPI in that price subsidization profits and taxes may cause the amount received by the producer to differ from what the consumer paid.

- Commodity price indices which measure the price of a selection of commodities.

- Core price indices core Inflation is less affected by short-run supply and demand conditions in specific markets.

- Other common measures of Inflation are:

(i) GDP Deflator: Is a measure of the price of all goods and services included in the gross domestic product.

(ii) Regional Inflation: The Bureau of Labour Statistics breaks down CPI-U calculation down to different regions of the US.

(iii) Historical Inflation: Most inflation data before the early 20th Century is imputed based on the known costs of goods rather than compiled at the time.

(iv) Asset Price Inflation: Is an undue increase in the prices of a real or financial asset such as stock and real estate.

Issues in Measuring:

Measuring Inflation in an economy requires objective means of differentiating changes in nominal prices on a common set of goods and services and distinguishing them from those price shifts resulting from changes in value such as volume, qualities or performance.

EFFECTS OF INFLATION:

General:

An increase in the general level of prices implies a decrease in the purchasing power of the currency that is when the general level of prices rise each monetary unit buys fewer goods and services. The effect of Inflation not distributed evenly in the economy and as a consequence, there are hidden costs to some and benefits to others from this decrease of purchasing power of money.

- Negative Effects Of Inflation:

- Cost-Push Inflation: High inflation can prompt employees to demand a rapid wage increase to keep up with consumer prices in this cost-push theory of inflation, rising wages, in turn, can help over inflation.

- Hoarding: People buy durable and/or non-perishable commodities and other goods of stores of wealth to avoid the losses expected from the declaring, purchasing of the power of money creating shortages of hoarded goods.

- Social Unrest and Revolts: Inflation can lead to massive demonstration and revolutions.

- Hyper-Inflation: Inflation becomes too reign, it can cause people to severely curtail their use of the currently leading to an acceleration in the Inflation rate.

- Associative Efficiency: A change in the supply or demand for goodwill normally cause its relative price to change signaling the buyer and seller that they should reallocate the resources in response to the new market conditions.

- Positive Effects of Inflation:

- Labour market adjustment: Nominal wages are slow to adjust downwards. This can lead to prolonged disequilibrium and result in unemployment in the labor market. Moderate Inflation evades labor markets to reach equilibrium faster.

- Room to Manoeuvre: The primary tools for controlling the money supply are the ability to set the discount rate. The rate at which banks can borrow from the Central Bank and Open Market operators, which are the Central Bank interventions into the Banks Market with the aim of affecting the nominal interest rate.

- Mundell-Tobin Effect: Robert Mundell noted that moderate Inflation would cause savers to substitution undoing for some money holding as a means to future spreading. Noble Laureate James Tobben noted that such Inflation would cause the business to substitute investment in physical capital for money balances in their asset portfolios.

- Instability with Deflation: Economist Tsiang noted that once substantial deflation is expected. Two important effects will appear with a result of money holding substitute for landing as an unethical for saving.

- Economical Market Inefficiency with Deflation: The second effect noted by Tsiang is that when savers’ have substituted money holding for landing on financial markets, the role of those markets in channeling savings into investment is undermined.

Inflation Expectation:

Inflation expectation, inflationary expectation or expected inflation is the rate of inflation that is anticipated for some period of time in the foreseeable future. There are 2 major approaches to meddling the formation of inflation expectation.

Adaptive expectation models them as a weighted average of what was expected one period earlier and the actual rate of inflation that most recently occurred. Rational expectation models them as unbiased, in the sense that the expected inflation rate is not systematically above or below the inflation rate that actually occurs.

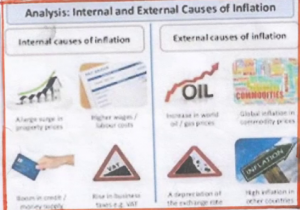

CAUSES OF INFLATION:

- The Money Supply: Inflation is primarily caused by an increase in the money supply that out-paces economic growth.

- Demand Pull Effect: The demand-pull effect states that as wages increases within an economic system, people will have more money to spend on consumer goods.

- Cost-Push Effect: This theory states that when companies are faced with increased inputs, costs like raw material or wages, they will preserve their profitability by passing this increased cost of production onto the customer in the form of higher prices.

- Exchange Rates: When the exchange rate suffers such that Indian currency has become less valuable relative foreign currency, this makes the foreign commodities more expensive to Indian Consumers.

THE GOOD ASPECTS OF INFLATION:

Inflation that is suppressing to most people economics generally argues that some inflation is a good thing. A healthy rate of inflation is considered to be approximately 2.3 % per year. The goal is for inflation to outpace the growth of the underlying economy by a small amount per year.

A healthy rate of inflation is considered positive because it results in increasing wages and corporate profitability and keeps capital flowing in a presumably growing economy. As long as things are moving in relative unison, Inflation will not be determined.

INFLATION OF ECONOMIC GROWTH:

If economic growth matches the growth of the money supply, inflation should not occur. When all else is equal, a large variety of factors can affect the rate of both. For example investment in market production, infrastructure, education, and preventative health concern, all grow an economy in greater amounts from the investment spending.

CONTROLLING INFLATION:

Monetary Policy:

Government and Central Banks primarily use monetary policy to control inflation. Central Banks such as the US Federal increase the interest rate. Slow or stop the growth of the money supply and reduces the money supply.

Fixed Exchange Rates:

Under a fixed exchange rate currency regime, a country’s currency is tied in value to another single currency or to a basket of other currencies or sometimes to another measure of value such as gold. A fixed exchange rate is usually used to stabilize the value of a currency.

Gold Standard:

The gold standard is a monetary system in which a region’s common medium of exchange is paper notes that are normally freely converted into pre-set fixed quantities of gold.

Wage and Price Controls:

Another method attempted in the past have been wages and price controls. Wage and price controls have been successful in wartime environments is a combination of rationing.

FINDINGS:

- Analyzing the project and found that inflation on a large scale is not good for any economy.

- There are many types of Inflation.

- Increasing the money supply in the economy is the major symptom of inflation.

- The Government and Central Bank is taking many measures to solve inflation.

- Both monetary and fiscal measures are useful to measure inflation.

CONCLUSION:

Inflation is not technically good or bad. Like so many things in life, the impact of inflation depends on your personal situation. Some points to remember:

Inflation is a sustained increase in the general level of prices for goods and services.

When inflation goes up, there is a decline in the value or purchasing power of money.

Variation on inflation include dis inflation, deflation, hyperinflation and stagflation.

Theories as the cause of inflation are up for debate. Some common theories include Demand Poll Inflation, Cost-Push Inflation and Monetary Inflation.

ACKNOWLEDGMENT:

There were many people who helped me through their support and guidance for the successful completion of this project.

First of all, I thank the Almighty God for this goodness and mercy in giving me the strength to complete this project.

I hereby express my abundant and sincere gratitude to Mrs. Pratibha, Department of Commerce, Dr. GR PS, Neyyattinkara for her valuable guidance, constant encouragement and creative suggestions rendered during the course of this project.

I thank Sister Mythili (Managing Trustee) Mrs. Gouri Nair (Senior Principal) Mr. Maria Joe Jagadesh (Principal) for providing me with all facilities and also for the constant inspiration and encouragement for successful completion of this project.

I offer my deepest gratitude to my family members whose prayers and blessing guided me for the successful completion of this project. I also owe my gratitude to my classmates whose support was inevitable for the completion of the project.

ANOOP S. NAIR

DECLARATION:

I, Your Name, do hereby declare that the project entitled “INFLATION” is a bonafide record of the project work done by me and was under the guidance of Mrs. XYZ, also declare this project or any part of it has not been submitted by me fully or partially for any other examination before.

Place: Delhi

Date: 13th September 2017

BIBLIOGRAPHY / REFERENCE:

- Investopedia

- The Week

- Indian Economy Development

- The Economist

In order to download the PDF, You must follow on Youtube. Once done, Click on Submit

Follow On YoutubeSubscribed? Click on Confirm

Download Economics Project CBSE Class 12 – Inflation PDF