Introduction to the Latest Instrument of Debt

INTRODUCTION:

Debt is when one thing, typically cash, is owed by one party, the recipient or debtor, to a second party, the loaner, or creditor. Debt is usually a credit, or series of payments, that’s owed within the future, that is what differentiates it from an instantaneous purchase. The debt is also owed by a sovereign state or country, government, company, or person. Industrial debt is mostly subject to written agreement terms relating to the quantity and temporal order of repayments of principal and interest. The term can even be used metaphorically to hide ethical obligations and different interactions not based on value. For instance, in Western cultures, an individual who has been helped by a person is usually aforesaid to owe a “debt of gratitude” to the second person. We will talk about the introduction to the Latest Instrument of Debt.

There are various types of debt instruments that help an individual choose the type of debt he can handle and take. The debt instruments keep renewing and adding new to the list. A brief introduction to the latest instrument of debt is given below in a detailed report.

AIMS AND OBJECTIVES:

This project aims to study the Introduction to the latest instrument of debt.

There are many objectives for this project. Major few objectives are given below.

Objectives:

- To understand Debt

- To know how to take a deb

- To understand who all are involved in the process of debt

- To know various types of debts

- To ascertain any doubts regarding the various instruments used in debt

- To understand why debt is important

METHOD AND METHODOLOGY:

The method used to gather the required information on the project is an internet survey method. The Internet has extensive information on this subject. It has a vast collection of data on Introduction to the latest instrument of debt. The survey has unveiled information about this topic, which has covered major few points which are listed below and explained in a detailed report of the project.

- The meaning of debt

- The meaning of debt instruments

- The various types of latest debt instruments

- The benefits of debt instruments

- The significance of debt instruments

DETAIL REPORT OF PROJECT:

-

The meaning of debt

Debt is a quantity of cash borrowed by one party from another. Several companies and people employ debt as a technique of creating giant purchases that they may not afford below traditional circumstances. A debt arrangement offers the borrowing party permission to borrow cash below the condition that it’s to be paid back at a later date, sometimes with interest.

Many companies and people use debt as a technique of creating giant purchases that they might not afford below traditional circumstances.

-

The meaning of debt instruments

A debt instrument is a tool an entity will utilize to lift capital. It’s a documented, binding obligation that gives funds to associate entity reciprocally for a promise from the entity to repay a loaner or capitalist following terms of a contract. Document contracts embrace elaborated provisions on the deal like collateral concerned, the speed of interest, the schedule for interest payments, and also the timeframe to maturity if applicable.

Any sort of instrument primarily classified as debt will be thought of as a document. Debt instruments are tools for a personal, government entity, or business entity will utilize for the aim of getting capital. Credit cards, credit lines, loans, and bonds will all be varieties of debt instruments.

-

The various types of latest debt instruments

Bonds

A Bond is solely an ‘IOU’ within which a capitalist agrees to lend cash to an organization or government in exchange for a preset rate of interest. If a business needs to expand, one amongst its choices is to borrow cash from individual investors. The corporate problems bond at completely different interest rates and sell them to the general public. Investors purchase them with the understanding that the corporate pay back their original principal with some interest that’s due by collection date; this is understood because of the “maturity.” The interest an investor earns depends on the strength of the corporation.

Also, check – How Will You Spend a Particular Amount on Various Goods to Experience the Law of Equi-Marginal Utility

Debenture

A debenture is comparable to a bond, except the securitization conditions are completely different. A debenture is mostly unsecured within the sense that there are not any liens or pledges on specific assets. It’s outlined as a certificate of agreement of loans that are given below the company’s stamp and carries an enterprise that the debenture holder can get a hard and fast come back (fixed on the premise of interest rates) and, therefore, the principal quantity whenever the debenture matures.

Commercial Papers

Commercial Paper (CP) is an unsecured market instrument issued within the style of note. It was introduced in India in 1990 with a read to sanctionative extremely rated company borrowers/ to diversify their sources of short borrowings and to produce an extra instrument to investors. Later, primary dealers and satellite dealers were conjointly allowable to issue CP to change them to fulfill their short funding needs for his or her operations. CP is often issued in denominations of Rs.5 lakh or multiples from that place. Quantity endowed by one capitalist mustn’t be but Rs.5 lakh (face value). It’ll be issued for a length of 30/45/60/90/120/180/270/364 days. Solely a regular bank will act as a supplying and Paying Agent IPA for the issue of CP.

Certificate of Deposit

A certificate of deposit or CD could be a time deposit, a money product normally offered to shoppers by banks, thrift establishments, and credit unions. CDs are kind of like savings accounts in this they’re insured and so just about risk-free; they’re “money within the bank.” They’re completely different from savings accounts in this the CD includes a specific, fastened term (often three months, six months, or one to five years), and, usually, a hard and fast rate of interest. It’s meant that the CD be controlled till maturity, at which period the money could also be withdrawn at the side of the accumulated interest.

Fixed Deposit

A fixed deposit (FD) could be a money instrument provided by banks or NBFCs that provides investors the next rate of interest than a daily bank account till the given date. It should or might not need the creation of a separate account. It’s referred to as a bond within the UK and India. For a hard and fast deposit is that the money can not be withdrawn from the FD as compared to a continual deposit or a requirement deposit before maturity. Some banks might provide further services to FD holders like loans against FD certificates at competitive interest rates. It is important to notice that banks might provide lesser interest rates beneath unsure economic conditions. The rate of interest varies between four and seven.50 percent

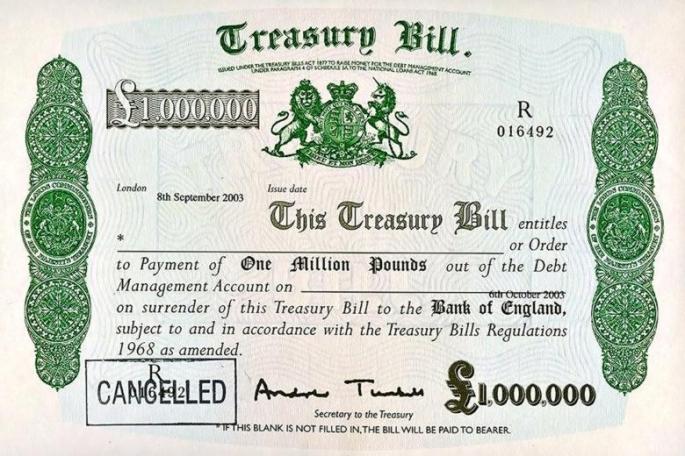

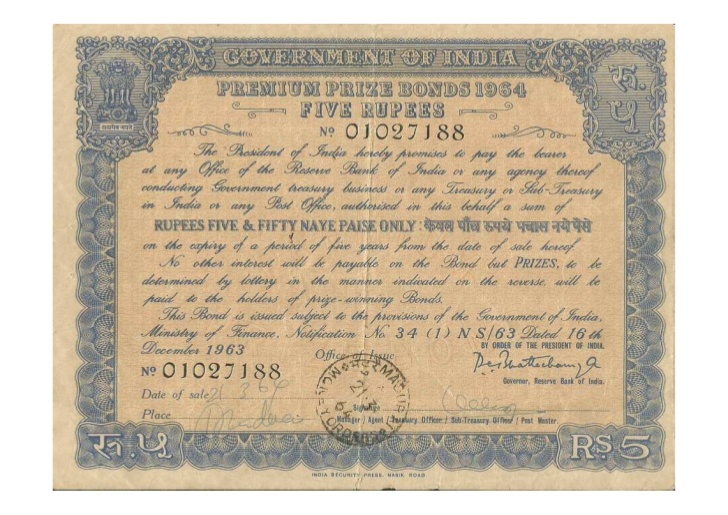

Govt. securities

Bonds/T-bills issued by the govt. Of India. Since the govt backs these. Of the Asian country, these are just about riskless investments. The guarantee from the govt. It is additionally known as ‘Sovereign Guarantee.’

The loan that the govt. Intends to repay inside a year is termed the Treasury Bills or T-bills. Loans that the govt. Intends to repay over a few years are known as the Bonds.

National Savings Certificate

The National Savings Certificate could be a mounted financial gain investment theme that you simply could open with any post office. A Government of India initiative, it’s a government bond that encourages subscribers – chiefly little to mid-income investors – to take a position whereas saving on revenue enhancement. A set financial gain instrument like Public Provident Fund and Post workplace FDs, this theme too could be a secure and low-risk product.

-

The benefits of debt instruments

- The major advantage of varied debt instruments is fastened and periodic receipts like interests.

- The Capital is preserved in several debt instruments, that helps in providing security to someone

- Having varied debt instruments is generally secured.

- There are varied instruments of debt which might be riskless if invested within government bonds (gilts)

- They Lower volatility compared to the equity market and type of instruments like index connected bonds; floating-rate notes.

-

The significance of debt instruments

In a volatile world, it’s the responsibility of each individual to secure himself and his family in monetary terms. Within the monetary world, there are several instruments created for a retail capitalist to take a position. Some instruments have high-interest rates of come, and thence such devices are riskier than those with a lower. However, a hard and fast rate of interest. Betting on one’s risk appetence, one will choose from an array of investment avenues.

Using debt is additionally advantageous to exist, homeowners, thanks to the result of economic leverage. Once firms use debt to produce addition capital for his or her business operations, equity homeowners get to stay any additional profits generated by the debt capital, when any interest payments. Given a constant quantity of equity investments, equity investors have a better come on equity thanks to the extra profits provided by the debt capital.

Using debt helps lower a company’s taxes thanks to allowable interest deductions. Tax rules allow interest payments as expense deductions against revenues to make a nonexempt financial gain. The lower the nonexempt financial gain, the fewer taxes a corporation pays. On the opposite hand, dividends paid to equity holders don’t seem to be tax-deductible and should come back from after-tax financial gain. Therefore, tax savings facilitate additional scale back a company’s debt funding price, which is a bonus that equity funding lacks.

While victimization debt might add pressure to a company’s in-progress operations as a result of having to fulfill interest-payment obligations, it helps retain additional profits inside the corporate compared to victimization equity. That is, as a result of equity, it needs the sharing of company profits with equity holders. Using debt, firms have to be compelled to pay the quantity of interest solely out of their profits. Victimization equity, on the opposite hand, the additional profits a corporation makes, the additional it’s to share with equity investors.

ANALYSIS OF DATA:

Common sorts of debt owed by people and households embrace mortgage loans, car loans, Mastercard debit, and financial gain taxes. For people, debt could be a means that of mistreatment anticipated financial gain and future buying power within the gift before it’s truly been earned. Commonly, folks in industrial nations use client debt to get homes, cars, and different things too high-priced to shop for with money accessible.

A term loan is the simplest kind of company debt. It consists of associate agreement to lend a set quantity of cash, referred to as the capital or principal, for a set amount of your time, with this quantity to be repaid by an exact date. In business loans interest, calculated as a share of the capital per annum, will get to be paid by that date, or even paid sporadically within the interval, like annually or monthly.

Governments issue debt to purchase current expenses still as major capital comes. Government debt is also issued by sovereign states still as by native governments, generally called municipalities. The level of liability by a government is often shown as a quantitative relation of debt-to-GDP. This quantitative relation helps to assess the speed of changes in government liability and, therefore, the size of the debt due.

CONCLUSION:

To conclude my findings,

The most common types of debt are loans, together with mortgages and motorcar loans, and Mastercard debit. Below the terms of a loan, the recipient is needed to repay the balance of the loan by an explicit date, usually many years within the future. The terms of the loan additionally stipulate the quantity of interest that the recipient is needed to pay annually, expressed as a proportion of the loan quantity. Interest is employed as to how to make sure that the investor is stipendiary for taking up the chance of the loan, whereas additionally encouraging the recipient to repay the loan quickly to limit his total disbursement. Credit card debt operates within the same method as a loan, except that the borrowed quantity changes over time in line with the borrower’s want, up to a planned limit, and features a rolling, or open-ended, compensation date. Bound styles of loans, like student loans, are often consolidated.

DISCUSSION:

The discussion has revealed:

At the house level, debts may have prejudices effects — significantly, once households create disbursal choices, the presumptuous financial gain can increase, or stay stable, in years to return. Once households take on credit supported this assumption, life events will simply change financial obligation into over-indebtedness. Such life events embrace sudden unemployment, relationship break-up, departure the parental home, business failure, illness, or home repairs. Over-indebtedness has severe social consequences, like financial hardship, low physical and mental state, stressful family, black mark, complication getting employment, and occupational disease, a strain on social relations, absence at work, and lack of organizational commitment, feeling of insecurity, and relative tensions.

SUGGESTION:

There are a few opinions and suggestions by family and friends whom I discussed my project findings with, and they are given below:

There should be a seminar in colleges conducted to give information to students about debt and various aspects of debt.

There should be more new instruments invented to suit the middle class and lower class of people.

The rate of interest charged by banks should be lessened for debtors.

ACKNOWLEDGMENT:

My profound gratitude to all the faculty members of the Department, for their timely assistance and encouragement throughout my research work.

I duly acknowledge the encouragement and support from the research scholars in the department, and all my colleagues and friends.

It gives me immense pleasure to take the opportunity to all the people who are directly or indirectly involved in the completion of my project based on Introduction to the latest instrument of debt.

With deep reverence, I offer my deepest gratitude _____, without whom this project could not have been fulfilled.

Lastly, I thank Almighty, my parents, family members, friends, and teachers for their constant encouragement and support, without which this project would not be possible.

Name of School/College

BIBLIOGRAPHY / REFERENCE:

- https://en.wikipedia.org/wiki/Debt

- https://moneymindz.com/articles/Deposits-and-Bank-Accounts/Fixed-deposits/What-are-the-different-types-of-debt-instruments-available-in-India

- https://www.referenceforbusiness.com/encyclopedia/Cos-Des/Debt.html

- https://www.sapling.com/6328411/types-debt-instruments

- https://www.investopedia.com/terms/d/debtinstrument.asp

In order to download the PDF, You must follow on Youtube. Once done, Click on Submit

Follow On YoutubeSubscribed? Click on Confirm

Download Introduction to the Latest Instrument of Debt PDF