Visit any Proprietary Concern and Preparation of a Journal of 8 Days With the Help of Business Transactions

INTRODUCTION:

A journal entry is an act of keeping or making data of any transactions, either Economic or non-economic. This project gives information by visiting any proprietary concern and preparation of a journal of 8 days with the help of business transactions.

Transactions are listed in an accounting journal that indicates a company’s debit and savings balances. The journal entry can consist of quite a few recordings, each of which is either a debit or a credit. The whole of the debits ought to equal the completion of the credits, or the journal entry is considered unbalanced.

Journal entries can file particular objects or routine gadgets such as depreciation or bond amortization. In accounting software, journal entries have typically entered the usage of a separate module from money owed payable, which commonly has its subledger, that in a roundabout way, impacts the familiar ledger. As a result, journal entries immediately trade the account balances on the time-honored ledger. A suitable documented journal entry consists of the accurate date, quantities that will be debited, the amount that will be credited, description of the transaction, and unique reference number.

AIMS AND OBJECTIVES:

This project aims to visit any proprietary concern and preparation of a journal of 8 days with the help of business transactions.

There are essential objectives for this project. They are given below.

Objectives:

- To understand journal entries

- To know an enterprise and its inner workings.

- To understand the journal of business for eight days

- To know journal entries from business transactions of the enterprise.

- To ascertain any doubts regarding business transactions in any journal

METHOD AND METHODOLOGY:

The method used to gather the required information on the project is an internet survey method that falls under the secondary data collection method. The Internet has extensive knowledge on this subject. It has a vast collection of data on journal entries. The survey for this project has unveiled information that is covered within major few points. They are listed below and explained in a detailed report of the project.

- What is journaling entry?

- Purpose of Journal Entry

- Types of a journal entry

- What is included in a journal entry?

- Journal of an enterprise showing eight days of business transaction

- Benefits of Journal entry in accounts

DETAIL REPORT OF PROJECT:

What is journaling entry?

A journal is a unique account that records all the monetary transactions of a business, to be used for future reconciling of and transfer to other reputable accounting records, such as the standard ledger. A journal states the date of a transaction, which bills had been affected, and the amounts, generally in a double-entry bookkeeping method.

For accounting purposes, a journal is a physical record or digital report saved as a book, spreadsheet, or statistics within the accounting software. When a commercial enterprise transaction is made, a bookkeeper enters the economic transaction as a journal entry. If the price or profits affects one or more enterprise accounts, the journal entry will element that as well. Journaling is an indispensable phase of goal record-keeping and allows for concise review and records transfer later in the accounting process. Journals are regularly reviewed as a phase of an alternate or audit process, along with the standard ledger.

Purpose of Journal Entry

A journal is a record of transactions listed as they appear that show the specific bills affected by the trade. Used in a double-entry accounting system, journal entries require each a debit and a credit to complete every entry. So, when you purchase goods, it increases each inventory as nicely as the money owed payable accounts.

Journal entries are the groundwork for all other monetary statements. They grant vital records that are used by way of auditors to analyze how economic transactions affect a business. The journalized entries are then posted to the universal ledger.

Types of Journal entries

There are two types of Journal entries. They are listed below:

Single Entry Accounting

As the identity suggests, every journal entry is made on its very own separate line when you use the single-entry technique of bookkeeping. You might subtract what you spend on a new pc system as a debit; then, on the subsequent line and as another entry, you may have income received from a purchaser or consumer as a credit. You’ll have two separate transactions or journal entries, each with its line. It’s simple, not a lot exclusive from how you would maintain track of transactions you make from your checking account.

Single entry accounting might also be applicable if you manage your own small financial business as a sole owner, and your books and transactions are not complicated. Anyone can handle it. You do not need any unique training.

Double Entry Accounting

A journal entry into the usage of the double-entry technique of accounting consists of a range of statistics in more than a few columns on an identical line. In a double-entry system, you might have a debit for the pc purchase, then a credit or expand to your typical office tools prices would show up on the same line but in a distinct column to offset the debit. These columns ought to be equal, such as -1,000rs as the debit and +1,000rs for the credit.

You may have to use even more columns relying on the nature of your entry, but at a minimum, there be two, one every for debits and credits. Double-entry accounting commonly makes a journal entry, now not for the transaction itself; however, for the account, it influences assets, liabilities, equity, revenue, and expenses. Debits and credits to each are all cited on the identical line. At the end of the accounting period or any different accounting length you select, all your journal entries for debits ought to correspond to an equal your journal entries for total credits. This skill, your account is “balanced.”

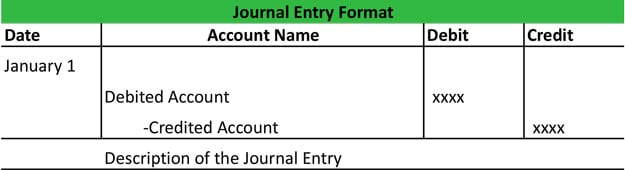

What is included in a journal entry?

There are specific things in a journal entry that need to be followed, particularly for precise results. They are listed below:

- A header which consists of the date of the entry

- A reference quantity or a journal entry wide variety that can be used to index and retrieve the journal when required

- The account number and name. These are documented in the 1st column into which the entry is recorded.

- The debit amount is entered in the 2nd column

- The savings quantity is registered in the 3rd column

- The description of the journal entry in the footer

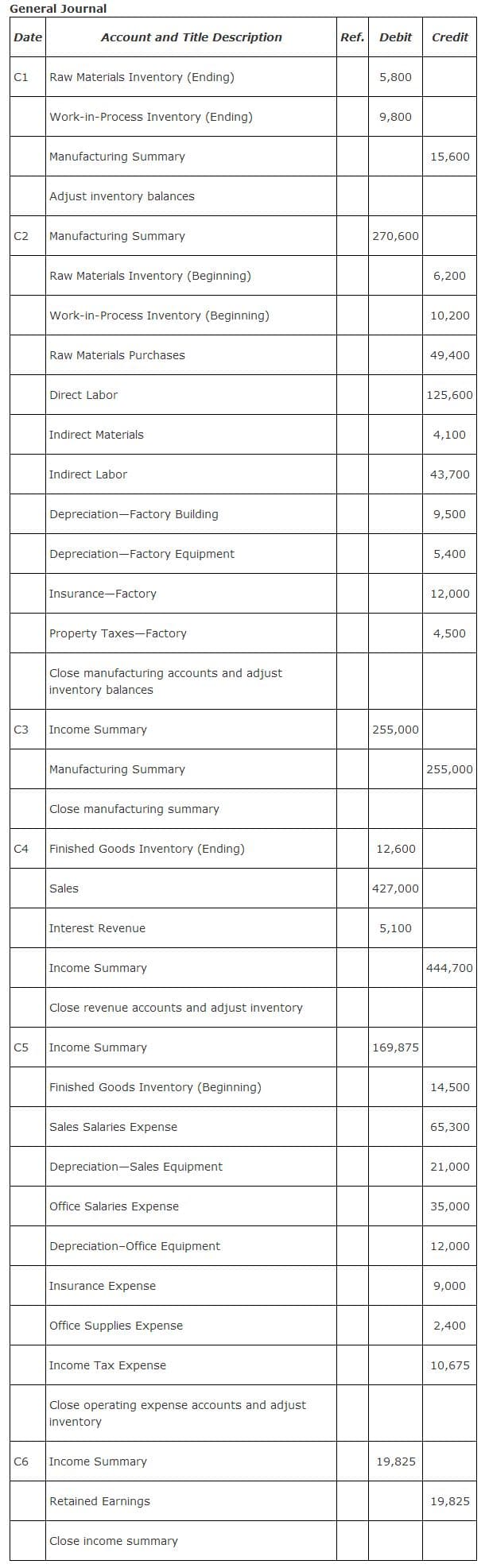

Journal of an enterprise showing 8 days of business transaction

Benefits of Journal entry in accounts

- Journal offers records of all commercial enterprise transactions in one location on the time and date basis.

- All transactions are recorded on the groundwork of receipts or bills, so we can take a look at the authenticity of every journal entries with their laws.

- There is a minimum threat to keep away from any specific transaction due to the fact that journal transactions are recorded date basis.

- Accountant writes each and every journal entry’s narration bellow of that journal entry, so different auditor can know what the cause of that journal entry is.

- In the journal, every transaction is recorded after an in-depth analysis of two debts on the groundwork of the double-entry system, so there is minimal danger of mistake in the journal.

- Journal is the foundation of posting in ledger accounts. With the making of the journal, the accountant can no longer make ledger accounts.

- If there is an error in the ledger, we can fix it with the help of a journal or fix journal entries in the journal.

- All opening journal entries, closing journal entries, and all different transactions which are now not recorded in any different subsidiary books will be recorded in the journal.

- Journal is also wished in every kind of accounting software. These accounting software programs can make the auto system of posting journal entries with the aid of their computerized processing; however, an accountant has to feed journal entries in journals and different particular vouchers of the journal.

- In the journal, there is one list of the ledger sheet. It is significant for checking a reference to every account’s posting with its original journal entry.

ANALYSIS OF DATA:

After analyzing the gathered data,

In accounting careers, journal entries are by some distance one of the essential skills to master. Without suited journal entries, companies’ monetary statements would be inaccurate and a whole mess.

An effortless way to recognize journal entries is to suppose Isaac Newton’s third law of motion, which states that for each action, there is an equal and opposite reaction. So, on every occasion a transaction happens inside a company, there should be at least two bills affected. For example, if a company offered a car, the company’s belongings would go up via the fee of the vehicle. However, there needs to be an additional account that modifications (i.e., the equal and opposite reaction). The different account that is affected is the company’s cash going down due to the fact they used the money to purchase the car.

Finally, simply like how the size of the forces on the first object needs to equal that of the 2nd object, so should the debits and credits of each journal entry ought to be equal.

CONCLUSION:

To successfully conclude my findings,

A journal entry is documented of the enterprise transactions in the accounting books of a firm. An exact documented journal entry consists of the precise date, quantities to be debited and credited, description of the transaction, and a unique reference number.

A journal entry is the 1st act in the accounting course. A journal important points all economic transactions of an enterprise and makes a be aware of the bills that are affected. Since most organizations use a double-entry accounting system, each financial transaction impact at least two accounts, while one account is debited; any other account is credited. This ability that a journal entry has equal debit and savings amounts.

DISCUSSION:

The discussion with my guidance counselor on this project, it is revealed:

Producing merchandise for sale to customers is solely part of the company’s task. Once the products are made and sold, this endeavor needs to be recorded in the company’s books. The journal entries in manufacturing accounting intently comply with the production technique flow. Admissions are made as to the organization purchasing materials, starting production, finishing merchandise, and selling to customers.

SUGGESTION:

After discussing this project with friends and peers, they have individual opinions and recommendations. They are given below:

There should be such projects more often to provide children with a practical insight into a business.

There should be a study tour of any big MNC for college students.

There should be awareness of the journal entry system.

ACKNOWLEDGMENT:

My profound gratitude to all the faculty members of the Department, for their timely assistance and encouragement throughout my research work.

I duly acknowledge the encouragement and support from the research scholars in the Department, and all my colleagues and friends.

It gives me immense pleasure to take the opportunity to all the people who are directly or indirectly involved in the completion of my project based on Visits to any proprietary concern and preparation of a journal of 8 days with the help of business transactions.

With deep reverence, I offer my deepest gratitude _____, without whom this project could not have been fulfilled.

Lastly, I thank Almighty, my parents, family members, friends, and teachers for their constant encouragement and support, without which this project would not be possible.

Name of School/College

BIBLIOGRAPHY / REFERENCE:

- https://www.thebalancecareers.com/definition-of-a-journal-entry-3515176

- https://corporatefinanceinstitute.com/resources/knowledge/accounting/journal-entries-guide/

- https://www.investopedia.com/terms/j/journal.asp

- https://en.wikipedia.org/wiki/Journal_entry

In order to download the PDF, You must follow on Youtube. Once done, Click on Submit

Follow On YoutubeSubscribed? Click on Confirm

Download Visit any Proprietary Concern and Preparation of a Journal of 8 Days With the Help of Business Transactions PDF