Visit the Branch of Any Commercial Bank And Write a Report on Various Functions Performed by Bank

INTRODUCTION :

A commercial bank is a type of financial institution by law to accept deposits from businesses and individuals and lend money to them, offers checking account services, makes business, personal and mortgage loans, and provides essential financial products like certificates of deposit (CDs) and savings accounts to individuals and small businesses. The project talks about the functions of commercial banks and its working mechanism. A commercial bank is where most people do their banking because A commercial bank is almost certainly the type of bank you think of when you think about a bank, as opposed to an investment bank.

Banks are regulated by federal and state laws, depending on how they are organized and the services they provide. Commercial banks are also monitored through the Federal Reserve System.

A commercial bank is a financial organization that performs the features of accepting deposits from the majority and giving loans for funding to earn a profit.

In reality, commercial banks, as their name suggests, ax-earnings-searching for establishments, i.e., they do banking business to gain earnings.

They generally finance trade and commerce with brief-time period loans. They price high fee of interest from the debtors but pay a good deal with much less charge of interest to their depositors with the result that the distinction between the two prices of interest becomes the main supply of earnings of the banks. The maximum of the Indian joint stock Banks is industrial Banks, which include Punjab national bank, Allahabad Bank, Canara Bank, Andhra Bank, Bank of Baroda, etc.

AIMS AND OBJECTIVES :

The project aims to understand how a commercial bank works. What functions a commercial bank carries out in their day to day working environment.

- To visit a local commercial bank

- To understand their workflow

- To understand how the work is distributed among the employees of a commercial bank

- To learn how a commercial bank organizes their functions

- To determine the benefits appointed

- To find out what types of accounts they provide for businesses and individuals

- To learn about cheques, withdrawing, and depositing limits of individual incorporate banks

METHOD AND METHODOLOGY :

In this project, we are going to learn about a corporate bank that works by collecting data by actually visiting a branch of a corporate bank in town.

Primary Data:-

Primary data is data gathered for the first time by the researcher. It is the raw form of data and thoroughly studied and hence, a helpful tool for secondary data. Here the method used for the collection of primary data is a visit to the actual place.

I will be using more of an actual visit to the corporate bank branch to collect the data for this project. The primary source of information is through visiting the corporate bank and observing their work environment, learning their work, Types of things their employees do and seeing the number of services provided by them

DETAIL REPORT OF PROJECT :

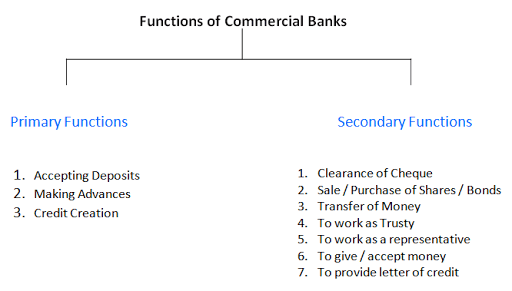

Primary Functions of Commercial banks:

Primary functions of commercial banks refer to the essential functions of commercial banks that include the following:

- Accepting Deposits:

This implies that commercial banks are mainly dependent on public deposits.

There are two types of deposits, which are discussed as follows:

- Demand Deposits:

Refer to the kind of deposits that can be readily withdrawn by individuals without any prior notice to the bank. In other words, the owners of these deposits are allowed to withdraw money anytime by merely writing a check. These deposits are part of the money supply as they are used as a means for the payment of goods and services as well as debts. Receiving these deposits is the primary function of commercial banks. - Time Deposits:

Refer to deposits that are for a specified period. Banks pay higher interest on time deposits. These deposits can be withdrawn only after a specific period is completed by providing written notice to the bank. - Advancing Loans:

This refers to one of the essential functions of commercial banks. Commercial banks use public deposits to grant loans to individuals and businesses. Commercial banks give loans in the form of overdraft, cash credit, and discounting bills of exchange.

Also, check – Functions of the central bank

Secondary Functions of Commercial banks:

Secondary functions of commercial banks refer to the crucial features of commercial banks. The auxiliary services can be classified into three heads, namely, agency functions, general utility functions, and other functions.

These functions are explained as follows:

- Agency Functions:

Implies that commercial banks act as agents of customers by performing various tasks, which are as follows: - Collecting Checks:

Refer to one of the essential features of commercial banks. The banks receive checks and bills of exchange on behalf of their customers through clearing house facilities provided by the central bank. - Receiving Income:

Constitute another significant function of commercial banks. Commercial banks collect dividends, pension, salaries, rents, and interests on investments on behalf of their customers. A credit voucher is sent to customers for information when the bank collects any income. - Paying Expenses:

Implies that commercial banks make the payments of various obligations of customers, such as telephone bills, insurance premium, school fees, and rents. Similar to a credit voucher, a debit voucher is sent to customers for information when the bank pays expenses.

Here is a list of all the documents used in banks and offices. These are the documents used by the banks in their day to day activities and other works.

ANALYSIS OF DATA :

Advantages of commercial banks:

Commercial banking can help small businesses by making it easier to manage day-to-day financial tasks. An established commercial account with a bank will make it easier to borrow money when you grow your business. Often a business is assigned a representative who works directly with the company to find the best services and solutions for the issues the industry is facing. For example, the company may save money by outsourcing payroll processing. Banks also offer invoicing services, with personalized invoices, and can set up transfers to other banks, which will simplify accounting procedures. Some banks provide retirement account management for your employees as well as other employee benefits. This can save you money, and make it easier to manage all of the services you offer employees. Some banks allow you to make deposits online by scanning checks. Your bank may provide you with discounts on your merchant services fees. Commercial banking will enable you to set up direct deposits for your employees as well as for any invoices you need to pay to others, which will save you time.

Disadvantages of commercial banks:

Commercial banking or business accounts are often more expensive than traditional bank accounts. Banks may charge fees for night deposits, for processing a certain number of checks and for the payroll services. Depending on the size of your business, some of the services offered may not be needed, and you may still be charged for the services even if you’re not entirely using them. Different banks may provide various services and charge different fees, and it can be challenging to compare the services. Signing up for a commercial account before your business is ready for one will cost you and may slow the growth of the market. If you choose the wrong bank, you may have a difficult time opening a new account and transferring all of the services to another bank. This can cost you both time and money.

CONCLUSION:

After spending a day in a corporate bank and observing their work environment, we could say that it’s the best services an individual could gain. A corporate bank has everything that is needed for an average citizen. It includes the transfer of money, quick cash, loans, deposits, cheques, etc. all at once place, thus saving time and money by providing everything right in one place. There is an entire staff facility in the bank that was ready to help whenever possible. The positive attitude of the employees gave enormous confidence to the clients to deal with the bank again

Aside from that, the bank also has various facilities like net banking, mobile banking through which a person can do almost everything from anywhere without actually visiting the bank physically. Hence I would say that the corporate bank in my town provided all the facilities one would need

DISCUSSION:

After discussing the bank details with one of the businessmen, he concluded that there are some facilities that a corporate bank cannot provide for a business person.

A mere example will be if you want to start a startup. It needs vast capital, and taking the capital on an interest rate higher than the required will eventually result in the liquidation of the newly emerged startup. Thus an investment bank does this risky task.

YOUR OPINION/ SUGGESTION :

Commercial banks should change their marketing concept. Under the new concept of marketing, the task of management should not so much be a skill in making the customer do what suits the rest of the business, as to be skillful in conceiving and making the business do what suits the interest of the customers.

The commercial banks should also provide credit to the agriculturists based on ‘joint guarantee’ given by the village panchayat or by a few well-known farmers of the village. The acceptance of such a basis will greatly help the farmers, particularly small farmers, in securing loans from commercial banks. This will also result in the more purposeful advent of the commercial banks in the rural sector and will bring them into a relationship with cooperative institutions. It will also ensure a fair understanding between them and encourage commercial banks to operate on the principle of collective service for a collective need.

ACKNOWLEDGMENT:

My profound gratitude to all the faculty members of the Department, for their timely assistance and encouragement throughout my research work.

I duly acknowledge the encouragement and support of the research scholars in the department, and all my colleagues and friends.

It gives me immense pleasure to take the opportunity to all the people who are directly or indirectly involved in the completion of my project based on Visit the Branch of Any Commercial Bank And Write a Report on Various Functions Performed by Bank.

With deep reverence, I offer my deepest gratitude _____, without whom this project could not have been fulfilled.

Lastly, I thank Almighty, my parents, family members, friends, and teachers for their constant encouragement and support, without which this project would not be possible.

Name of School/College

BIBLIOGRAPHY / REFERENCE :

- Wikipedia.com.

- Times of India Newspaper.

- mainstreamweekly.net

- https://study.com/academy/lesson/what-are-commercial-banks-definition-roles-functions.html

In order to download the PDF, You must follow on Youtube. Once done, Click on Submit

Follow On YoutubeSubscribed? Click on Confirm

Download Visit the Branch of Any Commercial Bank And Write a Report on Various Functions Performed by Bank PDF

These is very helpful. Especially for SYJC students!

Ya thats all we need that

this is very useful for HSC students

Very nicely detailed information is given I like that and I would like refer to my friends

Thanks for project and very helpful of hsc project

Very nice informatoin for hsc students

Thanks for help me it is very nice information i will like to refer to my friends

Very nicely written this project

Thank you so much

Nice information about commercial bank with this information my project is done thanks you alot

Really liked this website. It’s very helpful for the HSC students. I wish u make more articles on the project which are remaining plz do so.

This useful for arts students of SYJC

Very nice to detailed information I like the

Very good

very nice for hsc students

but the only problem is that the site is protected

means you cant print it

Nice details

This is so useful tysm ❤️

Yes this is useful