Preparation of a Report on Various Treatments of Bills of Exchange

INTRODUCTION:

A bill of exchange or “draft” may be a written order by the drawer to the payer to pay cash to the recipient. A typical sort of bill of exchange is that the cheque, outlined as a bill of exchange drawn on a banker and due on demand. Bills of exchange are used in international trade and are written orders by one person to his bank to pay the bearer a selected add on a selected date. Before the arrival of currency, bills of exchange were typical suggests that of exchange. They’re not used as typically nowadays.

AIMS AND OBJECTIVES:

The aim of this project is the preparation of a report on various treatments of bills of exchange

There are many objectives for this project. Major few objectives are given below.

Objectives:

- To understand what are bills of exchange

- To know how to do bills of exchange work

- To understand the treatments that are done on bills of exchange

- To ascertain any doubts regarding the bills of exchange

- To understand the importance of bills of exchange

METHOD AND METHODOLOGY:

The method used to gather the required information on the project is an internet survey method. The Internet has extensive information on this subject. It has a vast collection of data on the bills of exchange. The survey has unveiled information about this topic, which has covered major few points which are listed below and explained in a detailed report of the project.

- What are the bills of exchange

- Parties to the bills of exchange

- Types of bills of exchange

- Various accounting treatments of bills of exchange

DETAIL REPORT OF PROJECT:

-

What are the bills of exchange

Section 5 of the Negotiable Instruments Act, 1881 defines a bill of exchange as:

“A Bill of Exchange is an instrument in writing containing an unconditional order, signed by the maker, directing a certain person to pay a certain sum of money only to, or to the order of, a certain person or the bearer of the instrument.”

A bill of exchange is an order created by one person to a different from paying cash to a 3rd person. A bill of exchange needs in its beginning three parties—the drawer, the drawee, and, therefore, the receiver. The one that attracts the bill is named the drawer. He provides the order to pay cash to the third party. The party upon whom the bill is drawn is named the payer. He’s the person to whom the bill is addressed and who is ordered to pay. He becomes an acceptor once he indicates his disposition to pay the bill. The party in whose favor the bill is drawn or is due is named the receiver. The parties needn’t all be distinct persons. Thus, the drawer might draw on himself due to his order. The receiver could also support a bill of exchange in favor of a 3rd party, who might successively endorse it to a fourth, then on indefinitely. The “holder in due course” might claim the number of the bill against the payer and every one previous endorser, no matter any counterclaims which will have disabled the previous receiver or endorser from doing, therefore. This can be what’s meant by speech that a bill is negotiable.

In some cases, a bill is marked “not negotiable”—see the crossing of cheques. Therein case, it will still be transferred to a 3rd party. However, the third party will don’t have any higher rights than the transferer.

-

Parties to bills of exchange

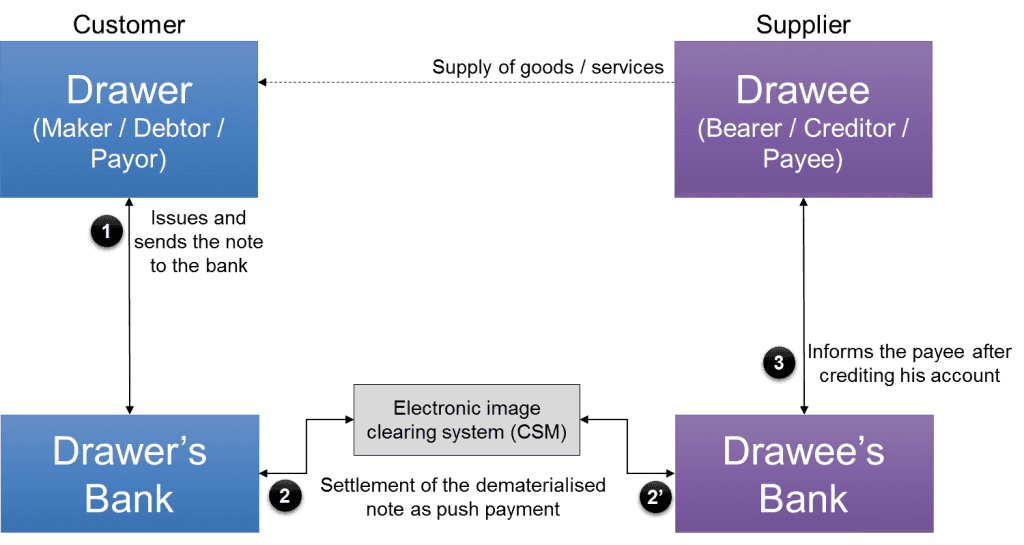

- DRAWER OR MAKER

The drawer is that the one that attracts (or makes) the Bill. He’s the one that is entitled to receive the money (i.e., the Creditor). He’s needed to sign the bill and send it to the remunerator for acceptance.

- DRAWEE

Drawee is the one on whom the bill is drawn. He’s the one that owes the money. The remunerator must settle for the bill of exchange drawn by the drawer. Acceptance is finished by linguistic communication, his name across the face of the bill. Acceptance of the bill denotes that the remunerator has united to pay the quantity mentioned within the bill on the maturity of the bill or demand because the case is also.

- PAYEE

The payee is the person to whom the money is collectible. In most cases, the drawer of the bill is himself the recipient.

- DRAWEE IN CASE OF NEED

If the drawer encompasses a doubt that the initial remunerator won’t settle for or dishonor the bill, he might write the name of another person for acceptive the bill just in case the initial remunerator doesn’t settle for it (You might imagine him to be a backup for the drawee). If the bill isn’t worthy by the initial payer, the bill should be conferred to the remunerator just in case of would like.

Also, Check – Functions of SEBI

-

Types of bills of exchange

Bills of Exchange: the amount

Bills of exchange may be supported amount as demand bills and term bills.

Demand bills don’t have a set date related to them. They’re collectible at any time.

Term bills of exchange are collectible when a precise quantity of your time or on a set date.

Bills of Exchange: Object

Bills of exchange are supported objects or purposes. There are trade bills and accommodation bills.

Trade bills are usually drawn by the vendor of products and are accepted by the customer.

Accommodation bills don’t involve the sale or purchase of any product and/ or services; rather, they’re agreements between 2 parties with the aim of economic support.

Bills of Exchange: Classification

Bills of exchange also can be supported classification. Bills of exchange may be classified as inland bills and foreign bills, and infrequently involve international trade.

Inland bills are drawn between 2 parties that are placed or reside within the same country, and so are created collectible within the same country.

Foreign bills are drawn and involve parties in 2 different countries. For instance, a global bill may involve a merchant placed within us, wherever the bill is drawn, and an emptor in England. During this example, the bill is formed collectible in England, the customer, or drawee’s location.

-

Various accounting treatments of bills of exchange

On the maturity date, Bill Is Honoured:

The accounting treatment below this heading relies on the belief that the bill is punctually worthy of the maturity of the bill.

Keeping in sight the importance of the bill, the drawer will treat the bill within the following ways:

(i) Bill is preserved until the date of maturity

(ii) Bill is discounted from the bank

(iii) Endorsement of bill

(iv) Bill is distributed for an assortment

Dishonor of a Bill:

When the acceptor fails to satisfy his commitment on the date of maturity, the bill is claimed to own been dishonored. Failure to satisfy the commitment means that the acceptor couldn’t pay the quantity of the bill to the holder of the bill on its maturity. Upon receiving the knowledge concerning dishonor of the bill, the entries ought to be passed in such some way that the first entries passed within the books of drawer and payer shall be reversed. Therefore, the original position of somebody and someone is fixed up between the drawer and, therefore, the payer. They’re currently once more thought-about as somebody and someone.

Accounting Treatment:

(i) Bill was lying with the drawer,

(ii) Bill was discounted from the bank

(iii) Bill was supported to the somebody

(iv)Bill was sent for an assortment

(v) Bill was pledged for getting the loan from the bank.

Renewal of the Bill:

Sometimes, the acceptor finds it tough to satisfy the duty of the bill on the maturity date of the bill. To avoid dishonoring of the bill, he might request the drawer of the bill, to increase the maturity. In this case, the drawer might cancel the recent bill and draw a brand new bill, with new terms, on the payer. This is often referred to as the renewal of the bill. During this case, noting of the bill isn’t needed because the cancellation of the bill is reciprocally specified by each of the parties of the bill.

The drawer might demand the interest charges for the extended amount. The interest is also enclosed within the quantity of a brand new bill or are often paid in money. Sometimes, the acceptor of the bill requests for cancellation of the recent bill, part for a brand new bill, and part for money.

Accounting Treatment:

For recording the entries within the books of each the parties, the entries shall be passed in 2 phases. Within the 1st section, an entry for cancellation of the recent bill is to be passed within the books of each of the parties of the bill. This entry would be similar to that of dishonor of bill. Within the second section, entries for interest and drawing and acceptive a brand new bill shall be recorded within the books of the parties.

Retiring of Bill:

In case of sufficient funds, the acceptor of the bill might approach the drawer to simply accept the payment of the bill before the maturity date of the bill. The intention of the payer is either to utilize the excess funds that otherwise would be lying idle or to withdraw the bill from more circulation. If the holder of the bill agrees to the proposal of the acceptor, the bill is claimed to be retired. Sometimes, the holder of the bill evokes the acceptor of the bill for retiring the bill before the maturity date of the bill. In each case, some discount is allowed to the acceptor that is understood as ‘rebate’ and recorded within the books of each the parties as ‘Rebate on Bills A/c.’ The rebate permitted by the holder is a price for him and gain for the acceptor. The quantity of rebate shall be calculated as a hard and fast proportion and on the valid amount solely.

Accounting Treatment:

In the case of retiring a bill, the entries shall be passed within the same method as were passed within the case once the bill was worthy of the maturity date of the bill. Additionally, to it ‘Rebate on Bill A/c’ is to be debited within the books of the holder (being an expense). Similarly, the acceptor of the bill shall credit the ‘Rebate on Bill A/c’ (being gain for him).

Insolvency of Acceptor:

Insolvent is that the person whose assets aren’t ample to pay off his liabilities fully. Therein case, the court appoints a legal one who is understood as ‘Official Assignee’ or Official Receiver.’ This person realizes all the assets of the acceptor of the bill and pays off to his creditors in proportion to their debts. The number that might not tend to the holder shall be thought-about as ‘Bad Debts’ from the purpose of reading of the holder and ‘Deficiency’ from the purpose of reading of the acceptor of the bill.

Accounting Treatment:

In case of the economic condition of the acceptor, the holder would get the proportionate quantity of what’s due from the bill. During this case, entries shall be recorded within the books of each of the parties in 2 phases. Within the 1st part, entry for cancellation of the bill shall be passed within the books of each of the parties. This entry shall be the same as would be passed at the time of dishonoring of the bill. Within the second part, entry for recording {the quantity|the quantity|the number} received (if any) and amount that might not receive, shall be recorded.

ANALYSIS OF DATA:

Exporting typically involves a novel set of risks that will be strange to business homeowners who are wont to commerce domestically. Separate laws and customs between states, combined with longer and additional complicated transport routes and strategies, will create mercantilism a great deal harder than commerce among a rustic.

A bill of exchange helps to counter a number of the risks committed mercantilism. The rate of exchange fluctuations may badly establish Semi-permanent commerce arrangements between corporations in numerous countries. Therefore the fastened payment terms ordered call at a bill of exchange provides exporters with the reassurance of hard and fast value. It additionally provides a businessperson with protection.

CONCLUSION:

To conclude my findings,

The bills of exchange ought to be in writing format. No verbal note would be thought of as valid. The bills of exchange would be an order for somebody to pay the number among a precise amount of your time. And also, the order would have any alternative conditions. The amount that has to be paid and also the date among that the number should be paid ought to be precise within the bills of exchange.

The payment ought to be created by the establishment of the bill by the bearer of the bill. Lastly, once articulating each detail on the bill, then someone who has issued the bill ought to sign the bill before causing it to the someone.

DISCUSSION:

The discussion has revealed:

“The main distinction is that not all bills of exchange involve borrowing funds. As explained on top of, some bills will involve the agreement to get hold of bound products or services. Understanding the assorted styles of bills of exchange will be somewhat confusing. However, it’s necessary to know the variations so that you recognize the premise of every bill, and you’ll verify which sort of bill of exchange most closely fits your scenario.”

SUGGESTION:

There are a few opinions and suggestions by family and friends whom I discussed my project findings with, and they are given below:

- Bill must be checked for everything, including the law.

- Bills should be handled carefully

- There should be a seminar on bills of exchange in colleges to make the youth aware of them.

ACKNOWLEDGMENT:

My profound gratitude to all the faculty members of the Department, for their timely assistance and encouragement throughout my research work.

I duly acknowledge the encouragement and support from the research scholars in the department, and all my colleagues and friends.

It gives me immense pleasure to take the opportunity to all the people who are directly or indirectly involved in the completion of my project based on the preparation of a report on various treatments of bills of exchange

With deep reverence, I offer my deepest gratitude _____, without whom this project could not have been fulfilled.

Lastly, I thank Almighty, my parents, family members, friends, and teachers for their constant encouragement and support, without which this project would not be possible.

Name of School/College

BIBLIOGRAPHY / REFERENCE:

- https://en.wikipedia.org/wiki/Negotiable_instrument#Bill_of_exchange

- https://blog.apruve.com/what-are-the-various-types-of-bills-of-exchange

- https://businessadvice.co.uk/insurance/export/what-is-a-bill-of-exchange-and-why-are-they-important/

- http://www.accountingnotes.net/bill-of-exchange/accounting-treatment-of-bill-of-exchange/4261

- https://thecommercetutor.com/bills-of-exchange-introduction/

In order to download the PDF, You must follow on Youtube. Once done, Click on Submit

Follow On YoutubeSubscribed? Click on Confirm

Download Preparation of a Report on Various Treatments of Bills of Exchange PDF

This content was very helpful thannk u very much for this it helps me alot to complete my project thank uu

Thank u so much ….For this helpful information 😇

Thank u very much it is very useful content

Thank you very much for the given information. This support’s me a lot for my project n completed as soon as possible.🤗

Thanks for this information about Bill exchange I really want this information as soon as possible for do my project. Once again thanks………

Thanks for giving me information it will help me to complete my project as soon as possible

Thank you so much ☺️☺️

Thankyou so much for the info it had helped me alot in completion of my project…this info is really akin….😚 once again a great great thanx…

Thanks 😊 for the info

Thanks a lot

THANKS FOR THE INFORMATION IT WAS NEEDED FOR ME

thanks for the information…….it help me a lot…