Collection Of All Type Of Documents Used In Banks And Office

INTRODUCTION:

A document could be a written, drawn, presented, or memorialized illustration of thought. A company uses documents to speak, interact business, and analyze its productivity. Since documents offer proof of an organization’s dealings and should be mentioned for years to return, they must be written. Business documents vary from temporary email messages to complicated legal agreements. Some documents are prepared by staff and business homeowners, whereas others are written by professionals from outside of the corporate, like accountants and lawyers. In this project, we will learn about Collection Of All Type Of Documents Used In Banks And Office.

A bank is an establishment that accepts deposits from the general public and creates credit. Loaning activities are often performed either directly or indirectly through capital markets. Because of their importance within the money stability of a country, banks are extremely regulated in most countries. Banks have various kind of documents such as cheque, payslip, loan receipt, etc

AIMS AND OBJECTIVES:

This project aims to see the usage of various kinds of documents in the business and banking sectors.

The main aim is to gather accurate information on the collection of all types of documents used in banks and offices.

Objective:

- Provide safe storage and backup of all transactions made in a bank or offices.

- Provide clarity relating to any business-related matter over documentation.

- Provide measures to take care of the restricted, confidential matter of any business or bank.

- Provide a correct and complete archive of any transaction ever made.

- To understand the importance of documentation in the banking and business sector.

METHOD AND METHODOLOGY:

The method used to gather information on the collection of all types of documents used in banks and offices is the internet. There is a huge collection of data on the internet regarding this project. After gathering the accurate information, we found about the various types of documents used in banks and offices.

The various documents are as follows:

Business: Emails and memos, financial documents, transactional documents, business reports, business letters.

Banks: deposit slip (pay-in-slip), withdrawal slip, cheque, passbook, FDR, account statement, demand draft, draft requisition form, etc.

DETAIL REPORT OF PROJECT:

Documents Used in Offices:

- E-Mails and memos:

Colleagues generally use email to convey data to each other. Before email became prevailing, memorandums were used for interoffice messages. Memos are still utilized in situations wherever a message is supposed to accompany a selected file, and in cases that need a lot of privacy than an email. Both a memorandum and an email establish the sender and recipient and contain a topic line. The text is formatted in one or a lot of paragraphs.

- Financial documents:

A business uses monetary documents to remain at intervals its budget, prepare budget proposals, and file tax returns. These documents embody receipt records, payroll reports, paid bills, bank statements, financial gain statements, balance sheets, and tax coverage forms. The company’s businessperson also prepares these documents. A business owner uses these documents to work out the monetary success of the corporate and to spot unproductive areas. A chief may use monetary documents to arrange a budget proposal.

- Transactional documents:

A company uses documents to interact with business with its purchasers. To avoid wasting time, these documents could also be formatted as a form, like a form, transmitting page, invoice, or receipt. The categories of transactional documents used vary somewhat by the character of business. An insurance broker, for instance, generates insurance applications and policies, whereas a loaner uses loan applications and mortgage documents. In some fields, businesses enter into agreements and contracts with others; the company’s professional person may well write these documents.

- Business reports:

Business reports convey info in an exceeding format that’s a lot of formal and frequently longer than a letter. Reports cover a spread of topics, like safety compliance, sales figures, money knowledge, feasibleness studies, and selling plans. They’ll embody statistics, charts, graphs, images, case studies, and survey results. Some reports are revealed for the good thing about investors. If a report is periodic, like a monthly sales report, a template is employed for convenience and to change compared with previous reports.

- Business letters:

Business letters are used to communicate with people outside of the workplace. Recipients might embody customers, colleagues in alternative businesses, service suppliers, professionals who advise the business, governance, and job candidates. A letter is sometimes formatted in block fashion, during which all of the elements of the letter, except the letterhead, are aligned with the left margin. It will be emailed or delivered by mail. If a letter is distributed within the text of an email, the sender includes his name, job title, and get in touch with data at rock bottom of the e-mail.

Check out the functions of the central bank in detail in this article.

Documents Used in Banks:

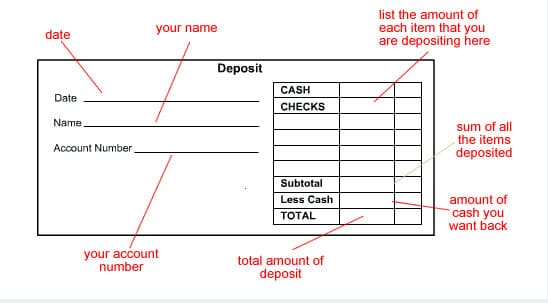

- Deposit slip:

A deposit slip could be a kind provided by a bank for an investor to fill out, designed to document in classes the things enclosed within the deposit group action. The classes embody the form of an item, and if it’s a cheque, wherever it’s from like a neighborhood bank or a state if the bank isn’t local. The seller keeps the deposit slip in conjunction with the deposit (cash and cheques) and provides the investor with a receipt. They’re stuffed during a store and not a bank; therefore, it’s very convenient in paying. They also are a means of transport of cash.[1][2][3] Pay-in slips encourage the sorting of money and coins, are crammed in and signed by the one that deposited the money, and a few take away from a record that’s conjointly stuffed in by the investor.

- Withdrawal slip:

A withdrawal slip is a written piece of paper utilized in the Bank to withdraw cash in money from the account. The slip contains sure particulars like the name of client, date, quantity to be withdrawn in words and figure, the signature of the client, etc. However, this to be utilized by the account holder whose account isn’t with cheque facility. Just in case of cheque facility account, withdrawal of cash may be made by cheque, and no withdrawal slip is needed.

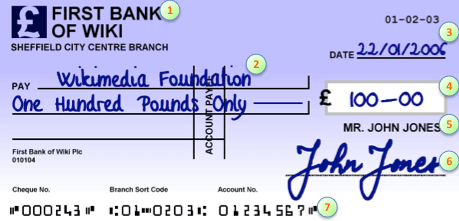

- Cheque:

A cheque is a document that orders a bank to pay a particular quantity of cash from an individual’s account to the person in whose name the cheque has been issued. The person writing the cheque, called the drawer, incorporates a dealings banking account (often referred to as a current checking account) wherever their cash is a command. The drawer writes the assorted details together with the financial quantity, date, and a recipient on the cheque, and signs it, ordering their bank, called the payer, to pay that person or company the number of cash declared.

Cheques are a sort of bill of exchange and were developed as a way to create payments while not the necessity to hold giant amounts of cash. Folding money evolved from commitment notes, another kind of official document the same as cheques in this they were originally a written order to pay the given quantity to whoever had it in their possession (the “bearer”).

- Fixed deposit receipt:

Applicants will procure fastened Deposit receipt by visiting their bank or maybe on their bank’s web site as several banks have enabled the ability to provide fastened deposits online. Once candidates apply for his or her FD theme and every one formality is complete, they’re going to receive a fast deposit receipt as an acknowledgment. This is often a crucial document and may be unbroken safely.

A Fixed Deposit Receipt (FDR) is nothing; however, a document provided by the bank once the person procures an FD theme from their bank. This document contains details like the individual’s name, age, address, details of the theme chosen by them like deposit quantity, tenure, and rate of interest applicable on the deposit and then on.

- Account statement:

A financial statement or account statement is an outline of monetary transactions that have occurred over a given amount on a bank account control by someone or business with an institution.

Bank statements have traditionally been and still be generally written on one or many items of paper and either armored on to the account holder, or unbroken at the monetary institution’s native branch for pick-up. In recent years there has been a shift towards paperless, electronic statements, and a few monetary establishments provide direct transfer into consideration holders’ accounting software systems.

- Demand Draft:

A demand draft is a legal instrument, almost like a bill of exchange. A bank issues a requirement draft to a shopper (drawer), guiding another bank (drawee) or one in all its branches to pay a particular total to the required party (payee).

A demand draft may be compared to a cheque. However, demand drafts are troublesome to countermand. Demand drafts will solely be created owed to a party, additionally referred to as pay to order. But, cheques may be created owed to the bearer. Demand drafts are orders of payment by a bank to a different bank, whereas cheques are orders of payment from an account holder to the bank.

- Demand draft requisition form:

A requisition refers to the method of formally requesting a service or item, generally employing a purchase form. The requisition method may be a standardized means of keeping track of and accounting for all requisitions created inside a business.

Requisition forms generally embody the name of the person creating the request, the date of the request, the things requested, the delivery date, the delivery location, and, therefore, the department to blame for fulfilling the request. The forms conjointly embody the signature of the individual fulfilling the request, and therefore, the date completed. In giant firms with multiple locations and centralized buying, these requisition processes are important in maintaining worker productivity.

Here is a detailed article on the documents required for the formation of a company.

ANALYSIS OF DATA:

Financial establishments are heavily regulated. To substantiate every group action, an incredible quantity of documentation is needed. All of this data should be handled properly and in an exceedingly secure manner to shield the support of the client and also the organization. An increasing range of banks, credit unions, master card corporations, and different monetary establishments are victimization document management computer code systems to lower prices and improve operational performance. These sorts of systems facilitate organizations convert from ancient paper-based processes to digital, electronic systems. They additionally enable organizations to realize efficiencies, lower body prices, and improve the protection of sensitive documents.

CONCLUSION:

In conclusion to the analysis of the gathered information, Documentation in banks and offices is a very crucial part. Without the use of documents, there is no record of any kind of transaction made. Documents used in business and banks are inter-related. All of the above documents are used daily in banks as well as offices.

Now a day’s there’s a lot of use of electronic media and online banking, but still, there is the use of the various kinds of documents listed above in the detailed report. Documents not only provide a record of a transaction but are also used in cases where there can be a misunderstanding in business. To avoid major issues, documents play an important role. Collection of all the documents that are used in banks and offices helped us realize the importance and benefits of the documentation process.

Lastly, I would like to conclude my findings as accurate information about all the documents required in the business and banking world.

DISCUSSION:

The discussion about this topic yielded more information about other documents that are used in the business and banking sector and how they are correlated. The discussion was conducted with family, friends, peers, and teachers.

The discussion with family and teachers lead to an in-depth study of the use of documents in banks.

The discussion with friends and peers was eccentric as they provided a variety of documents used in various banks n businesses.

SUGGESTION:

There were lots of suggestions and opinions given by everyone I discussed this topic with. A few opinions are given below:

- There should be lectures conducted for in-depth information on banking documents for youngsters.

- There should be a practical visit to the bank and office to see the documentation at work.

- There should be more data on various types of documents and how they are correlated.

- Awareness should be spread about the importance of documents in the business world to new entrepreneurs.

- Budding entrepreneurs should know all the various types of documents and their uses.

ACKNOWLEDGMENT:

My profound gratitude to all the faculty members of the Department, for their timely assistance and encouragement throughout my research work.

I duly acknowledge the encouragement and support from the research scholars in the department, and all my colleagues and friends.

It gives me immense pleasure to take the opportunity to all the people who are directly or indirectly involved in the completion of my project based on the Collection Of All Type Of Documents Used In Banks And Office.

With deep reverence, I offer my deepest gratitude _____, without whom this project could not have been fulfilled.

Lastly, I thank Almighty, my parents, family members, friends, and teachers for their constant encouragement and support, without which this project would not be possible.

Name of School/College

BIBLIOGRAPHY / REFERENCE :

- https://smallbusiness.chron.com/5-types-business-documents-22842.html

- https://brainly.in/question/2947371

- https://en.wikipedia.org/wiki/Deposit_slip

- https://www.quora.com/What-is-a-withdrawal-slip

- https://en.wikipedia.org/wiki/Cheque

- https://www.antworksmoney.com/blog/fixed-deposit-receipt-fdr/

- https://en.wikipedia.org/wiki/Bank_statement

- https://en.wikipedia.org/wiki/Demand_draft

- https://www.investopedia.com/terms/r/requisition.asp

- https://www.ilmcorp.com/the-importance-of-banking-financial-services-document-management/

In order to download the PDF, You must follow on Youtube. Once done, Click on Submit

Follow On YoutubeSubscribed? Click on Confirm

Download Collection Of All Type Of Documents Used In Banks And Office PDF

very impressive and helpful.thank you

This project are really good

Your website is best