Procedure of Registration of Partnership Firm Under Partnership Act 1932

INTRODUCTION:

A partnership could be a quite common kind of business concern. Particularly in India, partnership companies are usually finding favor once the business is medium scale. Thus we must tend to study the Partnership deed and, therefore, the registration of such acts. Currently, a partnership is once two persons type an association to hold out a business with the motive to earn profits. They share the benefits of such a business. Such an association is going to be voluntarily entered into by the partners supported an agreement between them. Registration of partnership firm is not an easy task, But here at Hscprojects we will simplify your query for you

Such an agreement between partners is often written or will even be oral. However, it’s powerfully suggested for legal and sensible functions that such an agreement or contract is within the written type. And this instrument between partners to make a partnership firm is what we tend to decide a Partnership Deed.

AIMS AND OBJECTIVES:

This project aims to make a report on the procedure of registration of partnership firm under partnership act 1932

There are many objectives for this project. Major few objectives are given below.

Objectives:

- To understand the Indian Partnership act 1932

- To know the basic of partnership act

- To understand the procedure of partnership act

- To know the challenges faced by every business in partnership

- To ascertain any doubts regarding the Indian partnership act 1932

- To understand the benefits of the partnership act 1932

METHOD AND METHODOLOGY:

The method used to gather the required information on the project is an internet survey method. The Internet has extensive information on this subject. It has a vast collection of data on the Indian partnership act 1932. The survey has unveiled information about this topic, which has covered major few points which are listed below and explained in a detailed report of the project.

- What is the Indian partnership act

- Process of registration

- Advantages of registrations

- Problems faced by companies for not registering under the partnership act

DETAIL REPORT OF PROJECT:

-

What is the Indian Partnership Act:

A Partnership is one among the foremost vital kinds of a business organization, wherever two or additional individuals close to do business and divide the profits from that place in an in quantitative agreement relation. A Partnership is simple to make, and therefore the compliance is minimal as compared to firms.

N read of the terribly sizable amount of little partnership companies operating in India, and wherever registration might not turn out an abundant public profit, this Act has created the registration nonobligatory entirely at the discretion of partners.

Under the Partnership Act, it’s not required for each partnership firm to induce it registered. However, an unregistered firm suffers from a variety of disabilities. In apply, therefore, few partnerships would consider it best to stay unregistered.

-

The process of registrations:

The procedure of registration is incredibly straightforward. An application within the prescribed kind, together with the prescribed fee, needs to be submitted to the Registrar of Corporations of the State during which anywhere of the business of the firm is located or planned to be located.

The application or statement should be signed by all the partners or by their agents specially authorized in this behalf, and should contain the subsequent particulars:

- The name of the firm.

- The place or principal place of business of the firm.

- The names of the other places wherever the firm carries on business.

- The date once every partner joined the firm.

- The names in full and permanent addresses of the partners.

- The period of the firm.

When the Registrar is satisfied that the above provisions are punctually complied with, he shall record an entry of the statement in an exceeding register referred to as the Register of corporations and shall file the statement (Sec. 59). This completes the procedure of registration.

Change of particulars:

With a read to stay the Registrar of corporations announce with up-to-date information concerning the firm, if any modification takes place in any of the particulars given above, it ought to be notified to the Registrar, who shall with that incorporate the mandatory modification within the Register of corporations.

Further, the Registrar ought to even be informed once any partner ceases to be a partner by retirement, expulsion, economic condition or death, or once a replacement partner is admitted or a minor, having been admitted, elects to become or not to become a partner, or once the firm is dissolved. (Sees. 60-63)

The penalty for false particulars (Sec. 70):

If anyone wittingly or while not believing in its truth signs any statement, amending statement, notice or intimation containing false or incomplete information to be equipped to the Registrar, he shall be punishable with imprisonment which can extend to 3 months, or with fine, or with both.

-

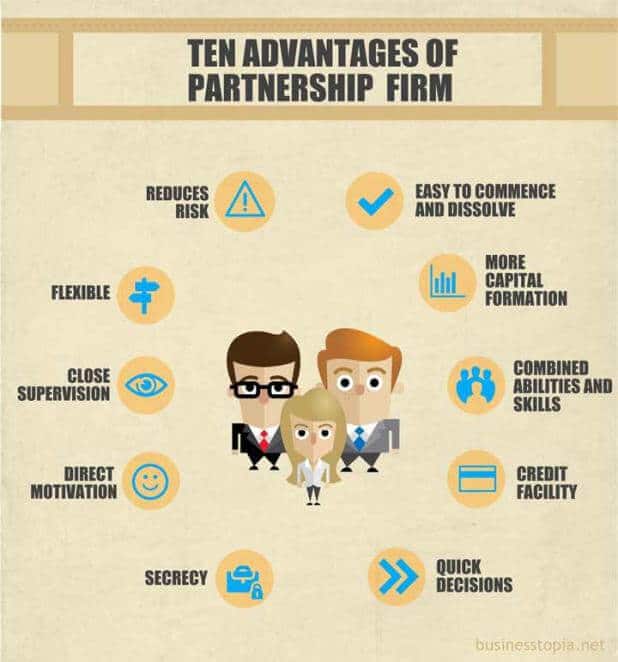

Advantages of registrations

The registration of a firm is finished not solely towards the advantage of the firm; however, additionally for people who deal with it. The subsequent advantages are obtained from the registration of a firm:

- Advantages to the Firm

The firm gets a complete right towards third parties in civil suits for obtaining its rights discharged. Within the non-existence of registration, the firm isn’t entitled to sue outside partners in courts.

- Advantages to Creditors

A person will use any partner for recuperating his cash due to the firm. All partners whose names are set within the registration area in the person responsible for the unknowns. So, creditors will restore their cash from any partner of the firm.

- Advantages to Partners

The partners will look for the assistance of a court of law against one another just in case of disagreement among partners. The partners will use external parties additionally for restoring their amounts, etc.

- Advantages to Incoming Partners

A new partner will contest for his rights within the firm if the firm is registered. If the firm isn’t registered, then he can get to rely on the trait of different partners.

- Advantages of outbound Partners

The registration of a firm acts as a bonus to the outbound partners in varied ways in which. The outbound partners could also be divided into two categories:

- On the death of a partner,

- On the superannuation of a partner.

On the death of a partner, his heirs don’t seem to be in command of the obligations no heritable by the firm when the date of his death. Just in case of a superannuation partner, he remains to be responsible up to the time he doesn’t provide public notice. The general public notice isn’t recorded with the Registrar, and he terminates his liabilities from the date of this notice. So, it’s important to urge a firm registered to obtain this profit.

-

Problems faced by companies for not registering under the partnership act

The following are often understood as the principal disadvantages faced by a partner if he/she doesn’t register the firm under the Indian Partnership Act, 1932:

- A partner isn’t entitled to file a suit in any court of law against the opposite partners or the firm for the execution of any right arising from any enterprise or right given by the Partnership Act.

- A right evolving from an enterprise cannot be enforced in any Court of law by or in support of one’s firm against the other firm.

- Furthermore, the firm or any of its associates cannot assert a collection off (i.e., basic negotiation of debts possessed by the argufied parties to at least one another) or different actions in an exceeding disagreement with a 3rd party.

Also, Check – Procedure on winding up of partnership firm

ANALYSIS OF DATA:

Before the passing of the Indian Partnership Act, 1932, there was no provision for the registration of partnership corporations in India. As a result, it had been troublesome for a 3rd person to prove the existence of a partnership and build his claim against all the members of the firm.

Whenever the question of partners’ liability arose, they didn’t hesitate to deny their membership of the partnership in question.

As such, there was a requirement for mandatory registration, as prevailing in the European nation, so that necessary particulars concerning the constitution of the firm may be created obtainable to people who could also be handling the firm.

Given the sizable amount of tiny partnership corporations operating in India, wherever registration might not turn out a lot of public profit, the current Act has created the registration-optional entirely at the discretion of partners.

Under the Partnership Act, each partnership firm doesn’t need to urge it registered. However, an unregistered firm suffers from a variety of disabilities. I follow; therefore, few partnerships would hold it advisable to stay unregistered.

CONCLUSION:

To conclude my findings,

The true intention behind scripting this paper that in line with the researcher Partnership Law that is thus crucial for business transactions continues to be operating in line with around century-old legislation. When Indian independence, there are several changes in Indian situation, and projecting to similar recent legislation is making new issues that weren’t predictable at the time of the drafting of this legislation, one amongst the outstanding space being non-registration of companies. Here during this paper, when analyzing this scope and judicial trend researcher felt there’s some ambiguity within the sections concerning the registration.

Analyzing the registration provisions in English Law and bearing on the Reports of Law Commissions researcher is attempting to present some suggestions for higher implementation of Partnership Law in India.

DISCUSSION:

The discussion has revealed:

A Partnership Firm could be a standard kind of business constitution for businesses that are closely-held, managed, and controlled by an Association of individuals for profit.

Partnership companies are comparatively simple to start are is rife amongst little and medium-sized businesses within the unorganized sectors. The document during which the various rights and obligations of the members of a partnership are written referred to as Partnership Deed.

SUGGESTION:

There are a few opinions and suggestions by family and friends whom I discussed my project findings with; they are given below:

- Partnership firm should be registered

- People should be made aware of the benefits of registration of partnership firm

- People should adopt the concept of partnership

- Partnership firms should have good faith in each other.

ACKNOWLEDGMENT:

My profound gratitude to all the faculty members of the Department, for their timely assistance and encouragement throughout my research work.

I duly acknowledge the encouragement and support from the research scholars in the department, and all my colleagues and friends.

It gives me immense pleasure to take the opportunity to all the people who are directly or indirectly involved in the completion of my project based on a report on procedure of registration of partnership firm under partnership act 1932

With deep reverence, I offer my deepest gratitude _____, without whom this project could not have been fulfilled.

Lastly, I thank Almighty, my parents, family members, friends, and teachers for their constant encouragement and support, without which this project would not be possible.

Name of School/College

BIBLIOGRAPHY / REFERENCE:

- https://blog.ipleaders.in/registration-firms-indian-partnership-act/

- http://www.shareyouressays.com/essays/the-procedure-for-registration-of-partnership-firms-in-india/92233

- https://racolblegal.com/registration-of-partnership-firm-in-india-registration-procedure-and-effects-of-non-registration/

- https://cleartax.in/s/partnership-registration-india-explained

- https://www.toppr.com/guides/business-studies/forms-of-business-organisations/partnership-deed-and-registration/

In order to download the PDF, You must follow on Youtube. Once done, Click on Submit

Follow On YoutubeSubscribed? Click on Confirm

Download Procedure of Registration of Partnership Firm Under Partnership Act 1932 PDF

Problems are not listed in it

Leaving it everything else is perfect 👍