A Report On The Procedure Of Opening A Demat Account

INTRODUCTION:

Similar to a bank account that holds your money, Deposit, and so on, A Demat account or a web Demat account is the account that owns shares, bonds, government securities, mutual funds, and exchange-traded funds (ETFs). In simple terms, a Demat account is a must-have and primary step for transacting in the share market.

In 1875 at BSE, stocks were traded within the “Ring,” investors shouted their prices to shop for or sell; once the trade was performed, money was exchanged for share certificates. Settlements took quite a few times because of the vast amount of paperwork involved in manually keeping track of shares sold/offered and later agreement of those transactions. Thanks to technology, we moved to a digital age, and everything grew to become electronic. In 1996 Demat accounts have been added, and after the dematerialization technique, all bodily share certificates have been transformed into electronic form and the same deposited into shareholders’ Demat Account.

A Demat is to your shares what a bank account is to your money. Put, it is the account that holds all your shares in electronic or dematerialized form. Like the bank account, a Demat account holds the certificates of your financial instruments like shares, bonds, government securities, mutual funds, and exchange-traded funds (ETFs). You cannot trade in the stock market without a Demat account.

AIMS AND OBJECTIVES:

To learn how to open a Demat account

- The main objective of the study is to know about the potential of the market regarding people’s dealing in the share market.

- To know the role of Demat Account

- To see the procedure of opening Demat account

METHOD AND METHODOLOGY :

Research Methodology refers to the search of knowledge .one can also define research methodology as a scientific and systematic search for required information on a specific topic. The word research methodology comes from the word “advanced learner’s dictionary meaning of research as a careful investigation or inquiry primarily through analysis for new facts in my branch of knowledge, and for example, some author has to define research methodology as a systematized effort to gain new understanding

Primary data collection:

In dealing with the real-life problem, it is often found that data at hand are inadequate, and hence, it becomes necessary to collect data that is appropriate. There are several ways of managing the relevant data which differ considerably in the context of money costs, time and other resources at the disposal of the researcher

Through personal interviews:

A rigid procedure was followed, and we were seeking answers to many pre-conceived questions through personal interviews.

Through a questionnaire:

Information to find out the investment potential and goal was found out through questionnaires.

Through Tele-Calling:

Information was also taken through telephone calls.

Secondary sources of data:

The secondary sources of data are used. (Internet, magazine, books, journals)

DETAIL REPORT OF PROJECT :

Understand How The Demat Account Works:

A Demat account is used for trading securities. Here we have a detailed guide on what is a Demat account, How it works. Check out this tutorial on the Informative report of Demat account to learn everything about it.

How Do You Open A Demat Account?

- Then fill up an account opening form and submit along with copies of the required documents and a passport-sized photograph. You also need to have a PAN card. Also, carry the original documents for verification.

- You will be provided with a copy of the rules and regulations, the terms of the agreement, and the charges that you will incur.

- During the process, an In-Person Verification would be carried out. A member of the DP’s staff would contact you to check the details provided in the account opening form.

- Once the application is processed, the DP will provide you with an account number or client ID. You can use the details to access your Demat account online.

- As a Demat account holder, you would need to pay some fees as the annual maintenance fee levied for the maintenance of account and the transaction fee — collected for debiting securities to and from the account every month. These fees differ from every service provider (called a Depository Participant or DP). While some DPs charge a flat fee per transaction, others peg the cost to the transaction value and are subject to a minimum amount. The price also differs based on the kind of deal (buying or selling of shares). In addition to the other fees, the DP also charges a fee for converting the shares from the physical to the electronic form or vice-versa.

- Minimum shares: A Demat account can be opened with no balance of stocks. It also does not require that a minimum balance is maintained.

What Are The Documents Required For A Demat Account?

You need to submit proof of identity and address along with a passport size photograph and the account opening form. Only photocopies of the documents are required for submission, but originals are also required for verification.

Here is a broad list of documents that can be used as proofs:

You need to submit proof of identity and address along with a passport size photograph and the account opening form. Only photocopies of the documents are required for submission, but originals are also required for verification.

Proof of identity:

PAN card, voter’s ID, passport, driver’s license, bank attestation, IT returns, electricity bill, telephone bill, ID cards with applicant’s photo issued by the central or state government and its departments, statutory or regulatory authorities, public sector undertakings (PSUs), scheduled commercial banks, public financial institutions, colleges affiliated to universities, or professional bodies such as ICAI, ICWAI, ICSI, bar council etc.

Proof of address:

Ration card, passport, voter ID card, driving license, bank passbook or bank statement, verified copies of electricity bills, residence telephone bills, leave and license agreement or agreement for sale, self-declaration by High Court or Supreme Court judges, identity card or a document with address issued by the central or state government and its departments, statutory or regulatory authorities, public sector undertakings (PSUs), scheduled commercial banks, public financial institutions, colleges affiliated to universities and professional bodies such as ICAI, ICWAI, Bar Council etc.

ANALYSIS OF DATA:

Benefits of Demat

A Demat account also allows to keep away troubles commonly related to physical share certificate, as an instance: delivery failures resulting from the signature mismatch, postal delays, and loss of certificates throughout transit. Similarly, it eliminates the risks related to forgery and because of the damaged stock certificate. Demat account holders also keep away from stamp duty (as towards 0.5 percent payable on physical stocks) and filling up of transfer deeds.

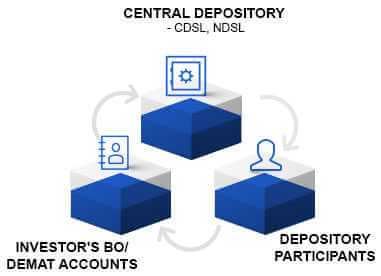

The goal of the Demats system

India adopted the Demat machine for electronic storing, in which stocks and securities are represented and maintained electronically, therefore removing the troubles associated with paper shares. After the introduction of the depository device using the Depository Act of 1996, the manner for sales, purchases, and transfers of shares has become drastically less stressful, and most of the risks associated with paper certificates had been mitigated.

Advantages of Demat Account

The benefits of Demat are enumerated as follows:

- An easy and convenient manner to preserve securities

- On the spot transfer of securities

- No stamp obligation on the transfer of securities

- Safer than paper-stocks (earlier risks associated with physical certificate consisting of inadequate transport, fake securities, delays, thefts and so on. are on the whole eliminated)

- Reduced paperwork for transfer of securities

- Reduced transaction cost

- No “odd lot” trouble: even one share can be bought

- Change in address recorded with a DP gets registered with all businesses wherein investor holds securities removing the need to correspond with each of them one at a time.

- Transmission of securities is performed with the aid of DP, eliminating the need for notifying agencies.

- Automated credit score into Demat account for shares arising out of bonus/break up consolidation/merger, and so forth.

- A single Demat account can maintain investments in both equity and debt instruments.

- Investors can work from anywhere (e.g., even from home).

The benefit to the company

The depository device allows in lowering the cost of the latest problems due to decrease printing and distribution prices. It will increase the efficiency of the registrars and switch agents and the secretarial department of a company. It affords higher facilities for communication and timely service to shareholders and investors.

The advantage to the investor

The depository gadget reduces risks involved in maintaining a physical certificate, e.g., loss, theft, mutilation, forgery, etc. It ensures transfer settlements and decreases the delay in registration of stocks. It provides faster conversations with buyers. It helps avoid bad delivery problems because of signature differences, and so forth. It guarantees speedier payment on the sale of stocks. No stamp duty is paid on the transfer of shares. It affords more acceptability and liquidity of securities.

Advantages to agents

It reduces the dangers of delayed settlement. It ensures extra earnings because of growth in the extent of trading. It removes the chances of forgery or terrible transport. It will increase universal trading and profitability. It will increase the self-belief of their traders.

CONCLUSION :

In India, stocks and securities are held electronically in a dematerialized account (or “Demat”) in preference to the investor taking physical possession of certificates. A Demat account is opened by the investor while registering with an investment broker (or a sub-dealer). The dematerialized account number is quoted for all transactions that permit the electronic settlement of transactions. Each shareholder can have a dematerialized account to get admission to the dematerialized account requires an internet password and a transaction password. Transfer or buy of securities can then commence. The purchases and sales of securities in the dematerialized account are made automatically once the transactions were showed and finished.

India followed the Demat machine for electronic storage, in which shares and securities are represented and maintained electronically, therefore removing the problems related to paper holdings. After the introduction of the deposit system by using the Depositary regulation of 1996, the procedure of sales, purchases, and transfers of stocks became a whole lot less stressful, and most of the dangers associated with a paper certificate have been mitigated.

In 1996, trading commenced in NSE for stocks in the form of a Demat account. It was the start of new paperless inventory marketplace surroundings. If an investor buys a stock nowadays, it is credited to the investor’s account in days. Nowadays, the stocks are transferred to the Demat account of the investor.

A Demat is to your stock what a bank account is to your cash. In short, it is the account that contains all its actions in digital or dematerialized form. Just like the financial institution account, a Demat account includes certificates of its economic units inclusive of shares, bonds, government securities, mutual funds, and traded funds (ETFs). You cannot alternate within the stock market without a Demat account.

DISCUSSION :

Things one should remember before opening a Demat account

Brokerage: Brokerage is the most crucial factor while selecting a broker as its effects on your long-term gains. A good discount broker should provide high-quality service at the best brokerage plan.

Customer Support: Other than the brokerage, Customer support is a significant factor in choosing a discount broker. Excellent customer support creates a positive environment for smooth and healthy trading.

Trading Platform: In this world of fast-changing technology, upgraded software is essential. Make sure the broker provides all three versions of software(Desktop, Web, and Mobile) at no extra cost. And the user interface of this software is easy to use. Before opening the account, every broker provides the demo for the software.

Credibility and Registration: Stockbroker should be registered with SEBI and Stock exchanges such as NSE and BSE. They should display the registration number on their website.

YOUR OPINION/ SUGGESTION :

There’s no harm in opening a Demat account at age 20. It’s the right age to get started in the stock market, in my opinion. In any case, what you should be aware of before you open a 3-in-1 account is the brokerage charges, which will be applicable and the facilities that you will get.

I suggest a person should do his research about different stockbrokers and open a brokerage account where you get value for money. Search for value before you begin your Demat account

ACKNOWLEDGMENT :

My profound gratitude to all the faculty members of the Department, for their timely assistance and encouragement throughout my research work.

I duly acknowledge the encouragement and support of the research scholars in the department, and all my colleagues and friends.

I thank my friends in the stock market and the management of broking firms who helped me with valuable data in time.

It gives me immense pleasure to take the opportunity to all the people who are directly or indirectly involved in the completion of my project based on A report on the procedure of opening a Demat account?

With deep reverence, I offer my deepest gratitude _____, without whom this project could not have been fulfilled.

Lastly, I thank Almighty, my parents, family members, friends, and teachers for their constant encouragement and support, without which this project would not be possible.

Name of School/College

BIBLIOGRAPHY / REFERENCE :

Websites:

- www.angelbroking.com

- www.hdfc.com

- www.icicidirect.com

- www.demataccount.com

- www.google.com

Reference books:

- Financial Institutions And Markets

- Investment Management

In order to download the PDF, You must follow on Youtube. Once done, Click on Submit

Follow On YoutubeSubscribed? Click on Confirm

Download A Report On The Procedure Of Opening A Demat Account PDF

This project helped me a lot

So nice and very helpful Thanking yoy

Very nice to the project. I will be study in very sharp.

Thanks for your opinion.

Ty for support in Project

Your projects are very nice and helpful for hsc students you just need to add need and importance of the topic thank u veru much.