Informative Report Of Demat Account

INTRODUCTION:

The word ‘Demat’ is the common short word for ‘Dematerialized account,’ which is a type of an account where shares and securities are held electronically to enable trading transactions & settlements in a stock exchange, thereby eliminating the need of a physical, financial instrument. Informative Report Of Demat Account will be given in this project

It was in the year 1996 when it was first introduced in India after the introduction of the depository system by the Depository Act of 1996. One must own a Demat account with an investment broker linked to a savings or other funded account if he/she wants to participate in the stock market trading.

The interested candidate needs to approach a Depository Participant (DP), which acts as intermediaries between the trader/investor and the depository. A DP will be registered with the Central Depository Services Ltd. (CDSL) and the National Securities Depository Ltd. (NSDL) of the country.

The DPS are the stockbroking firm, bank or sub-broker, etc., with whom one needs to get registered, which requires some identity proofs and other documents for verification and on its completion provides the trader with login credentials and transaction passwords upon whose confirmation the transfers or purchases of shares can then be initiated.

One can operate the transaction of buying/selling of shares by own or through broker personally or online from their Demat account. The broker then provides the candidate with the transaction password to carry out the share trading processes. A person can hold more than one DEMAT account.

Share trading using Demat account involves inward and outward brokerage, which varies from broker to broker and on trading style, whether intraday or delivery.

AIMS AND OBJECTIVES:

The project aims to learn about Demat account and its features

Objectives of the study are

- To learn about Demat account

- To learn about buying and selling through Demat account

- To learn about functions of Demat account

- To learn about the uses of Demat account

- To learn about the varieties of Demat account

- How to open a DEMAT account

- What are the requirements to open a DEMAT account

METHOD AND METHODOLOGY:

In this project, we are going to learn about different types of winding up of a partnership firm

Primary data is data gathered for the first time by the researcher. It is the raw form of data and thoroughly studied and hence, a helpful tool for secondary data. Here the method used for the collection of primary data is by using the reference of the website.

The referred websites in this project are used as a source of data for this project. Most of the content is collected from these websites. The authenticity of this information cannot be taken seriously, and thus, keeping that in mind, most of that data might be real or fake.

DETAIL REPORT OF PROJECT:

What is a Demat account?

The dematerialized account number is quoted for all transactions to enable electronic settlements of trades to take place. Every shareholder will have a Dematerialized account for transacting

Access to the Dematerialized account requires an internet password and a transaction password. Transfers or purchases of securities can then be initiated. Purchases and sales of securities on the Dematerialized account are automatically made once transactions are confirmed and completed.

Benefits of Demat Account

- An easy and convenient way to hold securities

- Immediate transfer of securities

- No stamp duty on transfer of securities

- Safer than paper-shares (earlier risks associated with physical certificates such as wrong delivery, fake securities, delays, thefts, etc. are mostly eliminated)

- Reduced paperwork for transfer of securities

- Reduced transaction cost

- No “odd lot” problem: even one share can be sold

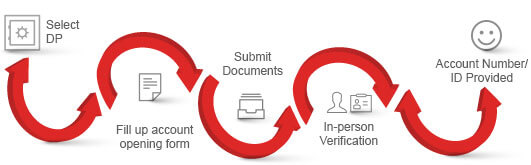

How to open a Demat Account

- To open a Demat account, you have to approach a depository participant (DP), an agent of the depository, and fill up an account opening form. The list of DPs is available on the websites of repositories: CDSL (Central Depository Services (India) Ltd and NSDL (National Securities Depository Ltd).

- Along with the account opening form, you must enclose photocopies of some documents for proof of identity and proof of address.

- You will have to sign an agreement with DP in the depository prescribed standard format, which gives details of the rights and duties of investor and DP. You are entitled to receive a copy of the agreement and schedule of charges for future reference.

- The DP will then open an account and give you the Demat account number. This is also called a beneficial owner identification number (BOID). All your purchases/investments in securities will be credited to this account. If you sell your securities, your Demat account will be debited.

- Here you can find a detailed report on the procedure of opening a Demat account

ANALYSIS OF DATA:

How to trade using the Demat account?

- Link your trading and Demat accounts. This way, you won’t have to keep supplying your Demat account details for every transaction.

- Place an order through your online trading account. This could be a market order, a limit or buy a prescription, or an after-market order. If your brokerage allows you to place orders through the phone, then you will need to supply your trading account details.

- The exchange will process your order. It will verify the details of the transaction, the market price, the availability of the shares in the market, and so on. It will also check the details of your Demat account that is linked to your trading account. This is especially so in case of a sell order.

- Once the order is processed, the shares will be either deposited in or debited from your Demat account.

- Here is a detailed report on how to purchase and sell shares through the Demat account.

CONCLUSION:

It’s not mandatory to have Demat to invest in mutual funds. However, whether it’s wise or not to open a Demat account depends on investors’ requirements and understanding of the product.

Demat account is compulsory to trade in equity shares., but these days due to advancement in technology stock exchanges came up with their platform for Mutual funds investments, so for associated benefits, these depository participants have also started offering transactions in mutual funds, along with other products like NPS, Bonds, corporate FDs, etc.

DISCUSSION:

I asked a friend, “Should I open a Demat account with a bank or with a brokerage firm?”

It depends on many factors. Brokerage firms and Banks have their pros and cons. The brokerage firm will charge you a low brokerage fee on the transaction when compared to banks, but the trade and stock in-depth and insightful report is what you will miss out on the brokerage firm.

It is always good to make a profit with detailed insights on how the stock is performing. Such in-depth detailed reports are available only through the banks.

I would prefer to have a detailed report, all analysis before investing the money. I have tried a few banks and zero brokerage providers, and by far, I found Kotak Securities to be the best sharebrokers.

Investment is always subjected to market risk, and in such situations, it is good to have a detailed stock performance report to compare and make a decision.

SUGGESTION:

I will suggest some following tips related to the Demat account, I have my Demat account, and I am using it for trading from the last two years. Trading in the stock market is only possible with a valid Demat and selling account. If your age is above 18 years, then opening Demat account is elementary, for open a Demat account you must have following documents like for id proof, pan card, along with saving bank account, cheques, address proof’s then you apply for the Demat account by any brokerage houses. It will take around one week to open a Demat account then brokers will provide you trading user id and password for trading in the stock market. But some essential tip’s I will suggest to you during the Demat account opening.

- First, check brokerage house feedback by its existing customers.

- Then compare brokerage’s charges between four to five brokerage houses.

- Compare charges annually.

- Compare its service.

- Check it’s trading software is user-friendly or not.

- Check call on trade facilities available or not.

- The customer’s care service is supported or not.

- Read all terms and conditions very carefully.

ACKNOWLEDGMENT:

My profound gratitude to all the faculty members of the Department, for their timely assistance and encouragement throughout my research work.

I duly acknowledge the encouragement and support of the research scholars in the department, and all my colleagues and friends.

I thank my friends in the stock market and the management of broking firms who helped me with valuable data in time.

It gives me immense pleasure to take the opportunity to all the people who are directly or indirectly involved in the completion of my project based on Informative report of Demat account

With deep reverence, I offer my deepest gratitude _____, without whom this project could not have been fulfilled.

Lastly, I thank Almighty, my parents, family members, friends, and teachers for their constant encouragement and support, without which this project would not be possible.

Name of School/College

BIBLIOGRAPHY / REFERENCE:

- https://businessjargons.com/demat-account.html

- https://en.wikipedia.org/wiki/Demat_account#Benefits_of_Demat_System

- https://www.kotaksecurities.com/ksweb/Research/Investment-Knowledge-Bank/what-is-demat-account

- https://www.kotaksecurities.com/ksweb/Research/Investment-Knowledge-Bank/difference-between-trading-account-and-demat-account

- https://www.quora.com/Is-the-Demat-account-necessary-for-doing-an-online-trading

In order to download the PDF, You must follow on Youtube. Once done, Click on Submit

Follow On YoutubeSubscribed? Click on Confirm

Download Informative Report Of Demat Account PDF

Please , upload the project based on’ comperative study of ‘profit organization’ and non profit organization and analysis of adjustment in final accounts of not for profit organization’

Sub : organization of commerce and management

Please use the request project page to request projects.