Study Of Various Adjustments In Final Accounts Of Partnership Firm

INTRODUCTION :

Final accounts inspire the profit and monetary position of a business to its management, owners, and different interested parties. All business transactions are initially recorded during a journal. They’re then transferred to a ledger and balanced. These final tallies are prepared for a particular period. The preparation of a final accounting is the last stage of the accounting cycle. It determines the monetary position of the business. Beneath this, it’s obligatory to create the trading account, the profit and loss account, and the balance sheet. we will talk about Analytical Study Of Various Adjustments In Final Accounts Of Partnership Firm.

The term “final accounts” includes the trading account, the profit and loss account, and, therefore, the balance sheet.

AIMS AND OBJECTIVES :

The aim of this project is to do an Analytical study on various adjustments in final accounts.

There are many objectives for this project. Major few objectives are given below.

Objectives:

- To understand the final account in detail

- To know the required adjustments done in the final account

- To understand the importance of the final account in business

- To know the contents of the final accounts

- To ascertain any doubts regarding the adjustments of the final account

METHOD AND METHODOLOGY :

The method used to gather the required information on the project is an internet survey method. The Internet has extensive information on this subject. It has a vast knowledge of the final accounts. The survey has unveiled information about final accounts that is vital to do this project. The major and basic few points to understand this project are listed below:

- Meaning of final accounts and its contents

- Adjustments of final accounts

DETAIL REPORT OF PROJECT :

Meaning of Final account and its contents

As the name suggests, they’re the ultimate accounts that are prepared at the last stage of an accounting cycle. Final accounts show each monetary position of a business in conjunction with the profit; they’re employed by external and internal parties for varied functions. Trading account, Profit and Loss account and balance sheet along are known as final accounts

Trading Account: This account is that the initial account prepared as a final account; it’s ready to establish gross profit margin or gross loss incurred throughout an accounting amount. On the accounting, i.e., the LHS of the trading account items like opening stock, purchases, and every one direct expense are shown.

Gross Profit – If the overall credit side is larger than the debit side, i.e., RHS > LHS, the surplus is named as gross profit. It’s transferred to the credit side of the Profit and Loss account.

Gross Loss – If the entire of the debit side is bigger than the credit side, i.e., LHS > RHS, the surplus is named as Gross Loss. It’s transferred to the accounting of the Profit and Loss account.

Profit and Loss Account: After preparation of trading account, a profit and loss account conjointly referred to as a financial statement is ready to establish the Net Profit or Net Loss incurred by a business. It starts with a gross profit or Gross Loss being transferred from the trading account.

On the accounting of a Profit and Loss account, all indirect expenses like pay, rent, workplace and admin, marketing, writing paper, etc. and loss incurred by the sale of assets, etc. are mentioned.

On the credit side of a Profit and Loss account, all indirect incomes like interest attained, dividends received on shares, dangerous debts recovered, profit on the sale of assets, etc. are mentioned.

Balance Sheet: Both trading accounts and profit-and-loss statements facilitate to work out the profit of a business, whereas a record is made to seek out out the money position of the business as on a selected date. A record consists of the capital, assets, and liabilities of a business.

It is a statement and not an account; it’s no debit or credit side there “To” & “By” are not used within a balance sheet. On the LHS of a record are all liabilities together with capital, and RHS are all assets, for a balance sheet, liabilities will invariably be adequate to assets.

Adjustments of final Account:

The items that seem within the trial balance have one impact within the final accounts; however, the transactions that seem outside the trial balance have a twin impact. The transactions that don’t seem within the trial balance are to be noted as changes. The adjustment transactions represent such things of incomes and expenditures that relate to this year and haven’t, however, been brought into the book of accounts. Such money transactions are adjusted when the preparation of trial balance. The adjustment helps to see the particular profits and monetary position of the business.

Every adjustment encompasses a twin impact. The potential effects are as follows: –

Trading account and balance sheet or Profit and loss account and balance sheet or Trading account and profit and loss account.

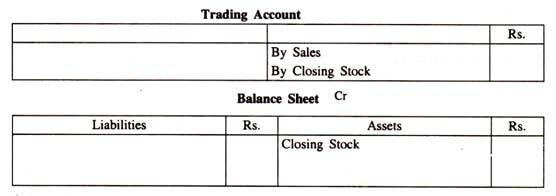

Closing Stock: As the worth of closing inventories is determined at the end of the accounting year, it seems like an adjustment. It ought to be attributable to trading a/c and shown within the asset side of the B/S.

The entry is:

Closing Stock a/c Dr.

To trading a/c

Trading Account and balance sheet

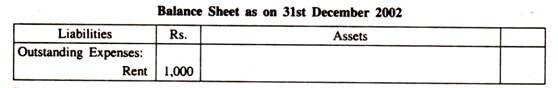

Outstanding Expenses: These are the expenses incurred among the accounting year; however, the payment has not been created. Outstanding or unpaid expenses ought to be else to the involved expenses a/c in P&L a/c and can be shown as a current liability within the B/S.

For example, the Rent of the month of October 2010 Rs. One thousand remain unpaid. The year is that the accounting year.

Adjusting Entry:

Rent account Dr. Rs.1000

To Outstanding Rent a/c Rs. 1,000

Profit and Loss Account

Balance Sheet

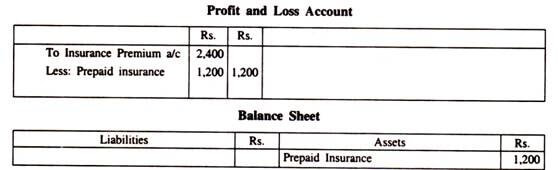

Prepaid Expenses: These are the expenses that are paid; however, a part of the quantity paid extends to the consequent year. It’s additionally known as ‘Un-expired expenses.’ The advance quantity paid ought to be subtracted from the involved expenses and be shown as a Current plus within the B/S.

For example, the premium of Rs.2,400 a year was paid on first July 2002. The yr is that the accounting year. Since one year’s premium has been paid on first July, the premium for six months, i.e., 0.5, the amount relates to the present year, and therefore the other half relates to consequent year.

Hence, Rs. One thousand two hundred should be treated as postpaid and subtracted from the premium paid and be shown as a plus within the B/S.

Adjusting Entry:

Prepaid Insurance a/c Dr. Rs. 1, 200

To premium a/c Rs. 1, 200

Prepaid Expenses

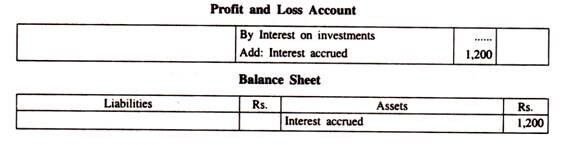

Accrued Financial Gain: It is the financial gain that has already been earned [i.e., the service has already been rendered]; however, the money has not been received. For instance, Interest on investments increased Rs. 1,200.

The interest for the present year is due at the shut of the year. The quantity could also be truly received within the next year. Nowadays, it represents a financial gain that has become due or increased. Thus it’s attributable to P&L a/c and being assets, shown as a plus within the B/S.

Adjusting Entry:

Accrued Interest a/c Dr. Rs. 1,200

To Interest a/c Rs. 1,200

Accrued Income

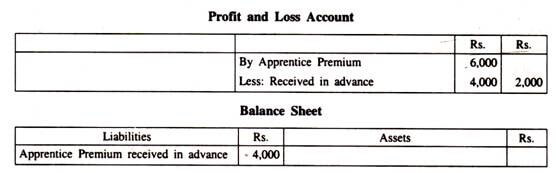

Incomes Received in Advance: These are incomes received throughout the present year. However, a part of the amount received relates to the consequent year. Such quantity should be subtracted from the entire amount received in P&L a/c and shown on the liabilities side of the B/S because it represents an amount that the business is obligated to come back.

For example, concern has received apprentice premium for three years amounting to Rs.6, 000. During this quantity Rs.2, 000, i.e., 1/3 of Rs.6, 000 is for the current year and may be attributable to P&L a/c as financial gain. And therefore, the balance Rs.4, 000 represents a liability because the business is obligated to come back.

Adjusting Entry:

Apprentice Premium a/c Dr. Rs. 4000

To Apprentice, Premium received before Rs. 4000

Income received before

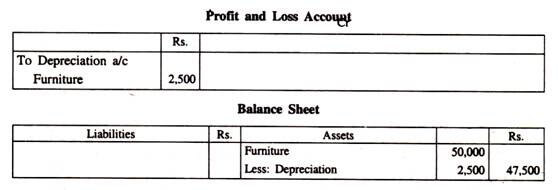

Depreciation on Assets: Depreciation suggests that diminution or fall in the worth of a plus thanks to its constant use. It’s going to additionally arise on account of damage and tear, the lapse of your time, and degeneration. It’s a loss to the business.

It is sometimes calculated at an explicit share on {the worth|the worth} of plus, and therefore, the quantity therefore obtained, is initially shown on the accounting system of the P&L a/c and so subtracted from the initial value of plus within the B/S.

For Example, a business has furnishings of the worth of Rs.50, 000 at the tip of the year it’s depreciated at five-hitter.

Adjusting Entry:

Depreciation a/c Dr. Rs. 2,500

To furnishings a/c Rs. 2,500

[5% on Rs.50, 000 = 2,500]Depreciation on Assets

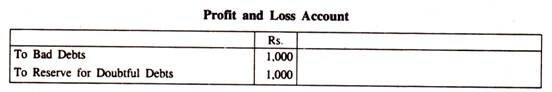

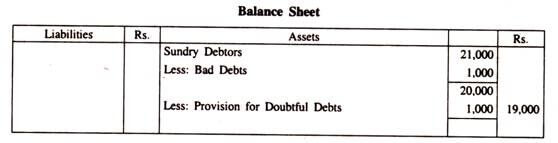

Bad Debts: Debts represent cash due from debtors [i.e., uncollected portion of credit sales]. Once debts become lost, it becomes dangerous debts and is treated as a loss. The quantity of dangerous debts is debited to P&L a/c and is subtracted from Sundry Debtors within the B/S.

For example, the ledger balance in respect of sundry debtors of a merchant shows Rs.20, 000 and of this Rs. 1,000 is calculable to be lost.

Adjusting Entry:

Bad Debts a/c Dr. Rs. 1,000

To Sundry Debtors a/c Rs. 1,000

Provision for bad and uncertain Debts: Every business features a heap of dealings by the method of credit transactions. This provides rise to a large number of book debts or debtors. However, it’s rarely that 100% of those debts are recovered.

Hence, it becomes necessary to bring down the debtor’s balance thereto to a true position. The same old observe is to calculate such uncertain debts at an explicit share, supported past expertise on debtors. It’s known as Provision or Reserve for uncertain Debts.

However, the supply for bad and uncertain debts is calculated on smart debts, i.e., when deducting bad debts not adjusted earlier.

Example:

The sundry debtors of a merchant at the shut of the year stood at Rs.21, 000. It’s calculable that Rs. 1,000 is written off as bad debts, and five-hitter provision is made for uncertain debts.

Adjusting Entries:

Bad Debts a/c Dr. Rs. 1,000

To Sundry Debtors a/c Rs. 1,000

Profit and Loss a/c Dr. Rs. 2,000

To bad Debts a/c Rs. 1,000

To Provision for uncertain Debts one,000

Profit and Loss Account

If there’s a recent provision for uncertain debts, it ought to be adjusted [deducted] against the new provision.

Balance Sheet

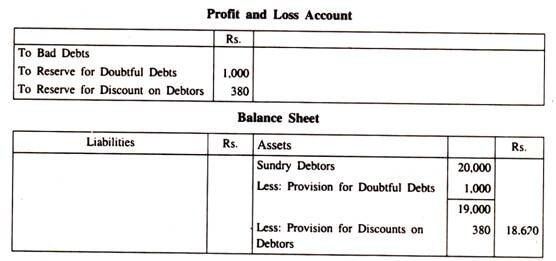

Provision for Discount on Debtors: Cash discounts are allowed to debtors so as to encourage them to form prompt payments. When providing for bad and uncertain debts, the balance of debtors represents debts due to sound parties.

They may attempt to pay their dues on time and avail themselves of the money discounts permissible. Hence, this discount ought to be anticipated and provided for. It is. Therefore, the same old observe in business is to supply for a discount on debtors at a sure share on smart debts.

Example:

Suppose a merchant has sundry debtors amounting to Rs.20, 000 and he estimates that when a provision of fifty for uncertain debts, a provision for discounts at two is fascinating. Then, on the sound debts, i.e., Rs. 19,000 a provision of twenty-two is formed as Reserve for Discount on Debtors.

Adjusting Entry:

Profit and Loss a/c Dr. Rs.380

To order for Discount on Debtors a/c Rs.380

Provision for Discount on Debtors

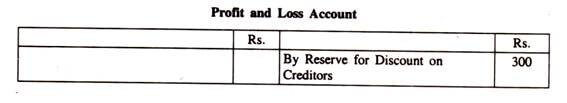

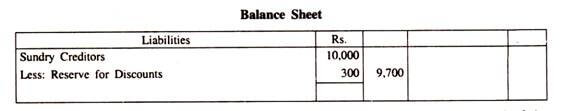

Provision for Discount on Creditors: Creditors represent the quantity owed by the business to suppliers of products on credit. Sound business issues create it a observe to settle accounts with creditors in time to earn the goodwill of the creditors and additionally the discount allowed by them.

In that case, the liability in respect of sundry creditors may be reduced to the extent of discounts anticipated. Supported the past observe, an explicit share on creditors balance is calculated as Provision for discounts and subtracted from the creditor’s balance within the B/S, and therefore, the same amount is attributable as again within the P&L a/c.

Example:

A merchant had sundry creditors at Rs. 10,000 on thirty-first December 2002. It’s desired to form a provision of three on this quantity for discounts.

Adjusting Entry:

Reserve for Discounts on Creditors a/c Dr. Rs. 300

To Profit and Loss a/c Rs. 300

Profit and Loss Account

Balance Sheet

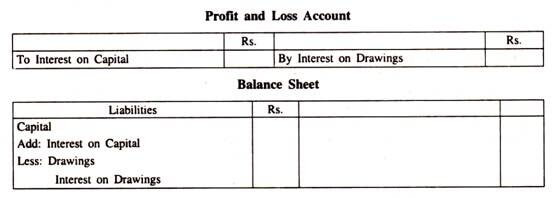

Interest on Capital: Often, interest at a traditional rate is allowed on the capital of the businessman utilized within the business. This can be necessary so as to assess the potency of the business. Otherwise, the profits would come with interest and seem at a better rate.

The interest, therefore, a charge may be a loss to the business and gain to the businessman. Therefore it’s debited to the Profit and Loss a/c and else to the capital within the record.

Adjusting Entries:

Interest on Capital a/c Dr.

To Capital a/c

Profit and Loss a/c Dr.

To Interest on Capital a/c

Interest on Drawings: Drawings are cash withdrawn by the businessman from his capital. Even as the business permits interest on capital, it charges interest on drawings. It’s again to the business and a loss to the businessman. So, it’s attributable to the Profit and Loss a/c and subtracted from the capital within the balance sheet.

ANALYSIS OF DATA :

Final accounts is a somewhat archaic accountancy term that refers to the ultimate balance at the end of an accounting amount from that the monetary statements are derived. This final balance includes all of the journal entries used to shut the books, such as:

- Wage and payroll tax accruals

- Income tax accruals Asset write-downs

- Adjustments to reserves for returns, uncertain debts, and bad inventory

- Depreciation and amortization

- Overhead allocation

- Customer billings

Thus, final accounts will refer to the ultimate balance or the monetary statements upon that they’re based mostly. The first monetary statements are the financial statement, balance sheet, and statement of money flows.

Since final accounts refers to a company’s ending account balances, that successively are used to produce monetary statements, this suggests that the ultimate accounts reveal the results of the business throughout an amount, its monetary position at the end of that amount, and its sources and uses of funds throughout that amount (which is that the purpose of the monetary statements).

A final account, or final accounting, can even be the summarized statement issued once a business dealing has been terminated.

CONCLUSION :

The purpose of the financial statements of a corporation is to supply insights into operations, the money position, and the money flows of a corporation. These financial statements of a corporation are employed by the readers to create choices relating to the allocation of resources. At a lot of refined levels, there’s a special purpose related to every of the money statements. The financial statement informs the reader regarding the flexibility of a business to come up with a profit. Additionally, it helps the reader interpret the number of sales, and also the nature of the varied expenses incurred, relying upon, however, expense data is mass.

The purpose of the balance sheet is to tell the reader regarding this standing of the business as of the date listed on the record. This data is employed to estimate the liquidity, funding, and debt position of an entity, and is that the basis for a variety of liquidity ratios.

Finally, the aim of the statement of money flows is to point out the character of money receipts and disbursements, in a very kind of classes. This data is of sizeable use since money flows don’t perpetually match the revenues and expenses shown within the financial statement. Financial statements of a corporation have a variety of functions, relying upon who is reading the knowledge and that money statements square measure getting used.

DISCUSSION :

The Discussion Revealed:

Final accounts refer to the financial statements ready at the shut of an accounting year. It majorly includes the Profit & Loss account (now referred to as a statement of profit or loss comprehensive financial gain account) and, therefore, the balance sheet (now referred to as the statement of economic position). The foremost basic use of ultimate accounts is to replicate or show the monetary transactions that are embarked upon by a company throughout the past year; during this regard, it is a report back to its various users. As an example, to the owner(s) of business, the ultimate accounts will offer data on the revenue earned during a year beside the corresponding expenses incurred to get the profit or loss created on the year’s business transactions. The ultimate accounts will any offer data for employees (or even suppliers) to work out the monetary standing of the organization they’re handling — they will forever compare the number of assets and liabilities displayed within the record to seek out if the business is doing okay and comparatively stable. Basically, the ultimate accounts may be a document that enables you to understand all that you simply have to be compelled to understand what business has been up to within the last twelve months!

SUGGESTION:

There are a few opinions and suggestions by family and friends whom I discussed my project findings with; they are given below:

- Final accounts should be made with caution

- They should be rechecked by CA

- Adjustments of final account are very important and should not be missed

- There should be a display of a sample of final accounts in colleges.

ACKNOWLEDGMENT :

My profound gratitude to all the faculty members of the Department, for their timely assistance and encouragement throughout my research work.

I duly acknowledge the encouragement and support from the research scholars in the department, and all my colleagues and friends.

It gives me immense pleasure to take the opportunity to all the people who are directly or indirectly involved in the completion of my project based on Analytical Study On Various Adjustments In Final Accounts Of Partnership Firm

With deep reverence, I offer my deepest gratitude _____, without whom this project could not have been fulfilled.

Lastly, I thank Almighty, my parents, family members, friends, and teachers for their constant encouragement and support, without which this project would not be possible.

Name of School/College

BIBLIOGRAPHY / REFERENCE :

- https://www.accountingcapital.com/books-and-accounts/what-are-final-accounts/

- https://en.wikipedia.org/wiki/Final_accounts

- https://www.kullabs.com/classes/subjects/units/lessons/notes/note-detail/2182

- https://www.accountingtools.com/articles/what-are-final-accounts.html

- https://www.toppr.com/bytes/financial-statements-of-a-company/

- http://www.yourarticlelibrary.com/accounting/final-accounts/types-of-adjustments-entries-in-final-accounts/61564

In order to download the PDF, You must follow on Youtube. Once done, Click on Submit

Follow On YoutubeSubscribed? Click on Confirm

Download Study Of Various Adjustments In Final Accounts Of Partnership Firm PDF

nice project it is