Government Budget And Its Components

INTRODUCTION:

In the modern world, every go government aims at maximizing the welfare of its country. It requires a number of infrastructural, economics and welfare activities. All these activities require huge expenditure to be incurred. This requires appropriate planning and policy of the solution to all these problems is ‘Budget’. A budget is a document containing detailed programmes and policies of action for the given fiscal year.

MEANING:

The government budget is an annual statement, showing item wise estimates of receipts and expenditures shown in the budget are not the actual figures, but the estimated values for the coming year. The fiscal year is taken from 1st April to 31st March.

Important Points of Govt. Budget:

- Budget is prepared by the Government of all level i.e. Central Government. State Government and Local Government, prepares its respective annual budget. However, we will restrict our studies to the budget of Central Government known as Union Budget.

- Estimated expenditures and receipts are planned as per the objectives of the government.

- In India, Budget is presented in parliament on such a day as the President may direct By convention it is presented on the last working day of February each year.

- It is required to be approved by the parliament before it can be implemented.

OBJECTIVES:

Government prepares the budget for fulfilling certain objectives. These objectives are the direct outcome of Government economic, social and political policies. The various objectives of the Government budget, etc.

Reallocation of Resources:

Through the budgetary policy, the Government aims to reallocate resources in accordance with the economic and social priorities of the country.

- Tax Concessions or Subsidies: To encourage investment, the Government can give tax to Producers. For example, the Government discourages the production of harmful by providing subsidies.

- Directly producing goods and services: If the private sector does not take an interest, the Government can directly undertake the production.

Reducing Inequalities in Income and Wealth:

Economic inequality is an inherent part of every economic system. The government aims to reduce inequalities of income and wealth through its budgetary policy. The government aims to influence the distribution of income by imposing taxes on the rich and spending more on the welfare of the poor. It will reduce the income of rich and raise the standard of living of the poor, thus reducing inequalities in the distribution of income.

Economic Stability:

Government budgets are used to prevent business fluctuations of inflation or deflation and achieve the object of economic stability. Government expenditure and taxes can help in fighting price fluctuations.

Inflationary tendencies emerge when aggregate demand is higher than expenditure. During deflation, the Government can increase its expenditure and give tax concessions and subsidies.

There are large numbers of Public sector industries and manager for the social welfare of the Public Budget is prepared with the objective of making various provision for managing such enterprises and providing them financial help.

Economic Growth:

The growth rate of a country depends on the rate of saving and investment for this purpose budgetary policy aims to mobilize sufficient resources for investment in the Public sector. Therefore, the Government makes various provisions in the Public sector. Therefore, the Government makes the various rate of saving and investments in the economy.

Reducing Regional Disparities:

The Government budget aims to reduce regional disparities through its taxation and expenditure policy for encouraging setting up of production units in economically backward regions.

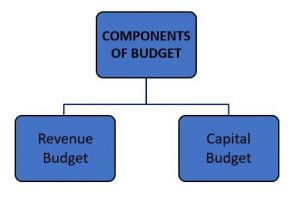

COMPONENTS OF BUDGET:

Two major components of the Budget are:

Revenue Budget:

This financial statement includes the revenue receipts of the Government i.e. revenue collected by way of taxes and other receipts. It also contains the items of expenditure met from such revenue. It has two components:

(I) Budget Receipts:

Budget receipts refer to the estimated money receipt of this Government from all sources during a given fiscal year Budge receipt.

(II) Revenue Receipts:

Revenue receipts refer to those receipts which neither create any liability nor cause any reduction in the assets of the Government. They are regular and recurring in nature and the Government receives them in its normal course of activities.

A receipt is a revenue receipt if it satisfies the following two essential conditions:

- The receipt must not create a liability for the Government. For example, taxes levied by the Government are revenue receipts as they do not create any liability. However, any amount borrowed by the Government is not a revenue receipt as it causes an increase in the liability in terms of repayment of borrowings.

- The receipt must not cause a decrease in the assets. For example, receipts from the sale of shares of a public enterprise is not a revenue receipt as it leads to a reduction in assets of the Government.

Capital Budget:

It deals with the revenue aspect of the Government budget. It explains how revenue is generated or collected by the components of the budget.

Source of Revenue:

Revenue receipts of the Government are generally classified under two heads:

- Tax Revenue:

Tax revenue refers to the sum total of receipts from taxes and duties imposed by the Government companies of the Government without reference to any direct benefit in return. It means there are two aspects of taxes.

(i) Tax is a compulsory payment. No one can refuse to pay it.

(ii) Tax receipts are spent by the Government for the common benefit of people in the country.

- Non-Tax Revenue:

The non-tax sources of public revenue are as follows:

- Fees: The Government provides a variety of services for which fees have to be paid. Example- fees paid for registration of property, births, deaths, etc.

- Fines and Penalties: Fines and penalties are imposed by the Government for not following the rules and regulations.

- Profits from public sector enterprises: Many enterprises are owned and managed by the Government. The profits received from them is an important source of non-tax revenue. For example, In India, the Indian Railways, Oil and Natural Gas Commission, Air India, Indian Airlines, etc. are owned by the Government of India.

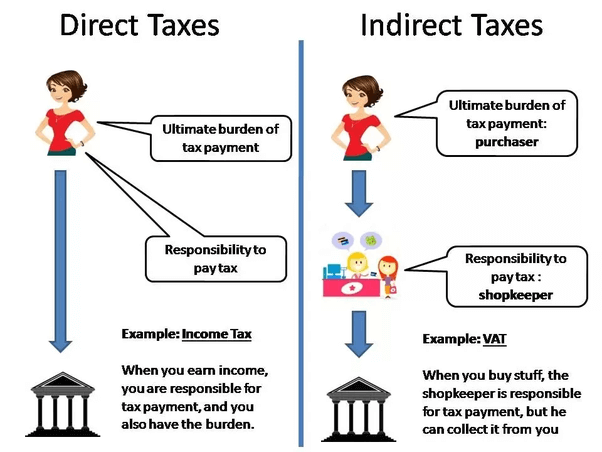

- Direct Taxes:

Direct Taxes are taxes that are imposed on the property and income of individuals and companies and are paid directly by them to the Government.

They are imposed on individuals and companies.

The liability to pay the tax and actual burden of tax lie on the same person i.e. is burden cannot be shifted to others.

- Indirect Taxes:

Indirect Taxes refers to those taxes which affect the income and property of individuals and companies through their consumption of expenditure.

How to classify a tax as Direct or Indirect?

A tax is a direct tax if its burden cannot be shifted. For example, income tax is a direct tax as its impact and incidence are on the same person. A tax is an indirect tax, if it’s an actual burden of the tax lie on different person i.e. its burden can be shifted to others. A tax is an indirect tax if its burden can be shifted. For example- sales tax is an indirect tax.

- Items categorized as Direct and Indirect Tax:

It is a direct tax as its impact and incidence lie on the same person. It is a direct line on the same person.

- Value Added Tax:

It is an indirect tax as its impact and incidence lie on two different people, its burden can be shifted.

- Service Tax:

It is an indirect tax as its impact and incidence lie on a different person.

- Excise Duty:

It is a direct tax as its impact and incidence lie on the same person.

- Non-Tax Revenue:

Non-Tax Revenue refers to receipts of the Government from all sources other than those of tax receipts. The main sources of non-tax revenues are:

- Interest:

The government receives interest on loans given by it to State Government, Union Territories, Private Enterprises and General Public.

- Fees:

Fees refer to charge imposed by Government to cover the cost of recurring services provided by it. Court fees, registration fees, import fees, etc. are some examples of fees.

- License Fees:

It is a payment charged by the Government to grant permission of something’s license fees paid for permission of keeping a gun or to obtain it.

National Permit for Commercial Vehicles:

- Times and Penalties:

They refer to that payment which is imposed on lawbreakers, fine for jumping light for non-payment of tax. The latter is imposed to generate revenue.

- Escheats:

It refers to the claim of the Government on the property of a person who dies without leaving behind a will.

- Gifts and Grants:

The government receives gifts and grants from foreign Government and International Organisations. Sometimes, individuals and companies money to the Government received during a national crisis such as war, food, etc.

- Forfeitures:

These are in the form if penalties which are imposed by the court for non-compliance of others contract, etc.

- Special Assessment:

It refers to the payment made by Owners of these properties whose value has appreciated due to developmental activities of the Government expenditure is recovered from owners.

Capital Receipts:

Capital receipts refer to those receipts which either create liability or cause a reduction in the assets of the Government. They are non-recurring and non-routine in nature.

- The receipts must create a liability for the Government Borrowings are capital receipts as they Government. However, tax received is not a capital receipt as it does not result in the creation of any liability.

- The receipts must cause a decrease in the assets receipts from the scale of a share of public enterprises is a capital receipt as it leads to a reduction in assets of the Government.

Capital receipts are broadly classified into three groups:

- Borrowings:

Borrowings are the funds raised by the Government to meet excess expenditure.

- Government Open Market

- Reserve Bank of India

- Foreign Government

- International Institutions

- Borrowings are capitals receipts as they create a liability for the Government.

- Recovery of Loans:

Government grants various loans to State Government or Union Territories, assets of the Government.

- Other Receipts:

Disinvestment refers to the act of selling a part or the whole of shares of selected Public Sector undertakings held by the Government. They are termed as Capital Receipts as they reduce the assets of the Government. A part or whole of its shares, it leads to transfer of ownerships PSU to the private enterprises.

Small Saving refers to funds raised from the Public in the form of Post office deposits, National Saving Certificates, Kisan Vikas Patras, etc. They are treated as capital receipts as they lead to increased liability.

Classification:

A receipt is capital if either creates a liability or reduces an asset.

Items categorized as Revenue and Capital Receipts:

- Loan from the Word Bank:

It is a capital receipt as it creates liability for this Government. - Corporation Tax:

It is revenue receipt as it neither creates any liability nor reduces any asset. - Grants received from world bank:

It is a revenue receipt as it neither creates nor reduces the asset of the Government. - Profits of Public Sector Undertakings:

It is a revenue receipt as it neither creates reduces asset of the Government. - The scale of a Public Sector Undertaking:

It is a capital receipt as it reduces assets of the Government. - Foreign Aid against Earthquake Victims:

It is revenue receipt as it neither creates nor reduces any asset of the Government. - Dividends on Investments Made Government:

It is revenue receipt as it neither creates nor reduces any asset of the Government. - Borrowings from Public:

It is a capital receipt as it creates liability. - Fees of Government College:

It is revenue receipt as it neither creates any nor reduces any asset of the Government.

BUDGET EXPENDITURE:

Budget Expenditure refers to the estimated expenditure of the Government during a given fiscal year. The budget expenditure can be broadly categorized as:

- Revenue Expenditure:

Revenue Expenditure refers to the expenditure which neither creates any asset nor causes a reduction in any liability of Government.

- It is recurring in nature.

- It is incurred on the normal functioning of the Government.

- The Expenditure must not create an asset of the Government payment of salaries or pension is revenue expenditure as it does not create an asset. Metro is not a revenue expenditure as it leads to the creation of an asset.

Capital Expenditure:

Capital expenditure refers to the expenditure which either creates an asset or causes a reduction in the liabilities of the Government.

- It is non-recurring in nature.

- It adds to the capital stock of the Economy and increases its productively through expenditure on long periods like Metro or Flyovers.

- Examples: Loan to State and Union Territories expenditure on building roads, flyovers, etc.

The expenditure must create an asset for the Government. Example: Construction of Metro is a capital expenditure as it leads to the creation of an asset. However, any amount paid as salaries is not capital in the assets.

How to Classify Expenditure as Revenue or Capital Expenditure?

An expenditure is a capital expenditure if it either creates an asset or reduces a liability.

An expenditure is revenue expenditure if it neither creates an asset nor reduces any liability.

- Subsidies: It is a revenue expenditure as it neither creates an asset nor reduces any of the Government.

- Defense capital equipment purchased from Germany. It is a capital expenditure as it increases asset of the government

- Grants are given to State Governments. It is a revenue expenditure as it neither creates any asset nor any reduces any of the government.

- Construction of School buildings. It is a capital expenditure as it increases asset of the Government.

- Expenditure incurred on administrative is a revenue expenditure as it neither creates nor reduces any liability of the Government.

- Repayment of Loans: It is a capital expenditure as it reduces the liability of the Government.

- Expenditure on building a bridge. It is a capital expenditure as it increases asset of the Government.

- Payment of salaries to the staff of Government. It is a revenue expenditure as it neither creates any asset nor reduces any of the Government.

- Purchase of 20 Cranes for the flyovers. It is a capital expenditure as it increases asset of the Government.

Plan and Non-Plan Expenditure:

- Plan Expenditure: Plan Expenditure refers to the expenditure that is incurred on the Programmes detailed in the current five-year plan. For example Expenditure on Agriculture and allied activities, irrigation, energy, transport, etc. (i) Projects covered under the Central Plans. (ii) Central Assistance for State and Union Territory.

- Non-Plan Expenditure: Non-Plan Expenditure refers to the expenditure other than the expenditure related to the current five-year plan.

Difference between Plan and Non-Plan Expenditure:

- Plan expenditure is spent on current development and investment outlays non-plan expenditure is spent on the asset of the Government.

- Plan expenditures arise only when the plans provide for such expenditure but non-plan expenditure is a must for every economy and the Government cannot escape from it.

How to Classify an Expenditure as Plan or Non-Plan?

Development expenditure refers to the expenditure which is directly related to economics and social development of the country. Expenditure on such services is not a part of the essential functions of the Government. Development expenditures added to the flow of goods and services in the economy.

Non-Development Expenditure refers to the expenditure which is incurred on the essential general services of the Government. It does not directly contribute to economic development but it indirectly helps in the development of the economy. Such expenditure is essential from the administration of view.

Difference between the two:

- Development expenditure directly contributes to the development of the economy, whereas non-development expenditure does not contribute directly to the development but it lubricates the wheels of economic development.

- Development expenditure is productive in nature as it adds to the flow of goods and services whereas non-development expenditure is not covered with the productivity of working clash.

- An Expenditure is a development expenditure if it directly adds to the flow of goods and services.

Measures of Govt. Deficit:

Budgetary deficit is defined as the excess of total estimated expenditure over total estimated revenue when the government spends more than it collects then it incurs a budgetary deficit with reference to the budget of Indian Government. Can be of 3 types:

- Revenue Deficit.

- Fiscal Deficit.

- Primary Deficit.

Revenue Deficit:

Revenue deficit is concerned with the revenue expenditures and revenue receipts of the Government. It refers to an excess of revenue expenditure over revenue receipts during the given fiscal year.

Revenue deficit signifies that the government own revenue is insufficient to meet expenditure on the normal functioning of Government Departments.

Implications:

- It indicates the inability of the Government to meet its regular and recurring expenditure in the proposed budget.

- It implies that the government is discussing i.e. Government is using up saving of other sectors of the economy to finance its expenditures.

- It also implies that the government has to make up this deficit from capital receipts i.e. through borrowings or reduces the assets through.

- Use of capital receipts for meeting the extra consumption expenditure leads to an inflationary situation in the economy.

- A high revenue deficit gives a warning signal to the government to curtail its expenditure.

- Reduce Expenditure: Government should take serious steps to reduce its expenditure and avoid unproductive or unnecessary expenditure.

Fiscal Deficit:

Fiscal deficit presents a more comprehensive view of budgetary imbalances. It is widely used as a budgetary tool for explaining and understanding the budgetary development in India.

The extent of fiscal deficit is an indication of how far the government is spending beyond its means.

Implications:

Fiscal deficit indicates the total borrowing requirements of the government borrowings not only involve repayment of the principal amount but also required payment of interest.

Government mainly borrow from Reserve Bank of India to meet its fiscal deficit. The government also borrows from the rest of the world which raises its dependence on their countries. Borrowings increase the financial burden.

Sources of Financing Fiscal Deficit:

- Borrowings:

Fiscal deficit can be met by borrowings from the internal sources on the external sources.

- Deficit Financing:

The government may borrow from RBI against its securities to meet the fiscal deficit. RBI issues new currency for this purpose.

Primary Deficit & Implications:

It indicates how much of the Government Borrowings are going to meet the expense. It indicates payment the difference between fiscal deficit and primary deficit shows the amount of interest payment on the borrowings made in the past.

In India, interest payment has considerably increased in recent years. High-interest payments on past borrowings have greatly increased the fiscal deficit. To reduce the fiscal deficit interest payment should be reduced through repayment of loans as early as possible.

Reasons for Selection of this Topic:

- To have an understanding of Government administration.

- To know about the sources of Government Expenditure + Government’s Revenue.

- To know about how Government meets its deficit.

- To have an acquaintance of Government objectives, capital receipts, capital expenditure, revenue receipts, and revenue expenditure.

ACKNOWLEDGMENT:

I would like to convey my heartfelt thanks to Mr./Mrs. Aman Khurana my Economics teacher who always gave me valuable suggestions and guidance during the completion of these projects. He/She has been a source of inspiration & helpful hand in the completion of this project. My project has been successful only because of his/her guidance.

Name of the Student: Your Name

Roll No. allotted by CBSE :

CERTIFICATE:

This is to certify that Mr./Mrs. Manminder Kaur of class XII – C of Guru Nanab International Sr. Sec. Public School has completed his/her project file under my supervision. He/She has taken my supervision and has taken proper care and shown utmost sincerity in the completion of the project. I certify that this project is up to my expectations and as per the guidance issued by CBSE.

___________________

(P.G.T Commerce)

(Signature)

DOWNLOAD PDF OF THE PROJECT

Password: hscprojects.com

In order to download the PDF, You must follow on Youtube. Once done, Click on Submit

Follow On YoutubeSubscribed? Click on Confirm

Download Government Budget And Its Components PDF

This is very good project of economics

THANK YOU SIR

Thanks for the project