Project on Central Bank And Its Functions in INDIA – Class 12

INTRODUCTION:

A Central Bank, Reserve Bank or Monetary Authority is an institution that manages a State’s Currency, money supply, and interest rates. Central banks also usually oversee the commercial banking system of their country. In contrast to a commercial bank, a central bank possesses a monopoly on increasing the monetary base in the state and usually also prints the national currency, which usually serves as the State’s legal tender. A project on central bank and its functions should be informative for children studying in 11 and 12 class.

The main function of a central bank is to control the Nation’s money supply(monetary policy), through active duties such as managing interest rates, setting the reserve requirement and acting as a lender of last resort to the banking sector during times of bank’s insolvency or financial crisis. Central bank usually also have supervisory powers, intended to prevent bank runs and to reduce the risk that commercial banks and other financial institutions engage in reckless or fraudulent behavior.

Central banks in most developed nations are institutionally designed to be independent of political interference. Still, limited control by the executive and legislative bodies usually exists.

BRIEF HISTORY:

- It was set up on the recommendation of HILTON YOUNG COMMISSION.

- It was started as Share-holders Bank with a paid up capital of Rs.5 Crores.

- It was established on April 1, 1935.

- Initially, it was located in Kolkata.

- It moved to Mumbai in the year 1937.

- Initially, it was privately owned.

- It was the first bank to be nationalized in 1949.

- It has 22 Regional offices, most of these in-state Capitals.

- Since nationalization in 1949, Reserve Bank is fully owned by the Government of India.

PREAMBLE:

The Preamble of the Reserve Bank of India describes the basic functions of the Reserve Bank as:

“To regulate the issue of Bank notes and keeping of reserves with a view to securing monetary stability in India and generally to operate the currency and credit systems of the country to its advantage; to have a modern monetary policy framework to meet the challenge of an increasingly complex economy, to maintain price stability while keeping in mind the objective of growth.”

OBJECTIVES OF RBI:

The Objectives of the Central Bank of India are :

- To help ensure the monetary, stability of the country.

- To assist in regulating the financial system of the country.

- To formulate, implement and monitor the monetary policy.

- To maintain liquidity in the country.

- To ensure an adequate flow of credits.

- Prescribes parameters for baking in the country.

- Maintain public confidence in the system.

- To manage the foreign management Act.

- To facilitate external trade.

- Issue and exchange currency.

- Maintain the supply of currency.

- Own and operate the depository and exchange for government bonds.

- Banker to the government.

- To stabilize the internal and external value of rupee.

- To centralize the cash reserves of commercial banks.

- To establish monetary relations with other countries of the world and international financial institutions.

MEANING AND DEFINITION:

“Central Bank is an ‘apex’ body that controls, operate, regulate and direct the entire banking and monetary structure of the country.”

It is known as the apex (supreme) body as it occupies the topmost position in the monetary and banking system of the country. All the financially developed countries have their own central bank. India’s RBI was established on April 1, 1935, under the Reserve Bank of India Act passes in 1934. Central Bank is known by different names in different countries. In India, it is Reserve Bank of India (RBI), in the UK as Bank of England and in the USA, it is known as Federal Reserve System.

FUNCTIONS OF CENTRAL BANK:

- Issue of currency

- Banker to the Government

- Bankers bank and supervisor

- Money supply and credit control

- Custodian of foreign reserve

As the Central Bank of the country, The Reserve Bank of India performs the following functions:

Currency Issue:

The central bank has the sole authority for the issue of currency in the country. In India, RBI has the sole right of issuing paper currency notes (except one rupee notes and coins, which are issued by Ministry of Finance).

All the currency issued by the Central Bank is its monetary liability i.e. Central Bank is obliged to back the currency with assets of equal value, to enhance the public confidence in paper currency.

Assets usually consist of gold coins, gold bullions, foreign securities, and domestic governments local currency securities.

- Advantages of Sole Authority of Note issue with RBI:

- It leads to uniformity in note circulation.

- It gives the Central Bank power to influence money supply because currency with the public is a part of the money supply.

- It enables the Government to have supervision and control over the Central Bank with respect to the issue of notes.

- It ensures public faith in the currency system.

- It helps in stabilization of internal and external value of the currency.

Central Government is also authorized to borrow money from the Central Bank. Whom government incurs a deficit in its budget, It borrows from Central Bank by selling its treasury bills. When Central Bank acquires these securities, it issues new currency. This is known as ‘monetizing the Govt’s Debt’ or ‘Deficit Financing’.

Banker to the Government:

The Reserve Bank of India acts as a Banker, Agent and a Financial Advisor to the Central Government and all State Governments [except that of Jammu and Kashmir].

As a banker, it carries out all banking business of the Government.

- It maintains a current account for keeping their cash balances.

- It accepts receipts and makes payments for the government and carries out the exchange, remittance and other banking operations.

- It also gives loans and advances to the government for temporary periods. The government borrows money by selling treasury bills to the Central Bank.

As an agent, the Central Bank also has the responsibility of managing the public debt.

As a financial advisor, the Central Bank advises the Government from time to time on economic, financial and monetary matters.

Banker’s Bank and Supervisor:

As the banker to banks, the Central Bank functions in three capacities:

- Custodian of Cash Reserves: Commercial Banks are required to keep a certain proportion of their deposits (known as Cash Reserve Ratio or CRR) with the Central Bank. In this way, Central Bank acts as a custodian of cash reserves of commercial banks.

- Lender of Last Resort: When Commercial Banks fails to meet their financial requirements from other sources, they approach the Central bank to give loans and advances as lender of the last resort. Central Bank assists these banks through discounting of approves securities and bills of exchange.

- Clearing House: All Commercial Banks have their account with the Central Bank. Therefore, The Central Bank can easily settle claims of various economical banks against each other, by making debit and credit entries in their accounts.

As a supervisor, Central Bank regulates and controls the Commercial Banks. The regulation of Banks may be related to their licensing, branch expansion, the liquidity of assets, management, merging, winding up, etc. The control is exercised by periodic inspection of banks and the return filed by them.

The controller of Money Supply and Credit:

Due to economic fluctuations, the Central Bank i.e. RBI controls the money supply and credit in the best interest of the economy as RBI has the sole monopoly in currency issue, it can control credit and supply of money. For this, RBI makes use of the following methods of credit control:

- Repo [Repurchase] Rate: ‘Repo rate is the rate at which the Central Bank of a country lends money to Commercial banks to meet their short-term needs.’ The Central bank advances loans against approved securities or eligible bills of exchange. An increase in repo rate increases the cost of borrowings from the Central Bank. It forces the commercial banks to increase their lending rates, which discourages borrowers from taking loans. It reduces the ability of Commercial Banks to create credit. A decrease in the repo rate will have the opposite effect.

- Bank Rate (or Discount Rate): ‘Bank rate is the rate at which the Central Bank of a country lends money to Commercial Banks to meet their long-term needs.’ RBI has been actively using Bank rate to control credit. Bank rate has the same effect as that of Repo rate, i.e. an increase in Bank rate increases the cost of borrowings from the Central bank, which leads to an increase in lending rates by Commercial banks. It discourages borrowers from taking loans, which reduces the ability of Commercial Banks to create credit. Reverse Repo Rate is the exact opposite of the Repo Rate. It is the rate at which RBI borrows from Commercial Banks. RBI makes use of this tool when it feels there is excess money supply in the banking system. An increase in Reverse Repo Rates induces the banks to transfer more funds to RBI due to attractive interest rates.

- Open Market Operations: “Open Market Operations (OMO) refers to buying and selling of Government securities by the Central Bank from/to the public and Commercial Banks.” It does not matter whether the securities are bought or sold to the public or banks because ultimately the amounts will be deposited in or transferred from some bank.

- Sale of Securities by Central Bank reduces the reserves of Commercial banks. It adversely affects the bank’s ability to create credit and therefore decreases the money supply in the economy.

- Purchase of Securities by Central Bank increases the reserves and raises the Bank’s ability to give credit.

- Legal Reserve Requirements (Variable Reserve Ratio Method): Commercial Banks are required to maintain reserves on two accounts:

(i) Cash Reserve Ratio (CRR): ‘It refers to the minimum percentage of net demand and time liabilities, to be kept by Commercial Banks with the Central bank.’ An increase in CRR reduces the excess reserves of Commercial Banks and limits credit creating power.

(ii) Statutory Liquidity Ratio (SLR): ‘It refers to the minimum percentage of net demand and time liabilities which Commercial Banks are required to maintain themselves.’ SLR is maintained in the form of designated liquid assets such as excess reserves, and other securities or current account balances with other banks. An increase in SLR reduces the ability of banks to give credit and vice-versa. - Margin Requirements: ‘Margin is the difference between the amount of loan and market value of the security offered by the borrower against the loan.’ An increase in margin reduces the borrowing capacity and money supply. A fall in margin encourages people to borrow more. RBI may prescribe differed margins for different types of borrowers against Other instruments of credit control are Moral Suasion and Selective Credit Controls. RBI uses the above-mentioned methods to control credit in the economy. The security of the same commodity. The margin is necessary because if a bank gives a loan equal to the full value of the security, the bank will suffer a loss in case fall in the price of the security.

Custodian of Foreign Exchange Reserves:

The Central Bank also acts as the custodian of the country’s stock of gold and reserves of foreign exchange. This function enables the Central bank to exercise reasonable control over foreign exchange. According to regulations of foreign exchange, all foreign exchange transactions must be routed through RBI. The centralization of foreign exchange transactions with RBI serves two objectives:

- It helps the bank in stabilizing the external value of the currency.

- It helps in pursuing a coordinated policy towards the balance of payments situations of the country.

PROMOTIONAL FUNCTIONS OF RBI:

Various promotional functions are performed by the Reserve Bank of India are given below:

- Promotion Of Banking Habit:

The RBI helps in mobilizing the savings of the people for investment. It expanded the banking system throughout institutions like UTI, IDBI, IRCI, NABARD, etc. Thereby it promoted banking habit among the people.

- Providing Refinance for Exports:

The RBI is providing refinance for export promotion. The Export Credit and Guarantee Corporation [ECGC] and Export-Import Bank were established initially by RBI to finance the foreign trade of India.

- Providing Credit to Agriculture:

RBI makes institutional arrangements for rural or agricultural finance. For e.g: the bank has set up special agricultural credit cells. It has promoted regional rural banks with the help of Commercial Banks. It has also promoted NABARD.

- Providing Credit to Small Scale Industrial Unit:

Commercial Banks lend loans to small-scale industrial units as per the directives issued by the RBI time to time. The RBI encourages Commercial Banks to render guarantee services also to the small-scale industrial sector. RBI directed Commercial Banks to open specialized branches to provide adequate financial and technical assistance to small-scale industrial branches.

- Providing Indirect Finance to Cooperative Sector:

The RBI has directed NABARD to give loans to state cooperative Banks, which in turn lend loans to cooperative sector. Hence, the Reserve Bank of India provides indirect finance to cooperative sector in India.

- Exercising Control over Monetary and Banking System of the Country:

The RBI is vested with enormous and extensive powers regarding supervision and control over Commercial Banks, Cooperative Banks and also Non-Banking Institution Institutions receiving deposits. The Banking Regulation Act prescribes extensive requirements reserves, cash reserves, and liquid assets. Every scheduled bank is required to furnish to the Reserve Bank a weekly statement showing the principal items of its liability and assets in India.

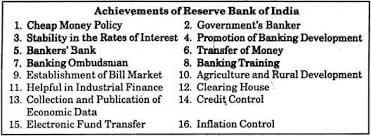

ACHIEVEMENTS OF RBI [CENTRAL BANK]:

- Flexible Monetary Policy:

The RBI has adopted a flexible monetary policy. It has introduced changes in monetary regulations of the Indian money market. The pressure of seasonal demand has been adequately met. - Stable Structure of Interest Rates:

The interest rate policy of RBI has resulted in a relatively stable structure of interest rates in the economy. The Bank rate remained unchanged at a low level of 3 percent up to 1951. - Modern Banking and Credit Structure:

The Reserve Bank has succeeded in building up a sound modern banking and credit structure. The Bank enjoyed vast supervisory powers which enabled it to guide the development of banking on sound lines. Training of Bank personnel has improved their efficiency. The geographical and fundamental coverage of banking has also increased substantially. - Cheap Remittance Facilities:

The Reserve bank has introduced very cheap remittance facilities. These have been widely used by the Commercial Banks, the Government, and Cooperative Banks. - Successful Management of Public Debt: The RBI has successfully managed public debt. It has floated loans for the Govt. at low rates of Interest. It has helped in raising the funds for expansion of the public sector in the economy.

- Exchange Stability: The RBI has maintained the exchange value of the rupee at a relatively higher rate than would have prevailed in the market. It has made judicious use of exchange control measures to keep the demand for foreign exchange within the limits of available supplies.

- Enhanced Public Confidence in the Banking Sector:

Banks are strictly supervised by Reserve Bank so as to avoid their failures and to enhance public confidence in the banking systems. The Deposit Insurance System has also been introduced to protect the interests of investors. - Central Authority Of Indian Money Market:

The RBI has functioned as the central authority in the Indian money market. It has supervised and controlled Commercial Banks, Cooperative Banks and Non-banking Financing Companies accepting deposits from the Public. - Development of Bill Market:

The RBI has made serious efforts to develop a sound bill market in India. It has imparted a Substantial degree of elasticity to the credit structure of the country by introducing several Bill Market Schemes. - Monetary Stability:

The Bank has made a rational use of quantitative and qualitative measures of credit control to maintain monetary stability. These controls were generally employed in the direction of greater restraint in the context of persistent imbalances in the economy. - Contribution to Economic Development:

The RBI has played an active role in promoting the economic development of the Indian economy. The Reserve Bank has helped in building up a well-differential structure of financial institutions to cater to the requirements of the different sources of the economy.

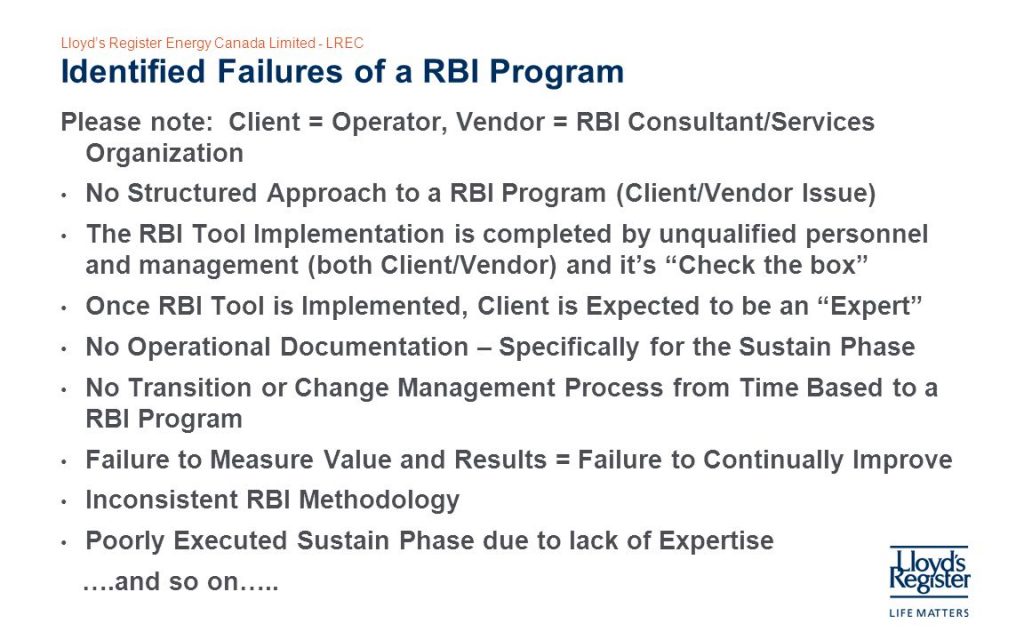

FAILURES OF RBI:

- Lack of Adjustment in Money Market:

RBI has virtually failed in regulating or controlling the activities of rural money lenders and other indigenous bankers. These bankers just do not come within the scope of the Reserve Bank. - Lack of Uniformity in the Rate of Interest:

Because of the lack of control on different sectors of the money market, different rates of interest continue to prevail outside the organized sector of the money market, ROI is exorbitantly higher than the Bank Rate. - Lack of Bill Market:

RBI prepared a plan for the development of Bill Market in 1952. But to date, there is no Independent and Organised widespread bill market in India. - Insufficient Availability of Agricultural Credit:

Despite the fact that a lot of steps have been initiated by RBI to provide enough agricultural credit, its requirement as it is still being dominated by rural money lenders and other indigenous bankers. - Insufficient Banking Facility:

Most of the banking activity is concentrated in urban areas. People in small villages and sub-urban areas still deprived of the banking facility. - Instability in the Internal Value of Rupee:

It has been the biggest failure of RBI because of ever-increasing circulation of money, prices have been rising almost non-stop. - Failure of the Banks:

RBI has also failed as a Bank of the bankers, its lack of assistance to the Commercial Banks cause their closure. Between 1939 to 1946 nearly 444 Banks failed in the country. Closure of three banks in 1985 is also a notable point. - Failure in Getting Sufficient Share in Foreign Exchange Business for the Indian Banks:

The Reserve Bank has not yet succeeded in getting the Commercial Banks any notable foreign exchange business. - Share Scam:

In 1992-1993, Country witnessed large scale share involving hundreds of crores of rupees. It was a glaring example of the failure of RBI.

CONCLUSION OF CENTRAL BANK:

Banking Systems have been with us for as long as people have been using the money. Banks and Financial Institutions provide security for individuals, businesses, and governments. In general, what banks do is pretty easy to figure out. For the average person, Banks accept deposits, lend loans and provides a safe place for money and valuables and act as a payment agent between merchants and banks.

History has power banks to be vulnerable to many risks, however, including credit, liquidity, market, operating interest rate, and legal risk, many global crises have been resulting of such vulnerabilities and this has led to the strict regulations of state and national banks.

However, Central Bank is the backbone of all Banking sector without which there would be absolutely no banking sector involved. This, Central Bank is an essential part of an economy and helps to grow resources of an economy.

ACKNOWLEDGMENT:

I would like to express my special thanks of gratitude to my teacher Mrs. XYZ as well as our principal Mrs. XYZ who gave me the golden opportunity to do this project on the topic Central Bank – RESERVE BANK OF INDIA. Which also helped me in doing a lot of research and I came to know about so many things. My project has been successful only because of her guidance

CERTIFICATE:

This is to certify that XYZ Of Class XII – D of XYZ has completed his/her project under my guidance and supervision. She has taken proper care and shown utmost sincerity in the completion of this project on central bank and its functions in india.. I certify that this project is up to my expectations and as per guidelines issued by CBSE.

DOWNLOAD PDF OF THE PROJECT ON CENTRAL BANK & ITS FUNCTIONS IN INDIA

Password: hscprojects.com

In order to download the PDF, You must follow on Youtube. Once done, Click on Submit

Follow On YoutubeSubscribed? Click on Confirm

Download Project on Central Bank And Its Functions in INDIA – Class 12 PDF

Best website for project

Best 👍💯 help me

Best…one

Thank you very much 😇. And this is best😊