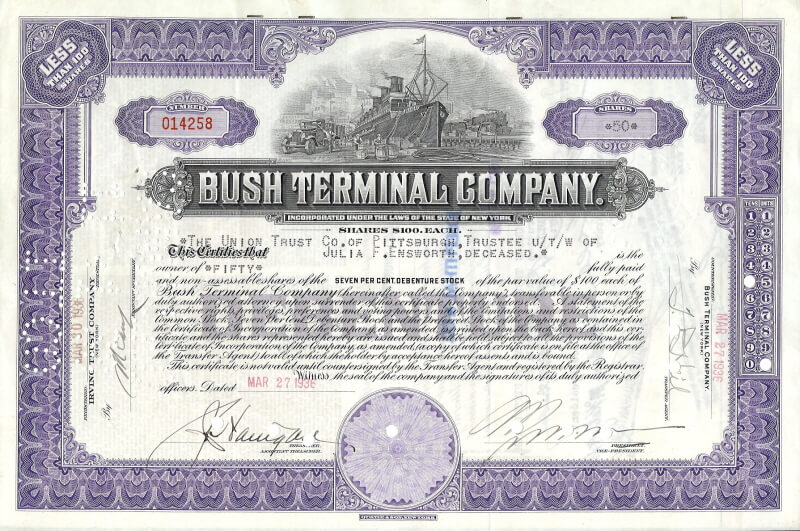

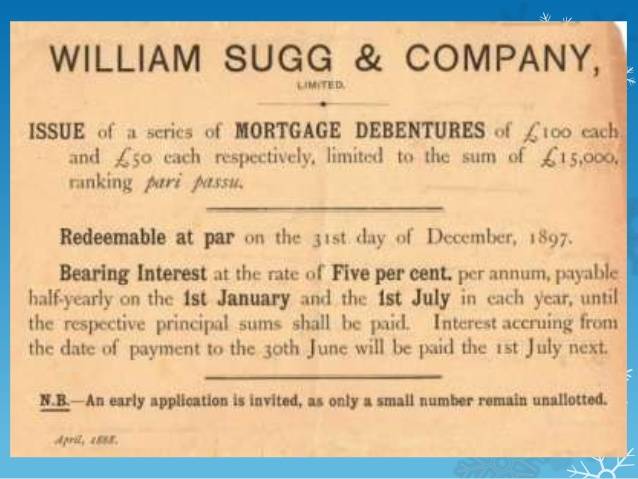

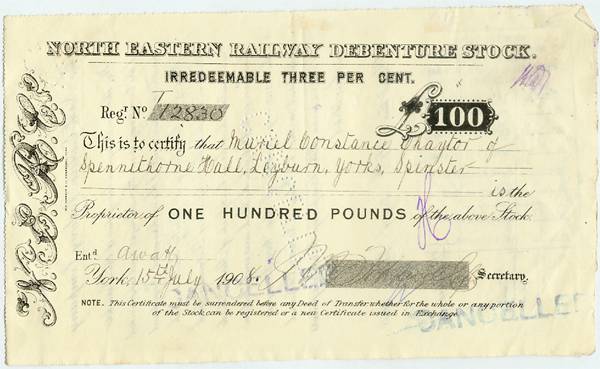

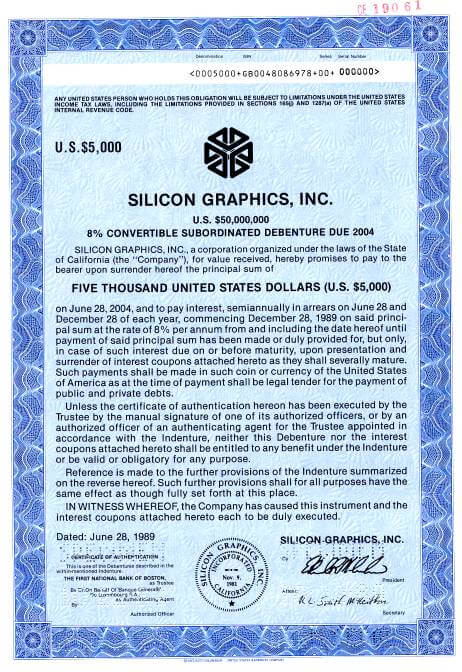

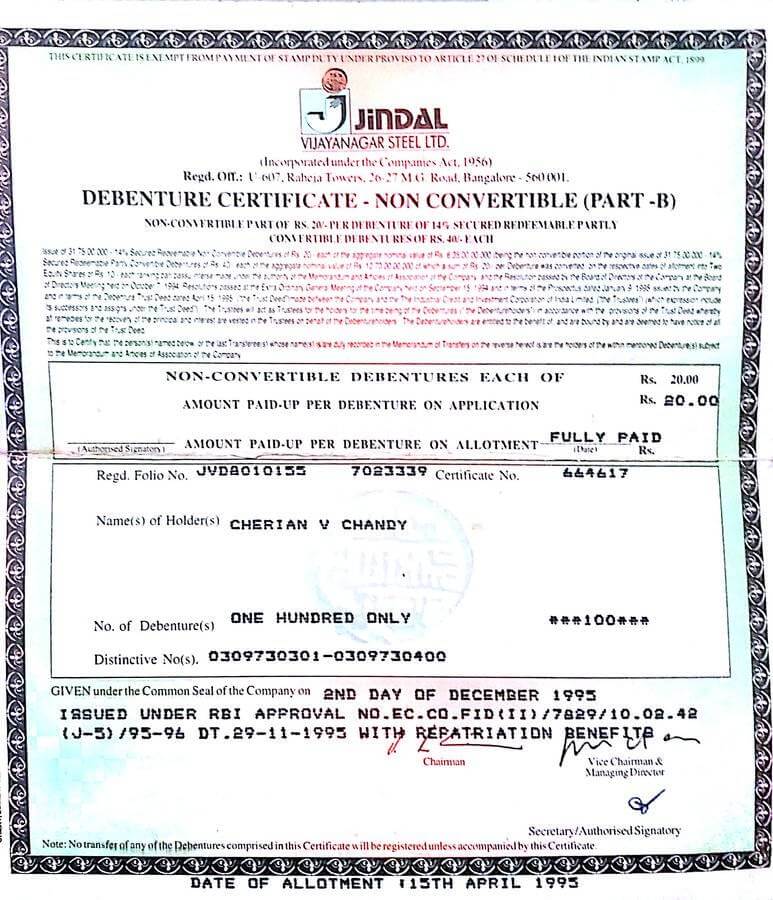

Specimen Certificates for Different Kinds of Debentures

INTRODUCTION:

In finance, a debenture is a medium- to long-term debt instrument employed by massive corporations to borrow cash at a set rate of interest. The legal term “debenture” originally stated a document that either creates a debt or acknowledges it, however in some countries, the time is currently used interchangeably with bond, loan stock, or note. A debenture is, therefore, sort of a certificate of a loan or a loan bond evidencing the fact that the corporate is at risk of pay such amount with interest. Though the money raised by the debentures becomes a vicinity of the company’s capital structure, it doesn’t become share capital. Senior debentures get paid before subordinate debentures, and there are variable rates of risk and payoff for these classes. Here we will study about Specimen Presentation of Debenture Certificates for Different Kinds of Debentures

AIMS AND OBJECTIVES:

This project aims to make a specimen presentation of debentures certificates of different kinds of debentures.

There are many objectives for this project. Primary few goals are given below.

Objectives:

- To understand debentures

- To know various types of debentures

- To realize the advantages of debenture certificates

- To know the disadvantages of debenture certificates

- To ascertain any doubt regarding debenture certificates

METHOD AND METHODOLOGY:

The method used to gather the required information on the project is an internet survey method. The Internet has extensive knowledge on this subject. It has a vast collection of data on debenture and various kinds of debentures certificates. The survey has unveiled information about this topic, which has covered major few points which are listed below and explained in a detailed report of the project.

- What is debenture

- Types of debenture certificates

- Advantages of debentures

- Disadvantages of debenture

DETAIL REPORT OF PROJECT:

What is Debenture?

A debenture is employed to issue the loan by the government and corporations. The credit is published at the fastened interest relying upon the name of the businesses. Once corporations have to be compelled to borrow some cash to expand them, they take the assistance of debentures.

The word ‘debenture’ itself may be a derivation of the Latin word ‘debate’ which implies to borrow or loan. Debentures are written instruments of debt that corporations issue below their tight seal. They’re just like a loan certificate.

Debentures are issued to the general public as a contract of compensation of cash borrowed from them. These debentures are for a set amount and a fixed charge per unit, which will be collectible yearly or half-yearly. Debentures are offered to the general public at the giant, like equity shares. Debentures are the first standard method for big corporations to borrow cash.

Types of Debenture certificates

Secured Debentures: These are debentures that are secured against assets/assets of the corporate. This suggests a charge is made on such a quality just in case of default in compensation of such debentures. So, the corporate doesn’t have enough funds to repay such debentures; the same quality is going to be oversubscribed to pay such a loan. The charge is also fastened, i.e., against selected assets/assets or floating, i.e., against all assets of the firm.

Unsecured Debentures: These aren’t secured by any charge against the assets of the corporate, neither fastened nor floating. Commonly such sorts of debentures aren’t issued by firms in India.

Redeemable Debentures: These debentures are owed at the expiration of their term. This implies at the top of an amount they’re owed, either within the payment or in installments over a fundamental quantity. Such debentures are redeemable at par, premium, or a reduction.

Irredeemable Debentures: Such debentures are perpetual. There’s no fastened date at that they become owed. They’re redeemable once the corporate goes into the liquidation method. Or they will be redeemable when associating unspecified very long time intervals.

Fully Convertible Debentures: These shares are regenerate to equity shares at the choice of the debenture holder. Therefore if he desires, then when a such that measures all his shares are going to be restored to equity shares, and he can become an investor.

Partly Convertible Debentures: Here, the holders of such debentures are given a choice to convert their debentures to shares partly. If he opts for the conversion, he is going to be each a mortal and an investor of the corporate.

Non-Convertible Debentures: because the name suggests such debentures don’t have the associate choice to be regenerate to shares or any quite equity. These debentures can stay; therefore, until their maturity, no conversion can occur. These are the foremost common kind of debentures.

Advantages of Debentures

- One of the most abundant blessings of debentures is that the corporate will get its needed funds while not diluting equity. Since debentures are a variety of debt, the capital of the corporate remains unchanged.

- Interest to be paid on debentures could be a charge against profit for the corporate. However, this additionally means that it’s a tax-deductible expense and is beneficial, whereas tax coming up with.

- Debentures encourage long coming up with and funding. And compared to alternative styles of loaning, debentures tend to be cheaper.

- Debenture holders bear little or no risk since the loan is secured and also the interest is collectible even within the case of a loss to the corporate

- At times of inflation, debentures are the popular instrument to lift funds since they need a hard and fast rate of interest

Disadvantages of Debentures

- The benefit due to debenture holders may be a monetary burden for the corporate. It’s due even within the event of a loss.

- While issue debentures facilitate an organization’s trade on equity, it additionally makes it captivating with debt. An inclined Debt-Equity quantitative relation isn’t smart for the monetary health of an organization

- Redemption of debentures may be a vital money outflow for the corporation which may imbalance its liquidity

- During a depression, once profits are declining, debentures will sway be dearly-won because of their mounted rate.

ANALYSIS OF DATA:

Debentures are instruments of debt, which suggests that debenture holders become creditors of the corporation. They are a certificate of debt, with the date of redemption and quantity of reimbursement mentioned on that. This certificate is issued beneath the corporate seal and is understood as a Debenture Deed.

Debentures have a hard and fast rate of interest, and such interest quantity is collectible yearly or half-yearly. Debenture holders don’t get any ballot rights. This is often as a result of they’re not instruments of equity. Thus debenture holders don’t seem to be homeowners of the corporate, solely creditors. The interest collectible to those debenture holders may be a charge against the profits of the corporate. Thus these payments got to be created even just in case of a loss.

CONCLUSION:

To conclude my findings,

Debentures holders or suppliers of loan capital haven’t any interest within the company. Finance accessible is on the market for a set amount with definitely, and therefore, the corporate will change its investment plans fittingly by taking under consideration the funds available.

Debentures enhance the earnings of equity holders through the operation of monetary leverage. In depressed market conditions, debentures play a vital role in providing an honest supply of finance for a corporation and are useful to investors.

Debentures provide semi-permanent finance to the company on low-cost and straightforward terms. The price of debt is under the cost of equity or preferred stock, as interest is tax-deductible. Debenture facilitates the mobilization of savings from the public, notably from those investors who are risk aversive.

DISCUSSION:

The discussion has revealed:

“If a corporation wants funds for extension and development purposes while not increasing its share capital, it will borrow from the final public by issuance certificates for a hard and fast amount of your time and at a hard and fast rate of interest. Such a loan certificate is termed a debenture. Debentures are offered to the general public for subscription within the same manner as for the issue of equity shares. A debenture is issued beneath the true seal of the corporate acknowledging the receipt of cash.”

SUGGESTION:

There are a few opinions and recommendations by family and friends whom I discussed my project findings with; they are given below:

- There should be an exhibition held at the college level with all the information regarding this topic so as for the youth to get proper knowledge about it

- Awareness should be spread amongst the child about the advantages and disadvantages of debenture certificates.

ACKNOWLEDGMENT:

My profound gratitude to all the faculty members of the Department, for their timely assistance and encouragement throughout my research work.

I duly acknowledge the encouragement and support from the research scholars in the department, and all my colleagues and friends.

It gives me immense pleasure to take the opportunity to all the people who are directly or indirectly involved in the completion of my project based on Specimen presentation of debenture certificates for different kinds of debentures.

With deep reverence, I offer my deepest gratitude _____, without whom this project could not have been fulfilled.

Lastly, I thank Almighty, my parents, family members, friends, and teachers for their constant encouragement and support, without which this project would not be possible.

Name of School/College

BIBLIOGRAPHY / REFERENCE:

- https://www.toppr.com/guides/accountancy/issue-and-redemption-of-debentures/meaning-of-debenture/

- https://edoc.site/specimen-presentation-of-debentures-certificate-for-different-kinds-of-debentures-pdf-free.html

- https://en.wikipedia.org/wiki/Debenture

- https://www.toppr.com/guides/business-studies/sources-of-business-finance/debentures/

In order to download the PDF, You must follow on Youtube. Once done, Click on Submit

Follow On YoutubeSubscribed? Click on Confirm

Download Specimen Certificates for Different Kinds of Debentures PDF