Studying The Method Of Valuation Of Goodwill Accounting Treatment In Case Of Admission, Retirement, Or Death Of A Partner

INTRODUCTION:

Goodwill in accounting is an intangible asset that arises once a purchaser acquires an existing business. Goodwill represents assets that aren’t on an individual basis identifiable. Goodwill doesn’t embody identifiable assets that are capable of being separated or divided from the entity and oversubscribed, transferred, licensed, rented, or changed, either singly or alongside a connected contract, identifiable plus, or liability notwithstanding whether or not the entity intends to try and do, therefore. Goodwill additionally doesn’t embody written agreement or different legal rights, notwithstanding whether or not those square measures transferable or dissociable from the entity or different rights and obligations. Samples of identifiable assets that aren’t goodwill embody a company’s brand, client relationships, creative intangible assets, and any patents or proprietary technology. The goodwill amounts to the surplus of the “purchase consideration” (the cash paid to buy the plus or business) over the full price of the assets and liabilities. We will study The Method Of Valuation Of Goodwill Accounting Treatment In Case Of Admission, Retirement, Or Death Of A Partner

AIMS AND OBJECTIVES:

This project aims to study the method of goodwill accounting treatment in case of admission, retirement, or death of a partner.

There are many objectives for this project. Major few objectives are given below.

Objectives:

- To understand what is goodwill accounting

- To know the purpose behind goodwill accounting

- To understand the various methods of goodwill accounting

- To know the importance of goodwill accounting

- To ascertain any doubts regarding the various methods of valuation of goodwill

- To understand the need for goodwill accounting

METHOD AND METHODOLOGY:

The method used to gather the required information on the project is an internet survey method. The Internet has extensive information on this subject. It has a vast collection of data on the topic of goodwill accounting. The survey has unveiled information about goodwill accounting, and major few points are listed below, which are explained in the detailed report of the project.

- What is goodwill accounting

- Various methods of valuation of goodwill accounting

- Need for valuation of goodwill accounting

- Factors affecting goodwill accounting

DETAIL REPORT OF PROJECT:

What is goodwill accounting?

Goodwill is that the price of the name of a firm designed over time with relevance to the expected future profits over and on top of the traditional profits. A well-established firm earns a decent name within the market, builds trust with the purchasers, and conjointly has additional business connections as compared to a recently came upon business. Thus, the price of this advantage that a client is prepared to pay is termed as Goodwill.

The buyer who pays expects that he is going to be ready to earn super profits as compared to the profits attained by the opposite companies. Thus, it will be aforesaid that goodwill exists solely just in case} of companies creating super profits and not in case of companies earning traditional profits or losses. It an intangible real plus that can’t be seen or felt however exists essentially and might be bought and sold.

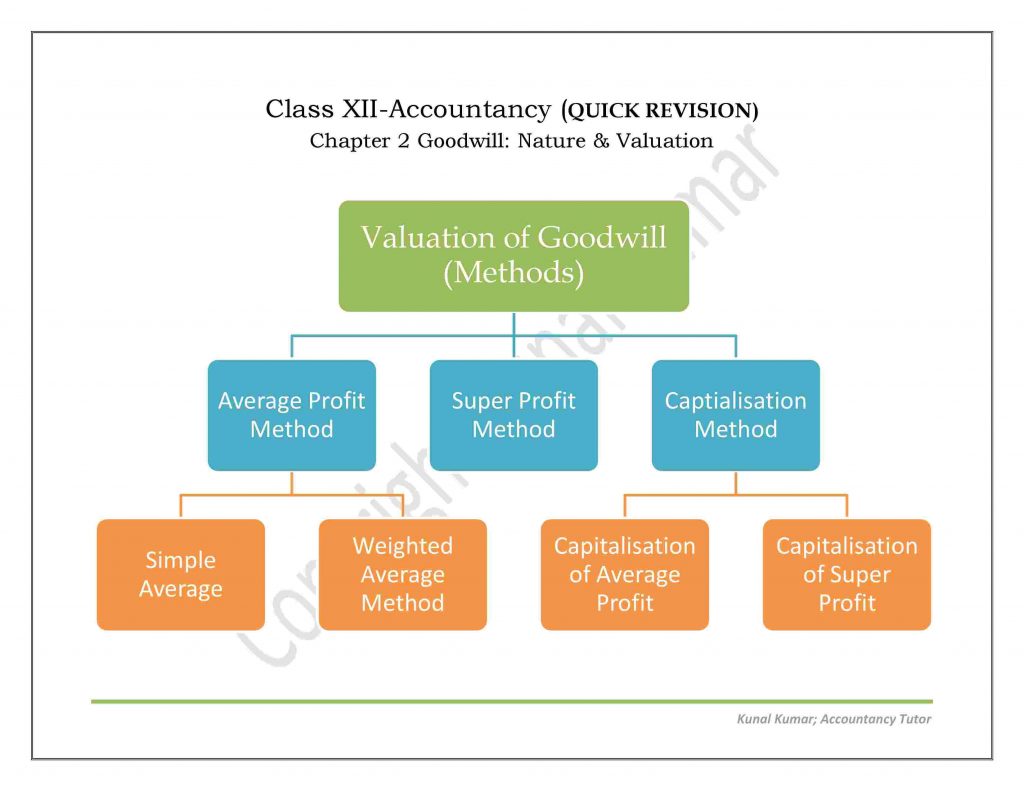

Various methods of valuation of goodwill accounting

- Average Profit Method:

Under this methodology, the worth of Goodwill is calculated by multiplying the typical Future profit by an exact range of year’s purchase.

Goodwill = Future reparable profit when tax x No. of years purchase

The first step below this methodology is that the calculation of average profit supported the past few years’ profits. Past profit is adjusted in respect of any abnormal things of profit or loss, which can affect future profit. Average profit could also be supported easy average or weighted average.

If profits are constant, equal weight-age could also be given in hard the typical profits, i.e., the easy average could also be calculated. However, if the trend shows increasing or decreasing profit, it’s necessary to administer a lot of weight-age to the profits of recent years.

Several year’s purchases:

After a hard future, reparable average profits, successive step is to work out the quantity of years’ purchase. The quantity of years of purchase is decided with relevancy the chance of the recent business to catch up with an existing business. It’ll disagree from trade to trade and from firm to firm. Commonly the quantity of years ranges between three to five.

Steps concerned below Average Profits Method:

- Calculation of past profits before tax.

- Calculate future-maintainable profit before tax when creating past changes.

- Calculate Average Past adjusted Profits (taking the easy average or weighted average as applicable).

- Multiple Future reparable Profits by a range of years’ purchase.

Value of Goodwill = Future reparable Profits x No. of years’ purchase.

- Super Profit Method:

Super profit is that the more than predictable future rectifiable profits over traditional profits. An enterprise might possess some benefits that change it to earn additional profits over and on top of the conventional profit that may be attained if the capital of the business was endowed in another business with similar risks. The goodwill below this methodology is observed by multiplying the super-profits by a bound range of year’s purchase.

Steps concerned in calculative Goodwill below Super Profit Method:

Step 1: Calculate capital used (it is that the combination of Shareholders’ equity and future debt or fastened assets and current internet assets).

Step 2: Calculate traditional Profits by multiplying capital used with a traditional rate of come back.

Step 3: Calculate average rectifiable profit.

Step 4: Calculate the Super Profit as follows:

Super Profit = Average rectifiable profits – traditional Profits.

Step 5: Calculate goodwill by multiplying super profit by a range of year’s purchase.\

- Capitalization Method:

Goodwill below this technique is often calculated by capitalizing average traditional profit or capitalizing super-profits.

(i) Capitalization of the Average Profit Method:

Under this technique, goodwill is observed by deducting Actual Capital utilized (i.e., net Assets as on the valuation date) from the capitalized worth of the typical profits on the premise of the traditional rate of coming back (also referred to as worthy of the firm or capitalized worth of business)

Goodwill = Capitalized worth – net Assets of Business

Steps concerned in calculative goodwill as per capitalization of Average Profits Method:

Step 1: Calculate Average future rectifiable profits

Step 2: Calculate Capitalized worth of business on the premise of Average Profits

Step 3: Calculate the worth of net Assets on the valuation date

Step 4: Calculate Goodwill

Goodwill = Capitalized worth – net assets of the business.

(ii) Capitalization of Super Profit Method:

The goodwill below this technique is observed by capitalizing the super profits on the premise of the traditional rate of come back. This technique assesses the capital required for earning the super profit.

- Annuity Method:

Under this methodology, goodwill is calculated by taking average super profit because of the worth of a regular payment over an explicit variety of years. The current worth of this annuity is computed by discounting at the given rate of interest (normal rate of return). This discounted gift worth of the annuity is that the worth of goodwill. The worth of annuity for Rupee one is often noted by relation to the annuity tables.

Need for valuation of goodwill accounting

Whenever there’s any amendment within the existing relationship of the partners bury see, some partners ought to sacrifice their future profit, and a few others would gain. Those people who are sacrificing future profit ought to be salaried by the others who are gaining. This adjustment of the partnership rights could arise because of the admission of a brand new partner, amendment within the portion quantitative relation, retirement or death of a partner, and dissolution of the partnership. The partners, who gain in terms of profit-sharing magnitude relation, ought to buy such gain as a proportion to the worth of goodwill. The partners, who lose in terms of portion quantitative relation, receive payments for the sacrifice as a proportion to the worth of goodwill

Factors affecting goodwill accounting

- Nature of business: A firm that deals with smart quality merchandise or has stable demand for its product is in a position to earn additional profits and so has additional worth.

- Location of business: A business that is found within the main market or at an area wherever there’s additional client traffic tends to earn an additional profit and additionally additional goodwill.

- Owner’s reputation: an owner, who incorporates a smart personal name within the market, is honest and trustworthy, attracts additional customers to the business, and makes additional profits and additionally goodwill.

- Efficient management: a corporation with economic management has high productivity and value potency. This offers it multiplied profits and, additionally, high goodwill.

- Market situation: The organization having a monopoly right or condition within the market or having restricted competition, permits it to earn a high profit that successively ends up in the higher worth of goodwill.

- Special blessings: A firm that has special advantages like import licenses, patents, trademarks, copyrights, assured an offer of electricity at low rates, subsidies for being placed in an exceedingly special economic zona (SEZs), etc. possess a better worth of goodwill.

ANALYSIS OF DATA:

We have to treat goodwill in accounting terms as a quality. It’s not a physical quality. As a result of we tend to cannot see orbit it. Despite this, we tend to treat it as assets as a result of we tend to derive some worth from it. According to Accounting Standards, assets should contain the subsequent options. Since goodwill contains these characteristics, we will conclude that it’s an asset. It should have characteristics of assets. This suggests that it should have some acknowledgeable worth. The quality should have future economic edges. The firm should be able to expect and predict what worth they’ll get from it. Its worth should be measurable. It’s not quality if we tend to cannot live its worth in financial terms.

CONCLUSION:

To conclude my findings, the incoming partner brings in some quantity as his share of Goodwill or Premium to compensate the present partners for the loss of their share within the future profits of the firm. Thus, at the time of admission of a partner, there are the following two ways to treat goodwill.

The retiring or deceased partner is entitled to his share of goodwill at the time of retirement or death as a result of the goodwill earned by the firm is that the results of the efforts of all the partners within the past since future profits can arise due to this goodwill.

The retiring or the deceased partner won’t be sharing future profits. Thus all continued partners pay to retire partner the share of Goodwill in gaining magnitude relation. It’s honest to compensate the retiring or deceased partner for an equivalent. At the time of retirement or death of a partner, we tend to worth the goodwill on the premise of agreement among the partners.

DISCUSSION:

The discussion with a retired partner revealed:

Goodwill to the undisciplined person may sound like one thing straightforward and abstract, but this can be a posh issue that’s difficult multiple firms and accounting corporations.

The quality of it involves tons of problems – recognizing the honest price of assets in an exceedingly business combination whereas being purchase, recognizing the thought transferred (and its honest value). Once the acquisition date, the impairment check is done annually that will cause goodwill impairment (consistent with IFRS – impairment loss is allotted initially to goodwill) can even be quite difficult.

SUGGESTION:

There are a few opinions and suggestions by family and friends whom I discussed my project findings with; they are given below:

- Goodwill accounting should be taken seriously in any partnership firm.

- Goodwill accounting says a lot about the partner’s professional life.

- Awareness about this topic should be generated through the youth as it might help them enrich their own professional life.

ACKNOWLEDGMENT:

My profound gratitude to all the faculty members of the Department, for their timely assistance and encouragement throughout my research work.

I duly acknowledge the encouragement and support from the research scholars in the department, and all my colleagues and friends.

It gives me immense pleasure to take the opportunity to all the people who are directly or indirectly involved in the completion of my project based on Studying The Method Of Valuation Of Goodwill Accounting Treatment In Case Of Admission, Retirement, Or Death Of A Partner.

With deep reverence, I offer my deepest gratitude _____, without whom this project could not have been fulfilled.

Lastly, I thank Almighty, my parents, family members, friends, and teachers for their constant encouragement and support, without which this project would not be possible.

Name of School/College

BIBLIOGRAPHY / REFERENCE:

- https://www.toppr.com/guides/principles-and-practice-of-accounting/treatment-of-goodwill/concept-of-goodwill/

- https://www.toppr.com/guides/accountancy/admission-of-a-partner/goodwill/

- http://studyduniya.com/app/study_post.php?course=CA%20CPT&subject=FUNDAMENTALS%20OF%20ACCOUNTING&chapter=Partnership%20Accounts&id=1774

- http://www.yourarticlelibrary.com/accounting/goodwill/accounting-procedure-for-valuation-of-goodwill-4-methods/57243

- https://en.wikipedia.org/wiki/Goodwill_(accounting)

In order to download the PDF, You must follow on Youtube. Once done, Click on Submit

Follow On YoutubeSubscribed? Click on Confirm

Download Studying The Method Of Valuation Of Goodwill Accounting Treatment In Case Of Admission, Retirement, Or Death Of A Partner PDF

Thanks For Giving Us Complete Detailed Regarding The Project. We Are Very Thankful To You

Nice the answer 👍

Super cool 😎