Project on GST- Class 12

INTRODUCTION TO PROJECT ON GST:

A wide range of reforms is happening in our country, like political and economic reforms. Among these, economic reforms are mainly taken into consideration by ordinary people. Some of the significant economic policies are demonetization and Goods and Service Tax (GST). GST is one of the biggest tax reforms in India, aiming to integrate State economies and boost overall growth by creating a single, unified Indian market to make the economy stronger. The government worked on ‘Project on GST’ for years before actually introducing it to the public.

GST is a comprehensive destination-based indirect level. Its main objective is to consider multiple indirect tax bills into a single tax, thus subsuming an array of tax levels, overcoming the limitations of the existing indirect tax structure, and creating efficiencies in tax administration.

NEED AND SIGNIFICANCE Of GST:

GST is a policy that affects the financial conditions of every citizen in the country.

Every individual must analyze the whole facts related to GST. This is the need of this project. We are learning Commerce, and we must have minimum knowledge about the country’s economic policies. GST Rates in India are four times that in Malaysia.

GST affects every aspect of the economy, such as business firms, tastes, and preferences of individuals for the demand of a commodity. This project helps us to know about the demand for a commodity. This project helps us to know about the role of opposition in many ways by analyzing the project. While the GST was about to take form in India, there was huge opposition to this project on gst.

This economic project on GST class 12 helps us to know about the reasons for the opposition and support of different sections of people to GST.

OBJECTIVES OF STUDY:

- To understand Goods and Services Tax (GST).

- To know more about the History of Goods and Services Tax (GST).

- To know more about different types of Goods and Services Tax (GST).

- To understand the importance of Goods and Services Tax (GST).

- To analyze the benefits of Goods and Services Tax (GST).

- To know about the Impact of Goods and Services Tax (GST) on economy of India.

- To know about different GST Software and its applications.

GOODS AND SERVICE TAX (GST):

Introduction:

Goods and Services Tax is an indirect tax (or consumption tax) levied in India on the sale of Goods and Services. GST is levied at every step in the production process but is refunded to parties in the chain of production other than the final consumer.

Goods and Services are divided into five tax slabs for collection of tax – 0 per cent, 5 per cent, 12 per cent, 18 per cent, and 28 per cent.

Petroleum products, alcoholic drinks, electricity, and real estate are taxed separately by the individual state governments. There is a special rate of 0.25 percent on rough precious and semi-precious stones and 3 percent on gold. In addition to a loss of 22 percent of other rates on top of 28 percent. GST applies to a few items. Pre-GST, the stationary tax rate for most Goods was about 26.5 percent, Post-GST, most goods are expected to be in the 18 percent range.

The Tax came into effect on July 1, 2017, through the implementation of One Hundred and the First Amendment of the Constitution of India by the Indian Government. The tax replaced existing multiple cascading taxes levied by the Central and State Governments.

The Tax rates, rules, and regulations are governed by the GST Council, which comprises finance ministers of central and all the states. GST implies a slow of indirect taxes with a unified tax and is therefore expected to reshape the country’s 2.4 trillion dollar economy dramatically. Truck travel time in an interstate moment dropped by 20%, because of no interstate check posts.

History of GST:

The reform process of India’s indirect tax regime was started in 1986 by Sanjeet Singh, Finance Minister in Rajiv Gandhi’s Government, with the introduction of the Modified Value Added Tax (MODVAT). Subsequently, Prime Minister P.V. Narasimha Rao and his Finance Minister Manmohan Singh initiated early discussions on a Value Added Tax (VAT) at the state level.

A single common “Goods and Services Tax (GST)” was proposed and given the go-ahead in 1999 during a meeting between Prime Minister Atul Bihari Vajpayee and his economic advisory panel, which included three former RBI Governors, IG Patel, Bimal Jalan, and C.Rangarajan. Vajpayee set up a committee headed by the Finance Minister of West Bengal, Asim Dasgupta, to design a GST model.

The Ravi Rasgupta committee which was also tasked with putting in place the back-end technology and logistics later came out for rolling out a uniform taxation regime in the country. In 2002, the Vajpayee Government formed a task force under Vijay Kelkar to recommend tax reforms. In 2005, the Kelkar committee recommended rolling out GST as suggested by the 12th Finance Commission and proposed a GST rollout by 1 April 2010.

However, in 2010, with the Trinamod Congress routing (PIIM) out of power in West Bengal, Asim Dasgupta resigned as the head of the GST Committee. Dasgupta admitted in an interview that 80 percent of the task had been done.

In the 2014 Lok Sabha election, the Bharatiya Janata Party-led NDA government was elected into power, this time under the leadership of Narendra Modi. With the consequential dissolution of the 15th Lok Sabha, the GST Bill approved by the standing committee for reintroduction lapsed seven months after the formation of the Modi Government, the new Finance Minister.

Arun Jaitley introduced the GST Bill in the Lok Sabha, where the BJP had a majority. In February 2015, Jaitley set another deadline of 1 April 2017 to implement GST. However, the Opposition led by Congress, demanded that the GST Bill be again sent back to the Selection Committee of the Rajya Sabha due to disagreements on several statements in the Bill relating to taxation.

Finally, in August 2016, the Amendment Bill was passed. Over the next 15 to 20 days, 18 states ratified the Constitution Amendment Bill, and President Pranab Mukherjee gave his consent to it.

A 21 member Selected Committee was formed to look into the proposed GST Laws. After the GST Council approved the Central Goods and Services Tax Bill 2017 (The CGST Bill), the Integrated Goods and Services Tax Bill 2017 (The IGST Bill), the Union Territory Goods and Services Tax Bill 2017 (The UTGST Bill), the Goods and Service Tax (Compensation to the States) Bill 2017 (The Compensation Bill), these Bills were passed by the Lok Sabha on 29th March 2017.

After that, State Legislatures of different states passed respective State Goods and Services Tax Bills. After the enactment of various GST laws, Goods and Services Tax was launched all over India with effect from 01 July 2017. The Jammu and Kashmir state legislature passed its GST act on 7 July under a unified indirect taxation scheme. There was no GST on the sale of Goods and Purchases of securities. That continues to be governed by Securities Transaction Tax (STT).

Launch:

The GST was launched at midnight on 1st July 2017 by the President of India, Pranab Mukherjee and the Prime Minister of India, Narendra Modi. The launch was marked by a historic midnight (30th June – 1st July) session of both the houses of parliament convened at the Central Hall of the Parliament. Though the session was attended by high-profile guests from the business and the entertainment industry, including Ratan Tata, it was boycotted by the opposition due to the predicted problems that were bound to happen for the middle and lower class Indians.

It is one of the few midnight sessions that have been helped by the Parliament, the others being the declaration of India’s independence on 15th August 1947 and the silver and golden jubilees of that occasion. Since its launch, the GST rates have been modified multiple times, the latest being on 18th January 2018, when a panel of Federal and State Finance Ministers decided to revise the GST rates on 29 Goods and 53 Services.

Members of Congress boycotted the GST launch altogether. They were joined by the members of the Trinamool Congress, Communist Parties of India, and the DMK. The parties reported that they found virtually no difference between the GST and the existing taxation system, claiming that the Government was trying to rebrand the current taxation system merely.

TAXATION SCHEME:

Taxes Subsumed:

The single GST replaced several taxes and levies, which included: central excise duty, services tax, additional customs duty, surcharges, state-level value-added tax, and Octroi. Other levies that applied to inter-state transportation of goods have also been done away with in the GST regime. GST is levied on all transactions such as sale, transfer, purchase, barker, lease, or import of Goods and Services.

India adopted a dual GST model, meaning the taxation is administered by both the Union and State Governments. Transactions made within a single state are levied with Central GST (CGST) by the Central Government and State GST (SGST) by the State Governments. For inter-state transactions and imported goods and services, an Integrated GST (IGST) is levied by the Central Government.

GST is a consumption-based tax/destination-based tax. Therefore taxes are paid to the state where the Goods and Services are consumed, not to the state in which they were produced. IGST complicates tax collection for State Governments by disabling them from collecting the tax owed to them directly from the Central Government. Under the previous system, a state would only have to deal with a single Government to collect tax revenue.

HSN Code in GST:

HSN (Harmonised System of Nomenclature) is an eight-digit code for identifying the applicable rate of GST on different products as per CGST rules. If a company has a turnover of up to 1.5 Crore in the preceding financial year, then they will not have to mention the HSN Code while supplying Goods on invoices. If turnover crosses 5 Crores, then they shall mention a four-digit HSN code on invoices.

E-Way Bill:

An E-Way Bill is an electronic permit for shipping goods similar to a waybill. It was made mandatory for inter-state transport of Goods from 1st June 2018. It is required to be generated for every Inter-state movement of Goods beyond 10 Kilometres and the threshold limit of 50,000

It is a paperless technology solution, and critical anti-evasion had to check tax leakages and clamp down on trade that currently happens on a cash basis. The pilot started on 1st February 2018 but was withdrawn after glitches in the GST Network. The states are divided into four zones for rolling out in phases by the end of April 2018.

The official Android mobile app can be used for generating an away bill, with powerful features for cash generation and for maintaining records.

Inter-State E-way Bill:

The famous states piloting are Andhra Pradesh, Gujarat, Kerala, Telangana, and Uttar Pradesh, which accounts for 61% of the Inter-State E-way bills, started mandatory inter-state e-way bill on 15th April 2018 to further reduce tax evasion. It was successfully introduced in Karnataka on 1st April 2018. The Intra-state e-way bill will pave the way for a seamless, nationwide single e-way bill system. Six more states had also rolled it from 20th April 2018. All states introduced it on May 30, 2018.

Reverse Charge Mechanism:

Reverse Charge Mechanism (RCM) is a system in GST where the receiver pays the tax on behalf of unregistered, smaller material and service suppliers. The receiver of the goods is eligible for Input Tax Credit while the unregistered dealers are not.

The RCM and matching of invoices by buyers and sellers were earlier suspended due to pressure from the industry. It is put on hold until June.

Goods Kept Outside the GST:

- Alcohol for human consumption.

- Petrol and Petroleum products (GST will apply later).

GST Council:

GST Council is the governing body of GST, having 33 members. The Union Finance Minister chairs it.

Goods and Service Tax Network:

Infosys Technologies develop the (GSTN) Goods and Services Tax Network software, and NIC maintains IT Network. “Goods and Services Tax Network (GSTN) is a non-profit organization formed for creating a sophisticated network, accessible to stakeholders, Government, and Tax Payers to access information from a single source (portal). The portal is accessible to the Tax authorities for tracking down every transaction, while taxpayers can connect for their tax returns.

The GSTN’s authorized capital is 10 Crore of which the Central Government holds 24.5% of the shares while the state government holds 24.5 per cent, Non-Government Financial Institutions hold the remaining 51%, HDFC and HDFC Bank hold 20%, ICICI Bank holds 10%, NSE Strategic Investment holds 10%, and LIC Housing Finance holds 11%.

GST Rates (2018):

GST is the biggest tax-related reform in the country, bringing uniformity to the taxation structure and eliminating the cascade of taxes that are currently levied. When the GST Council met on 11th June 2017, the GST rates were revised for 66 items. Several states and industries recommended a reduction in GST tax rates for several items, which was followed through in this meeting.

Revised GST Rates:

The Government has proposed 4-tier structures for all goods and services under the slabs – 5%, 12%, 18%, and 28%. After the recent revision of GST rates, these are the commodities that fall under the four tax stabs along with those that do not attract any tax.

No Tax:

- Apart from other items that enjoy 0% GST tax rates, these are the commodities added to the list after the 11th June tax revision.

- Hulled Cereal Grains.

- Palmyra jaggery.

- All types of salt.

- Children’s picture colouring books and drawing books.

- Dicalcium Phosphate (DCP) of animal feed grade.

Benefits of GST:

GST offers benefits to the Government, the industry, as well as the citizens of India. The price of Goods and Services is expected to reduce under the new reform, while the economy will receive a healthy boost. It is also expected to make Indian products and services internationally competitive.

Uniformity in Taxation:

The objective of GST is to drive India towards becoming an integrated economy by charging uniform tax rates and eliminating economic barriers, thereby making the country a common national market. The subsuming of the State as mentioned earlier and Central indirect taxes into just one tax will also provide a major life to the Government’s ‘Make in India’ campaign, as Goods that are produced or supplied in the country will be competitive not only in national markets but in the international ones as well.

Moreover, IGST (Integrated Goods and Services Tax) will be levied on all imported goods. IGST will be equal to State GST plus Central GST, more or less, thus bringing uniformity in taxation on both local as well as imported goods.

Helping Government Revenue find Buoyancy:

GST is forecast to help the Government Revenue find Buoyancy by expanding the tax base while enhancing the taxpayer’s compliance. The reform is also expected to improve the country’s ranking so far as the ‘Ease of Doing Business Index is concerned. It also enhances GDP by 1.5% to 2%.

Cascading of Taxes:

GST will prevent the cascading of Taxes as the whole supply chain will get an all-inclusive input tax credit mechanism. Business operations can be streamlined at each stage of supply thanks to the seamless services.

Simpler and Lesser Number of Compliances:

Compliance will be simpler through the harmonization of tax rates, procedures, and laws. Inter-state disputes such as those on e-commerce taxation and entry tax that currently prevail will no longer cause concerns, while multiple taxations on the same transactions will also be removed. Compliance costs will also reduce as a result.

The previous tax regime had service tax and VAT, and they both had their compliances and returns. GST will merge then and lower the number of returns as well as the time spent on tax compliances. GST has around 11 returns under it. Four of them are basic returns that apply to all taxable entities under GST. Although the number of returns could increase, the main GSTR-1 shall be manually populated, while GSTR-2, GSTR-3, and GSTR-4 shall be auto-populated.

Common Procedures:

The procedures for the refund of taxes and registration of taxpayers will be common, while the formats of the tax return will be uniform. The tax base will also be common, as will the system of an assortment of products or services in addition to the timelines for each activity.

Common Portal:

Since technology will be used heavily to drive GST, taxpayers will have a common pedal (GSTN). The procedures for different processes like registration, tax payments, refunds, returns, etc. will be automated and simplified. Whether it is the filing of returns, filing of refund claims, payments of taxes, and event registration, all processes will be done online via GSTN.

The verification of input tax credit will be done online, too, and input tax credits across the country will be matched electronically, thereby turning the process into an accountable and transparent one.

Lowered Tax Burden on Industry and Trade:

The average tax burden on Industry and Trade is expected to lower because of GST, resulting in a reduction in prices and increased consumption, which will eventually increase productivity and ultimately enhance the development of various industries. Domestic demand is set to increase, and local businesses will have greater opportunities, thus generating more jobs within the country.

Benefits to the Common Men:

A good number of products and services are either exampled from tax or charged 5% or less.

The pool will receive its due.

Small traders will find themselves on a level playing field.

Simplified tax structure with fewer exemptions.

Products and Services will be allowed to move freely across the country.

Increased competition between manufacturers and businesses will benefit consumers.

Benefits to the Economy:

Creation of a unified common market.

Increase in manufacturing processes.

Enhancement of exploits and investments.

Generation of more jobs through enhanced economic activity.

Benefits to Industry and Trade:

Uniform procedures for registration, filing of returns, payment of taxes, and tax refunds.

Elimination of cascading of taxes.

Small scale suppliers can make the most of the composition scheme to make their goods less expensive.

Higher efficiency with regards to the neutralization of taxes so that exports are globally competitive.

Disadvantages of GST:

Higher Tax Burden on Small Businesses:

Small businesses in the manufacturing sector will bear most of the impact of GST implementation. Under the existing laws, only manufacturing businesses with a turnover of more than 1.5 Crores have to pay excise duty.

However, under GST, the income limit has been condensed to Rs. 20 Lakhs, thus increasing the tax burden for many manufacturing SMEs.

Increment in the Cost of Operating:

For GST, though, as it is a completely new tax system, small businesses will require professional help as most of them do not hire professionals and prefer to pay taxes and file returns on their own to save costs. While this will benefit the professionals, the small business will need to train their employees in GST obedience, increasing their overhead expenses.

Change in business software:

Most businesses use accounting Software for filing tax returns, which have excise, VAT, and service tax already incorporated in them. The change to GST will require them to change the Software too, leading to increased costs of purchasing new software and training employees.

Confusion and Observation Issues:

The provisional GST implementation date is 1st July 2017. So far, the fiscal year 2017-18 business will follow the old tax structure for the first three months and GST for the following months. It is impossible to cross over from one tax structure to the other in just a day, and hence, the business will end up running both tax systems in parallel, resulting in made confusion and compliance issues.

An increase in Taxes will Increase Prices:

Currently, some sectors, like the textile industry, are freed from taxes or pay low taxes. GST has only 4 proposed tax rates of 5%, 12%, 18% and 28%. Thus for many sectors, the tax burden will increase, which in turn will increase the price of final goods.

Petroleum Products are not Part of GST yet:

Petroleum products are kept out of GST. States will levy their taxes on this sector. Tax credit for inputs will, therefore, not be available to related industries like the plastic industry, which is heavily dependent on petroleum products. Petrol and Diesel are required to run factory machinery, and the unavailability of the input tax credit on petroleum products will most probably push up the final price of all manufactured goods.

Registration in the Different States:

GST needs businesses to register in all the states they are operating in. This will increase the burden of compliance.

Problems faced by E-commerce:

Nowadays, many SMEs operate through their online shopping websites or through third party websites to sell to different parts of India. Under GST, they will be required to register for all states. Not only that, they will not be eligible for the configuration scheme and will be required to pay taxes like any large organization. E-Commerce helpers are now required to collect TCS under GST, which will lead to increased complications and agreements.

The composition Scheme is not available for many Businesses:

The composition scheme is not available to service providers or online sellers. This sets small and medium enterprises or SMEs at par with large organizations in a biased move.

No anti-inflationary measures:

Every country that follows GST experienced a hike in inflation when they were introduced. They encountered inflation by keeping tabs on prices and initiating anti-profiteering measures at the retail level to protect consumers from price cheating.

While there have been similar discussions in the GST Council, India still does not have concrete anti-inflationary measures to control the inflation that is an unavoidable outcome of GST.

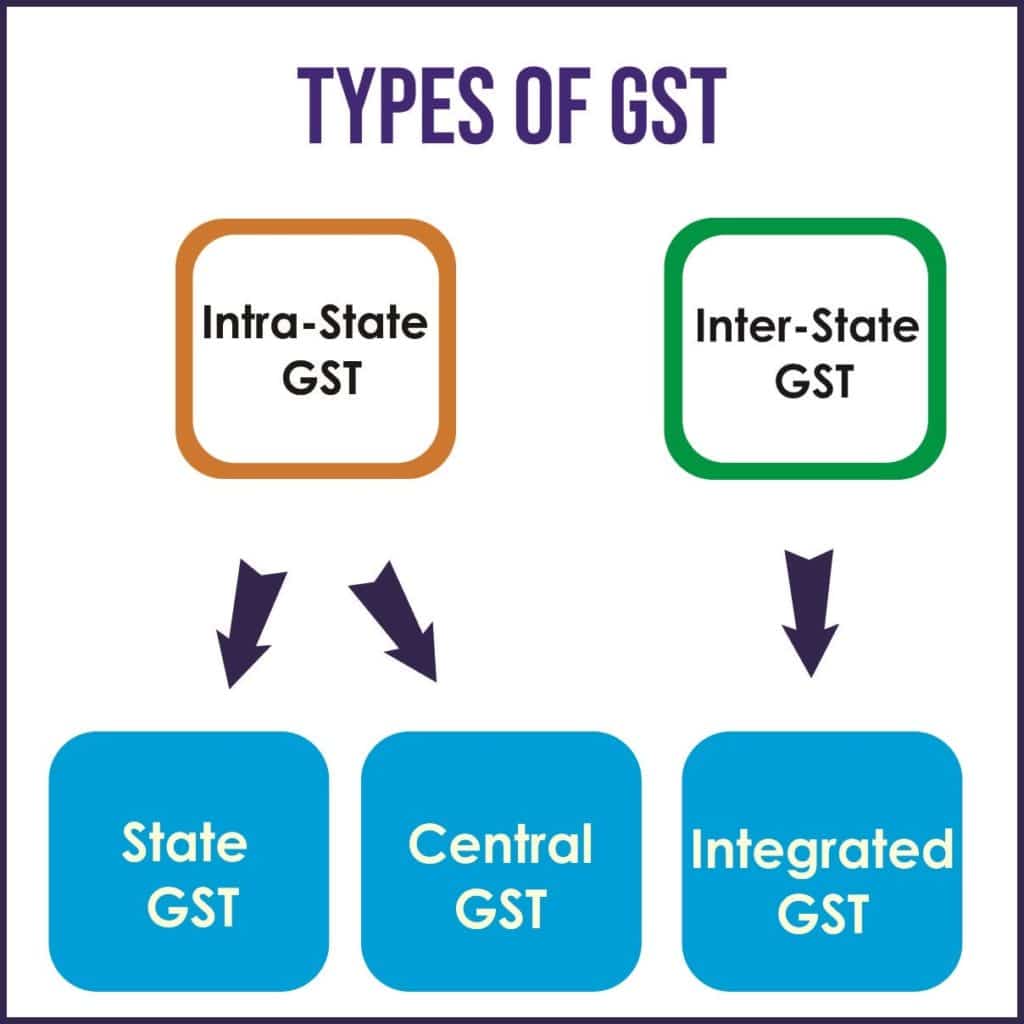

Types of GST:

There are mainly four types of GST. They are:

- Central Goods and Services Tax (CGST).

- State Goods and Services Tax (SGST).

- Integrated Goods and Services Tax (IGST).

- Union Territory Goods and Services Tax (UTGST).

Central Goods and Services Tax (CGST):

As per the Central Goods and Services Tax Act, 2016, CGST is the Centralised part of GST that subsumes the present central taxations and levies Central Sales Tax, Central Excise Duty, Service Tax, Excise Duty under Medical and Toiletries Preparation Act, Additional Excise Duty Countervailing Duty (CVD), Additional Customs Duty and other centralized taxations.

CGST applies to the supply of Goods and Services of standard services and commodities, which can be amended periodically by a specialized body under the central government. The revenue collected under CGST belongs to the Central Government. The input tax is given to the state governments, which they can utilize only against the payment of CGST.

State Goods and Services Tax (SGST):

SGST is an important part of GST. It stands for state goods and services tax as per the 2016 GST bill. SGST subsumes various taxations and levies under the state authority as one uniform taxation. It includes the amalgamation of State Sales Tax, Luxury Tax, Entertainment Tax, and levies on Lottery, Entry Tax, Octroi and other taxations related to the movement of Commodities and Services under State authority through one uniform taxation SGST.

Revenue collected under SGST belongs to the State Government. However, the mainstream framework of the state governing body will be supervised by the central government. Each state will be having its own state Authority to collect SGST.

Integrated Goods and Services Tax (IGST):

GST focuses on the concept of one tax, one nation. IGST stands for Integrated Goods and Services Tax, which is charged on the supply of commodities and services from one state to another state. For example, if the supply of goods and services occurs between Gujarat and Maharashtra, IGST will be applicable.

The Government of India will collect the revenue under IGST.

Union Territory Goods and Services Tax (UTGST):

The Union Territories in India are accounted for under specialized taxation called Union Territory Goods and Services Tax as per the GST regime 2016. It will subsume the various taxations, levies, and duties with one uniform taxation in Union Territories as well.

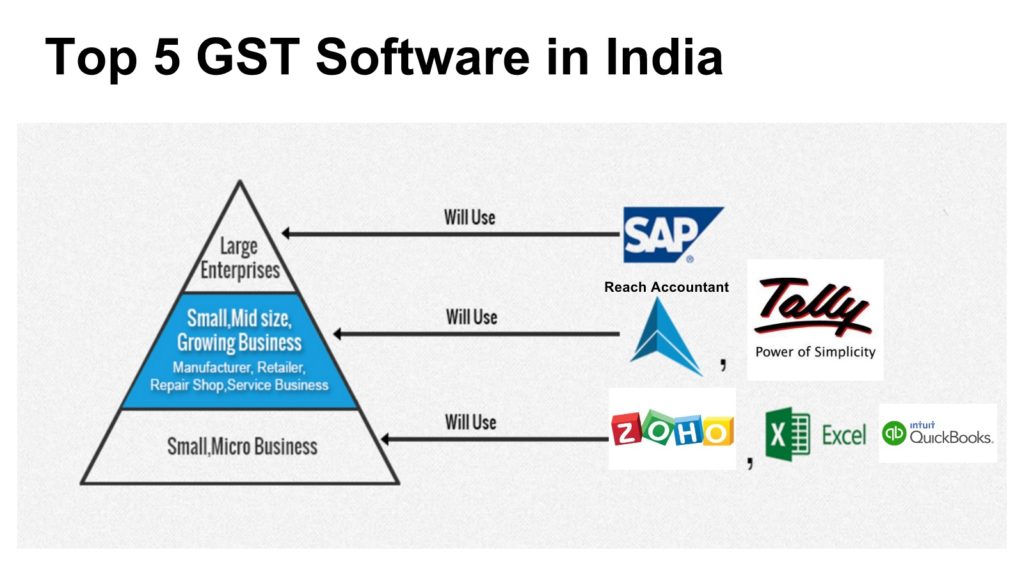

Top Accounting Software with GST:

- Tally ERP9:

Tally ERP9 is India’s most popular business software and GST Software. Tally is the leader in helping businesses in managing their compliance for more than two decades.

- MARG GST:

MARG ERP9 is very simple and user-friendly software. MARG GST Software allows you to convert your bill into any format you require. In addition to this, it can also send the bills through email. This saves plenty of time for the user.

- Busy GST:

BUSY is an integrated business accounting software for Micro, Small, and Medium Businesses. With over 200k installations worldwide, BUSY is one of the leading accounting software in India. The company provides 30 days of free trial to the users. BUSY offers a range of accounting software to cater to the needs of different business segments. The primary editions offered by BUSY are Basic, Standard, and Enterprise.

- Zoho Books:

Zoho Books is a product of GST-ready accounting software. It lets you send invoices, reconcile bank transactions, track inventory, and generate reports. All these help users in filling GST returns effortlessly. The solution offers 14 days of free trial for its clients.

- Quick Books:

Quick Books is very popular in India. It also allows 30 day free trial for the users. The user-friendly interface helps you in creating GST invoices effortlessly. In addition to this, you can monitor input tax credit on your purchases and save money.

Top Money Filing Software:

- Cleartax: Cleartax is a powerful cloud-based software. It ensures that you will never make mistakes or lose data. Additionally, you can access your returns and data anytime, anywhere. It is trusted by CA Firms, Banks and Businesses across India. It helps in creating GST invoices and provides GST compliance Tax Invoice Formats.

- GEN-GST: GEN-GST is a very user-friendly Goods Tax Preparation Software. It is useful for accountants who need a tool to prepare GST returns for their clients without accounting. It can extract data from any accounting software for filing purposes. The best part is it does not require the internet to operate.

- Taxmann’s One Solution: Taxmann’s One Solution Software is a complete GST Software with all ASP-GSPservices. It is one of the best end-to-end GST Compliance Software for Invoicing, Reconciliation, and Returns filing software available at present in India. Taxmann is ISO 270001 certified. Company.

- Sahi GST: Sahi GST is a cloud-based Filing software for CA and Businesses to manage their GST return filings and reconciliations. The platform automatically reconciles all invoices between vendors and suppliers. There is a system-driven tracking of an input tax credit.

- Reach Accountant: Reach Accountant GST Software is a good alternative to Tally and Quickbooks. This GST filing software helps chartered accountants, accounting professionals, corporate lawyers, and tax consultants in filing returns for their clients. The best part is that they provide the software free of cost. One just needs to pay per filing.

FINDING OF STUDY:

By analyzing the project, I find that the consumer retail prices are comparatively lower in the Post-GST period in comparison to Pre-GST period along with the following points:

There is no double taxation effect in the Post-GST period, unlikely in Pre-GST.

There is no cascading effect in the Post-GST period, which leads to a price hike.

The effective tax rate remains constant and lower in the Post-GST period in comparison to the traditional tax system.

In Post-GST System, the ultimate tax burden to the consumer abated.

CONCLUSIONS:

Goods and Services Tax (GST) is an extension of VAT, which includes services also. When GST is implanted in Good spirit, the revenue to the state government and the central government shall be increased in the long run. This single most important tax reform initiative by the government of India since independence provides a significant fill up to the investment and growth of our country; it should be assured that the benefit of input credit is ultimately enjoyed by final consumers.

The efficiency of tax administration will be improved. Indirect tax revenue will be increased considerably due to the inclusion of more goods and services, and at last, the cost compliance will be reduced.

GST will surely boost the country’s economic growth and ease of doing business in the overall industrial sectors. It will begin a new phase in India’s economy by providing logistics and supply chain efficiency and the state-based party that the country requires the most.

DOWNLOAD PDF OF THE PROJECT ON GST CLASS 12

Password: hscprojects.com

In order to download the PDF, You must follow on Youtube. Once done, Click on Submit

Follow On YoutubeSubscribed? Click on Confirm

Download Project on GST- Class 12 PDF

I need thia project

You can download this project by clicking on download button